Dallas, Texas-based Atmos Energy Corporation (ATO) distributes natural gas. With a market cap of $26.6 billion, the company provides natural gas marketing and procurement services to large customers, as well as manages storage and pipeline assets.

Shares of this natural gas distributor have outperformed the broader market over the past year. ATO has gained 27.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, ATO stock is up 18.8%, surpassing the SPX’s 9.5% rise on a YTD basis.

Zooming in further, ATO has surpassed the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 12.8% over the past year and 12.4% in 2025.

Atmos Energy reported solid third-quarter earnings on Aug. 6, with revenue rising 19.6% year-over-year to $838.8 million, slightly above estimates, and EPS of $1.16 matching expectations. Net income increased 12.6% to $186.4 million, driven by customer growth and infrastructure investments totaling $2.6 billion, 86% of which was dedicated to enhancing safety and reliability.

The company raised its full-year EPS guidance to $7.35–$7.45, declared a quarterly dividend of $0.87 per share, and maintained robust liquidity of $5.5 billion, reinforcing its stable growth trajectory. As a result, ATO shares jumped 3.6% in the following trading session.

For the current fiscal year, ending in September, analysts expect ATO’s EPS to grow 8.4% to $7.40 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters, missing on one occasion.

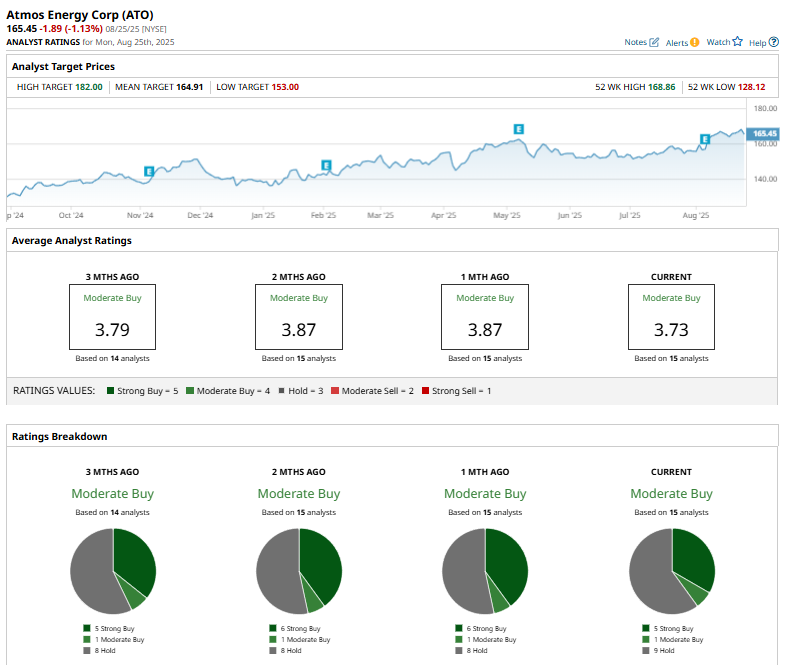

Among the 15 analysts covering ATO stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

This configuration is bearish than a month ago, with six analysts suggesting a “Strong Buy.”

On July 1, UBS analyst Josh Silverstein raised Expand Energy’s price target from $144 to $145, while maintaining a “Buy” rating. The move reflects UBS’s continued confidence in the company’s growth potential amid favorable market conditions.

The stock currently trades above its mean price target of $164.91. The Street-high price target of $182 suggests an upside potential of 10% from the current market prices.