Australia is on track for its steepest tightening of monetary policy in a generation, raising the risk of an economic slowdown as the housing market shifts into reverse and consumers pull back on spending.

The Reserve Bank of Australia will lift its key interest rate by 50 basis points for a third consecutive month on Tuesday to 1.85%, according to 28 of 30 economists surveyed. That will take its combined tightening since May to 175 basis-points, the biggest increase inside six months since 1994.

“The RBA is behind the pack,” said Andrew Ticehurst, senior economist and rates strategist at Nomura Holdings Inc. The current cash rate is “not appropriate for an economy with an unemployment rate at around a 50-year low and with core inflation running at a 6% annualized pace.”

Ticehurst sees the cash rate at 3.35% by year’s end while money markets are pricing in about 3%. Such a sharp pace of tightening will ratchet up repayments and weigh on consumption, which accounts for about 60% of economic output.

Policy makers are trying to rein in inflation that’s running at more than twice the upper end of the RBA’s 2-3% target. They maintain households can cope with further hikes because they built up savings during the pandemic and 3.5% unemployment means most Australians have incomes to meet their obligations.

RBA rate hikes flow through quickly to borrowers as most are on variable-rate loans. A slide in property prices has accelerated since tightening began, with July data showing the key Sydney market fell 2.2%, its sixth monthly decline.

Real estate firm PropTrack expects prices will fall 15% from current levels in 2023, after climbing at an “exceptional pace” over the past two years.

Help-wanted notices also fell in July and may have passed their peak, an Australia & New Zealand Banking Group Ltd. survey showed Monday. Even so, ANZ economists see unemployment falling further in months ahead to less than 3% as the economy has to absorb all of the job vacancies still available.

The labor market’s strength is a key source of confidence for the central bank raising rates quickly.

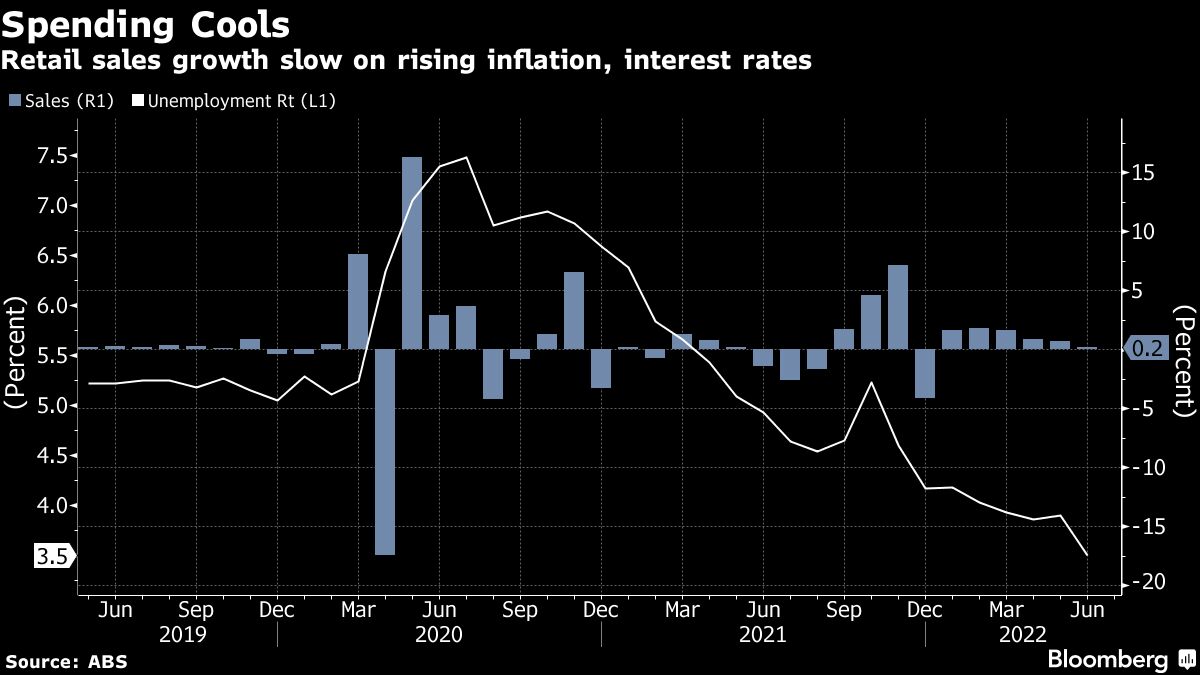

Consumer sentiment has weakened in response to rate increases and there are signs of cooling demand. Commonwealth Bank of Australia internal data, which tracks spending on credit and debit cards at the nation’s largest lender, showed a “clear easing” in consumption in July.

