Australian shares have lost ground following a big sell-off on Wall Street, as strong economic growth figures drove worries that the Federal Reserve would continue to make steep interest rate rises.

Thanks for joining for joining the ABC News Markets blog today.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Markets snapshot 4:20pm AEDT

By Sue Lannin

- ASX 200: down 0.6 per cent to 7,108

- All Ordinaries: down 0.6 per cent to 7,288

- Australian dollar: up 0.2 per cent to 66.77 US cents

- Wall Street: Dow down 1 per cent to 33,027, S&P 500 down 1.4 per cent to 3,822, Nasdaq down 2.2 per cent to 10,476

- Europe: FTSE down 0.4 per cent to 7,469, DAX down 1.3 per cent to 13,914, CAC 40 down 0.9 per cent to 4,903

- Spot gold: up 0.2 per cent to $US1,795 an ounce

- Brent crude: up 0.8 per cent to $US81.66 a barrel

- Iron ore: $US110.43 a tonne

-

Bitcoin: up 0.2 per cent to $US16,829.76

- Nikkei 225: down 0.9 per cent to 26,269

Merry Christmas to the marketeers!

By Sue Lannin

All goods things must come to an end so I bid you adieu from the ABC Markets blog.

Thanks for joining me.

Have a great Christmas and Happy New Year!

Star falls and Retail Foods is fined $10 million for misleading franchisees

By Sue Lannin

The Australian share market ended lower on the last trading day before Christmas as strong US data reignited fears of more steep rate hikes by the US central bank.

Oil firms floundered on weaker overnight oil prices, even though Brent crude rose during the day on expectations of a drop in Russian crude supply.

Even though alot of traders were on holiday, there was still alot of company news around.

Gaming giant Star Entertainment (-4.8 per cent) fell after it said it would assess the impact of New South Wales plans to increase casino taxes.

It will also pay a $100 million fine imposed by NSW authorities for allowing money laundering and crime at its casinos, in three instalments next year.

Petroleum explorer and takeover target Warrego Energy (-4.6 per cent) also lost ground as suitors Hancock Energy and Strike battle it out for control of the firm.

And food chain Retail Foods (+10.1 per cent) rose after it agreed to pay $10 million to settle a misleading representation case taken by the Australian Competition and Consumer Commission.

The ACCC alleged the company sold Michel's Patisseries franchises to people knowing they were operating at a loss.

Retail Foods owns chains like Donut King and Gloria Jeans.

Graphite miner Syrah Resources (+2.2 per cent) gained after Tesla increased its order for battery making material.

ASX 200 market movers

By Sue Lannin

Most sectors finished in the red on the ASX 200 today with industrials, consumer firms and energy stocks weighing the most on the market.

Here are the top movers.

ASX loses Christmas cheer after Wall Street slump

By Sue Lannin

The Australian share market has ended lower after a big fall on Wall Street.

It fell more than 1 per cent around midday, but has finished off its lows.

The ASX 200 lost 0.6 per cent to 7,108, while the Australian dollar is higher at 66.75 US cents.

Nearly all sectors ended with the red with industrial firms, consumer stocks and oil and gas companies among the losers.

Utilities were the only sector that gained.

TPG Telecom (+2.7 per cent) was the best performer, while automotive and plumbing products firm GUD Holdings (-5.6 per cent) was the worst.

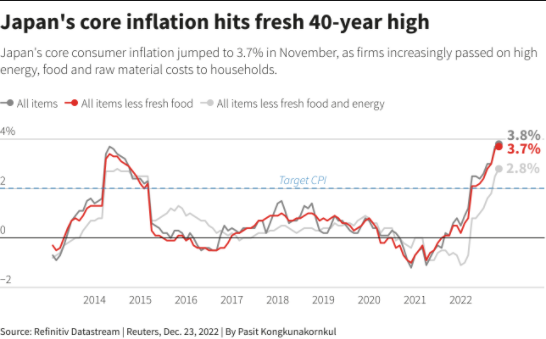

Inflation in Japan hits 40-year high

By Sue Lannin

Higher costs for oil and gas drove a rise in the cost of living in Japan last month as companies pass on rising expenses to consumers.

