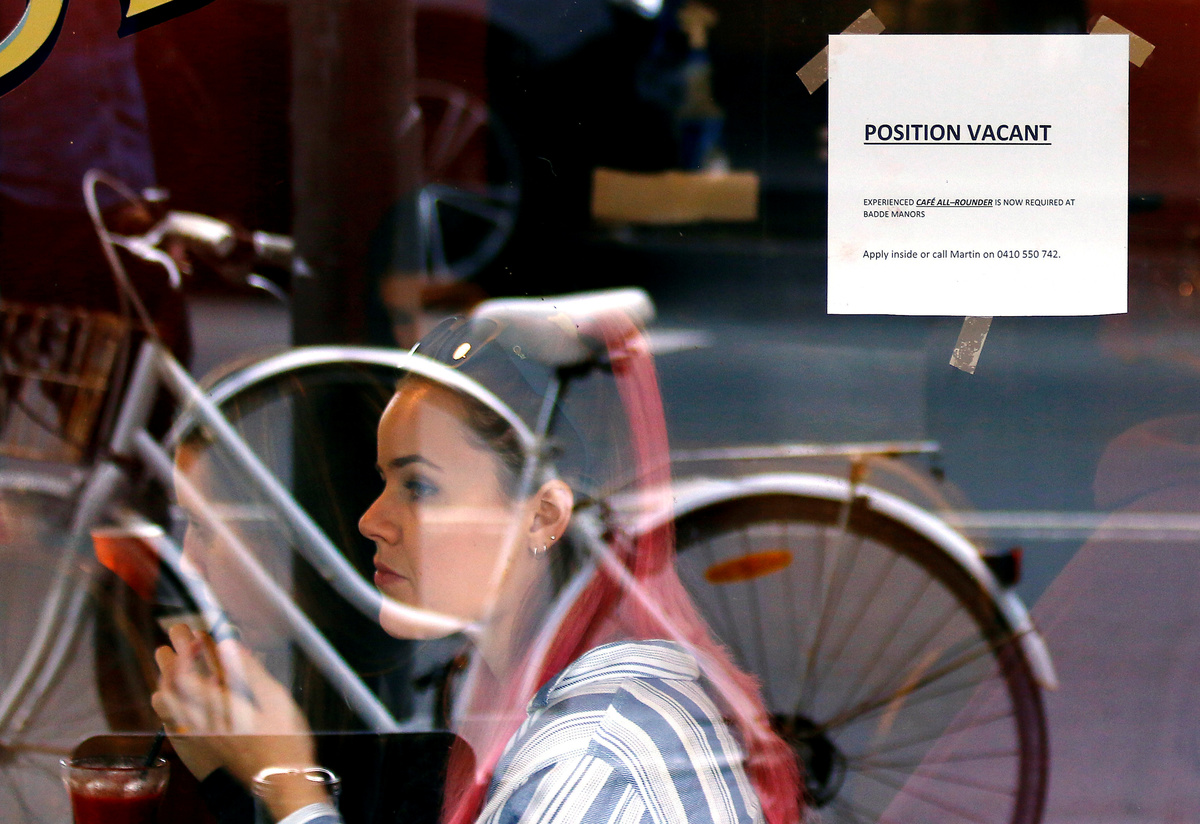

Australian job advertisements rose for a second consecutive month in February after a sharp decline in December though a prolonged bushfire season and a rapidly spreading virus are seen likely to hurt labour demand in coming months.

Monday's figures from Australia and New Zealand Banking Group <ANZ.AX> showed total job ads added 0.7% in February, following a 3.8% gain in January.

Job ads averaged 151,146 in February but were still down 10.2% from a year earlier.

"This has been a surprise to the positive side," said Catherine Birch, a senior economist at ANZ.

"However, the past two months of gains weren't enough to regain levels seen prior to the sharp loss in December and any underlying momentum may stall in the near-term," Birch added.

"Demand for labour may pull back as the effects of COVID-19 on tourism, trade, supply chains and the wider economy become more apparent."

Other labour market indicators have turned down and in January employment growth slowed to its weakest annual rate in almost three years sending the jobless rate to 5.3%.

Economists expect the unemployment rate to tick higher as a horrendous bushfire season this summer together with the coronavirus outbreak dealt a blow to the country's A$2 trillion ($1.30 trillion) economy.

The ANZ vacancies series is closely watched by the Reserve Bank of Australia (RBA) given it counts actual job ads, while Australian Bureau of Statistics data is based on intentions by firms to hire.

The RBA has cut its cash rate to a record low of 0.75% in recent months, partly as a response to the rising unemployment rate.

Speculation is growing the central bank will cut rates to 0.5% at a policy meeting on Tuesday as part of a response to the coronavirus and its impact on financial markets.

(Reporting by Swati Pandey; Editing by Sam Holmes)