Aurora Cannabis (ACB) shares gained more than 28% on Monday after President Donald Trump promoted cannabidiol (CBD) as a viable alternative to prescription drugs.

In his latest social media, the U.S. president endorsed the medicinal compound for its potential to “revolutionize senior healthcare,” adding it could lower the related costs as well.

Including the aforementioned surge, Aurora Cannabis stock is up roughly 68% versus its year-to-date low.

Why Did Aurora Cannabis Stock Soar on Trump’s Endorsement?

The ACB stock price rally reflects growing optimism about a potential shift in federal policy, especially regarding the possible rescheduling of marijuana from Schedule I to Schedule III.

Such a development could eliminate significant financial challenges for cannabis firms, including restrictions on banking services and tax deductions under Section 280E.

Deriving about two-third of its revenue from medical channels, Aurora Cannabis looks particularly well-positioned to benefit from any regulatory changes favoring medical cannabis.

Note that the U.S. medical cannabis market – expected to surpass $15 billion in revenue this year – presents a substantial opportunity for ACB’s overall growth trajectory.

Where Options Data Suggests ACB Shares Are Headed

Options data from Barchart paints a volatile picture, with traders pricing in a rather broad range of outcomes.

Contracts expiring on Dec. 19 imply a potential swing between $3.94 to $7.52 – while near-term expectations through Oct. 17 suggest a 16.9% move, contained between $4.76 and $6.70.

While the upper bounds sure reflect optimism, possibly due to speculative sentiment and political tailwinds, the more probable path appears skewed to the downside.

Why? Because Aurora Cannabis shares continue to struggle with deteriorating financials including persistent cash burn that undermines the company’s path to profitability.

Unless fundamentals improve, options positioning may be reflective of hedging than conviction.

Aurora Cannabis Has Already Touched Street’s Mean Target

Investors are recommended caution also because ACB shares are no longer undervalued following the recent surge.

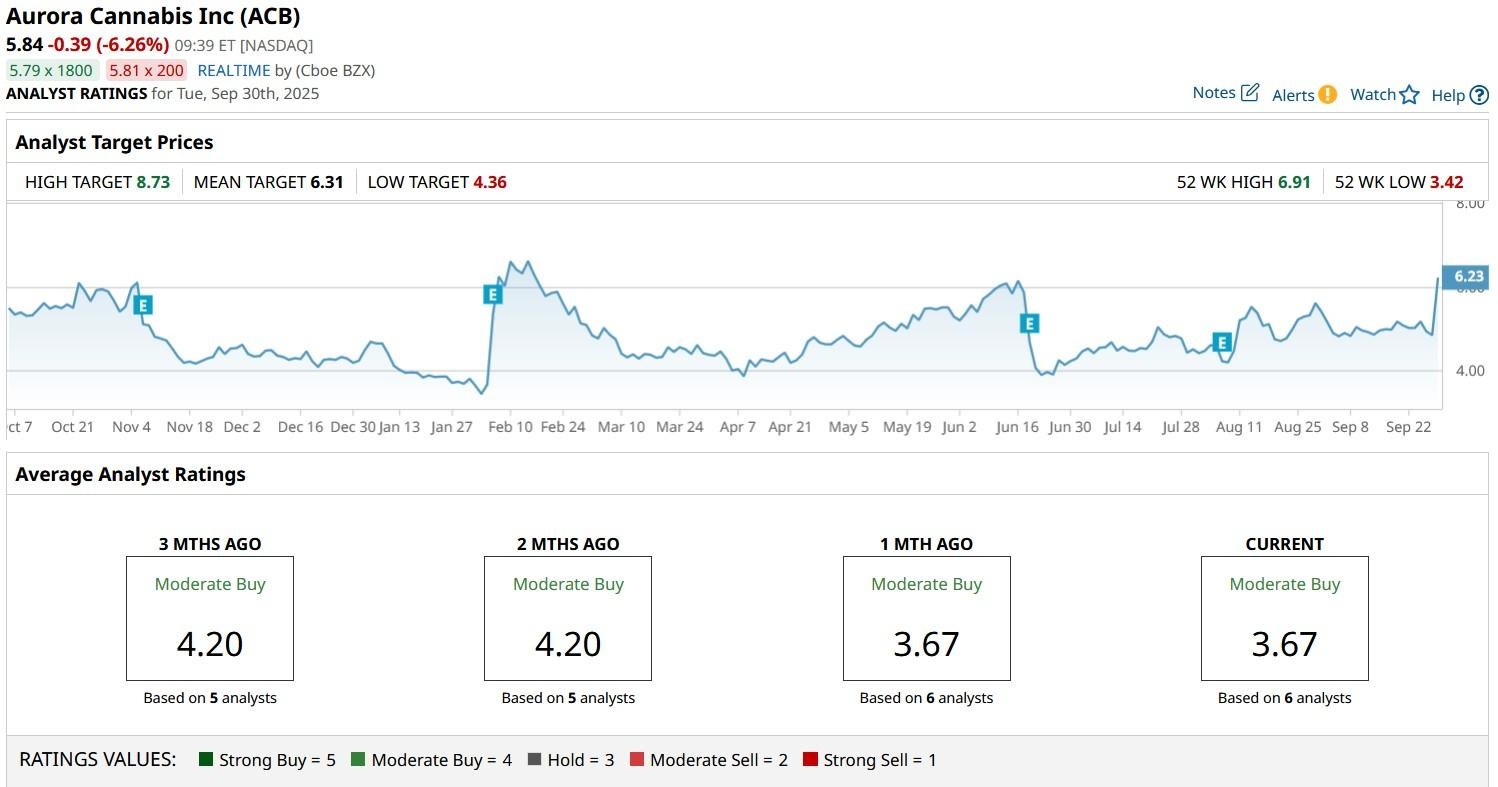

According to Barchart, while the consensus rating on Aurora Cannabis stock remains at “Moderate Buy,” the mean target of $6.31 is just 8% higher than its current trading price.