Prices rose at the fastest pace since 1981 with items like processed food, smartphones, electricity and air conditioners climbing.

Core consumer prices, which strips out volatile items like fresh food, increased 3.7 per cent over the year to November.

The data puts the Bank of Japan under pressure to start lifting interest rates out of ultra low negative territory.

"The hurdle for policy normalisation isn't low," said Takeshi Minami, chief economist at Norinchukin Research Institute told Reuters.

"The global economy may worsen in the first half of next year, making it hard for the BOJ to take steps that can be interpreted as monetary tightening."

Earlier this week, the Bank of Japan allowed long term interest rates to rise more spurring fears that the central bank was on the verge of tightening monetary policy.

The Bank of Japan is the only major central bank to have negative interest rates.

Best and worst performing sectors

By Sue Lannin

And here are the best and worst sectors according to Bloomberg & CommSec.

Best and worst performing stocks for 2022

By Sue Lannin

Here's who did the best and the worst over the year on the stock market. Coal miners did the best as prices soared because of the energy crisis caused by the war in Ukraine.

ASX 200 market movers at 3pm AEDT

By Sue Lannin

Only 23 stocks are going up out of Australia's top 200 companies

ASX in the red on the day before Christmas

By Sue Lannin

The Australian market remains in the doldrums with many investors already on Christmas holidays.

A plunge on Wall Street on renewed rate rise fears set the tone for the day.

At 2:50pm AEDT the ASX 200 is down 0.8 per cent to 7,096 with most sectors in the red led down industrials, energy firms, and consumer stocks as everyone worries about inflation.

However, the benchmark has come off its lows with utilities popping the champagne.

Nickel miner Liontown Resources (-6.2 per cent) is doing the worst, while TPG Telecom (+2.8 per cent) is doing the best.

ASX 200 market movers at midday

By Sue Lannin

Duck for cover. Just ten stocks are higher.

ASX falls deeper into the red

By Sue Lannin

The Australian share market has deepened its losses at midday after selling resumed on Wall Street with good US economic data fueling fears of more steep interest rate rises

The ASX 200 index is down more than 1 per cent to 7,076 at 11:50am.

All sectors fell with industrials, energy firms and real estate leading the losses.

Gold stocks and banks also weighed on the market, and tech stocks also slumped with payments giant Block (-3.6 per cent) falling.

Shares in the rest of the Asia Pacific are lower after inflation in Japan reached a 40 year high of 3.7 per cent for core consumer inflation.

At 11:50am, the Nikkei 225 fell 1.3 per cent to 26,154.

Twitter asks judge to throw out disability lawsuit

By Sue Lannin

As well as the general chaos caused by Elon Musk since taking over Twitter, the social media firm is also being sued by former workers because of Mr Musk's arbitrary changes.

Reuters reports that Twitter asked a federal judge in California to throw out a proposed class action, which alleges the mandate by Mr Musk that employees return to the office and put in "long hours at high intensity" discriminates against workers with disabilities.

Twitter's lawyers filed a motion to dismiss the November lawsuit, saying the plaintiffs had not alleged that any of the company's actions were targeted at people with disabilities or had a disproportionate impact on them.

Twitter laid off about 3,700 employees in early November in a cost-cutting measure by Mr Musk.

Hundreds more resigned after he asked staff "to be extremely hardcore" or quit.

The lawsuit claims Mr Musk's ultimatum violated the federal Americans with Disabilities Act (ADA), which requires employers to offer reasonable accommodations to workers with disabilities.

Elon Musk says he won't sell Tesla stock until 2025

By Sue Lannin

More Tesla news.

Chief executive and Chief Twit Elon Musk says he will not sell anymore Tesla stock for two years according to Reuters.

He told a Twitter Spaces audio chat that he foresees the US economy will be in a "serious recession" in 2023 and consumer demand will fall.

Tesla shares rose 3 per cent in after hours trading after a nearly 9 per cent fall overnight.

The Tesla boss disclosed last week that he had sold $US3.6 billion worth of shares, bringing his share sales this year to $US40 billion.