“There is a clear risk that the volume of household consumption falls by late-2022,” according to Gareth Aird, head of Australia economics at CBA. “We expect forward-looking indicators of the economy to slow sharply.”

Yet it’s inflation, which Australia’s government expects to reach almost 8% by December, that’s concerning the RBA. Bloomberg’s survey showed the median estimate is for a cash rate of 2.85% by year’s end, slightly lower than money market bets of around 3%.

If rates rise too quickly “it will cause a major problem for the economy,” said Shane Oliver, chief economist at AMP Capital Markets, who sees the central bank pausing at 2.6%.

Oliver pointed to RBA analysis showing around 1.3 million households may see a 40% or greater increase in mortgage payments with a 3% hike in interest rates. “This at a time of falling real wages will have a huge impact on spending in the economy and risk a significant rise in forced property sales.”

That’s one reason why Nomura, CBA, AMP and UBS Group AG are predicting rate cuts will come as early as next year.

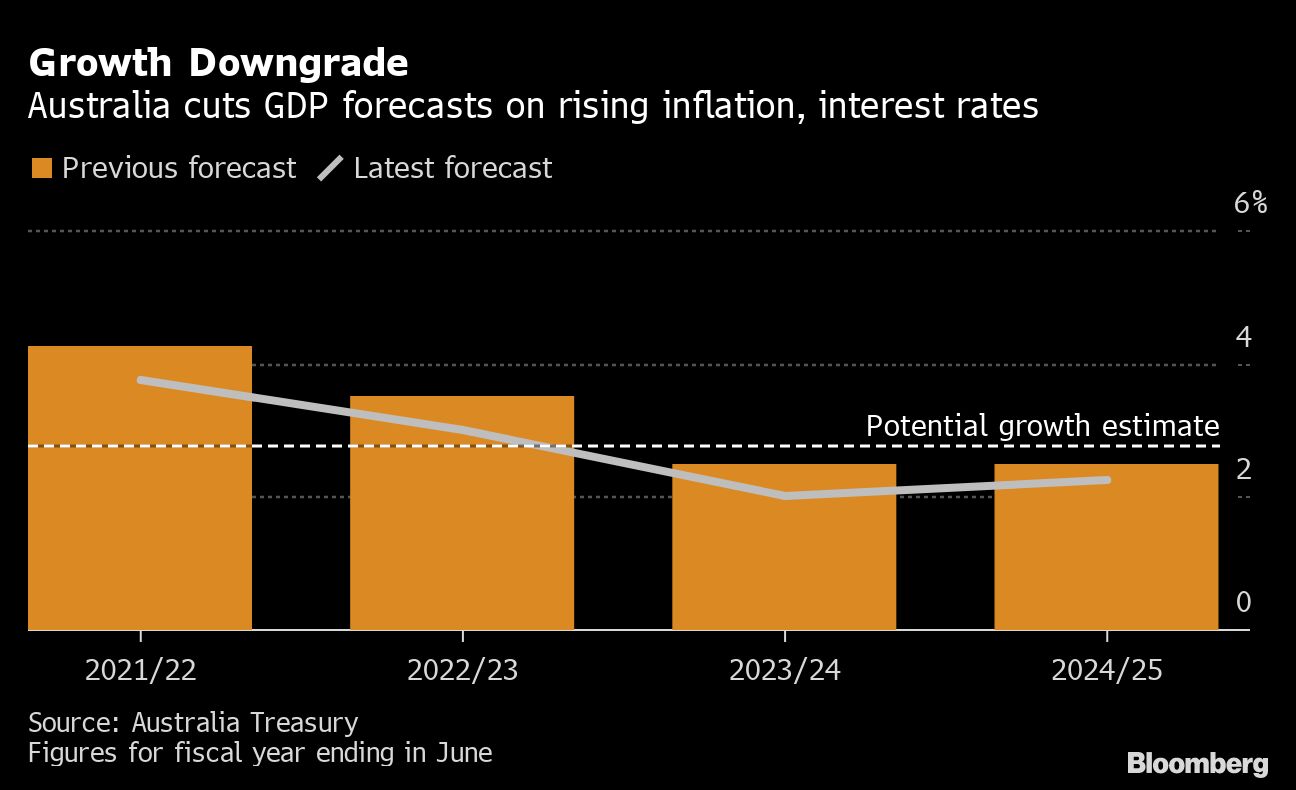

The RBA will publish its quarterly update of forecasts on Friday that’s widely expected to show downgrades to economic growth and employment and a sharp increase in the inflation outlook -- in line with Treasury’s outlook last week.

©2022 Bloomberg L.P.