Tesla shares have slumped by two-thirds since Mr Musk announced his Twitter takeover earlier this year.

"I needed to sell some stock to make sure, like, there's powder dry.... to account for a worst case," he said.

However, the billionaire has promised not to sell Tesla shares before and then sold them.

Mr Musk also would not be drawn on who would replace him as the boss of Twitter, after he said he would step down following a user poll which voted for him to go.

"(Twitter) is maybe 10 per cent of the complexity of Tesla."

ASX 200 market movers

By Sue Lannin

Just a handful of stocks going up this morning on the day before Christmas.

ASX falls in early trade after Wall Street slump

By Sue Lannin

The Australian share market is a sea of red this morning after Wall Street resumed its December sell-off on worries about rising interest rates.

Just eight stocks are higher on the ASX 200 index.

The ASX 200 is down 0.8 per cent at 10:20 am, while the Australian dollar is lower at 66.66 US cents.

All sectors are lower led down by industrials, energy stocks, real estate and technology.

Lithium explorer Lake Resources (-5 per cent) is the worst performer and media group News Corporation (1.5 per cent) is doing the best.

Tesla car sale sparks overnight share plunge

By Sue Lannin

Tesla investors were spooked overnight because the electric car maker decided to double its price discounts on some US models for North American customers.

It started offering discounts of $US7,500 on Model 3 and Model Y vehicles delivered in the US this month.

It's good for car buyers, but Tesla investors are worried its a sign of lower demand as economies slow down.

Tesla shares fell 8.9 per cent.

The share price is already down by almost two thirds this year, because investors think chief executive Elon Musk is distracted by his chaotic takeover of Twitter (he is).

Meanwhile, Elon Musk told a Twitter Spaces audio chat that he won't sell more Tesla stock for another two years.

That boosted Telsa shares after the bell.

Mr Musk has sold nearly $US40 billion ($60 billion) worth of Telsa shares to fund his nearly $70 billion takeover of Twitter.

Meanwhile, Tesla is spruiking the discounted Model Y on Twitter.

S&P 500 market movers

By Sue Lannin

Here are the best and worst performing companies on the S&P 500 overnight.

Energy, consumer staples and tech stocks were the biggest sector losers in a sea of red.

US stocks dive in Christmas sell-off on rate hike panic

By Sue Lannin

Wall Street's major indices slumped overnight after new figures showing a resilient economy sparked another sell-off.

That is because investors are worried a strong economy will see the US Federal Reserve continue with its steep interest rate hikes to curb inflation.

The final estimate of third quarter gross domestic product in North America was for annual growth of 3.2 per cent, higher than the previous estimate of 2.9 per cent.

At one stage, the Dow Jones index lost 2 per cent, and the Nasdaq fell more than 3 per cent.

They came off their lows by the close with the Dow down 1 per cent, the Nasdaq lost 2.2 per cent, and the benchmark S&P 500 fell 1.4 per cent.

Chipmaker Micron Technology fell 3.3 per cent after it forecast a bigger than expected loss for the second quarter and said it plans to lay off 10 per cent of its workforce next year.

Electric car maker Tesla plunged nearly 9 per cent after it doubled its price discounts on key models in the US this month, while tech giants Apple and Microsoft also tumbled.

In other economic news, the Labor Department said filings for state unemployment benefits rose to 216,000 last week.

FTX founder Sam Bankman-Fried released on bail

By Sue Lannin

This is the big news overnight.

The former crypto wunderkind Sam Bankman-Fried has been released on $US250 million bail ($375 million) by a US judge as he awaits trial for fraud, money laundering and conspiracy over the collapse of the FTX cryptocurrency exchange.

He will be under house arrest at his parent's home in California, must surrender his passport, and undergo regular mental health treatment and evaluation.

Mr Bankman-Fried has been accused of stealing billions of dollars in FTX customer funds to plug losses at his hedge fund, Alameda Research.

Meanwhile, his former associates, Caroline Ellison, and Gary Wang, have pleaded guilty to fraud charges over the collapse of FTX and are co-operating with prosecutors.

Here's the latest from Reuters.