The ASX managed a gain as real estate and mining stocks rose, while ANZ and Macquarie shares sank as they traded without rights to their latest dividend payments.

Newcrest's board is backing the latest takeover offer from Newmont that values the company close to $29 billion, with the gold sector bouncing as a whole.

Follow how the day's financial news unfolded, plus insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:30pm AEST

By Stephanie Chalmers

- ASX 200: +0.1% to 7,267.1 points

- All Ordinaries: +0.1% to 7,460.5 points

- Australian dollar: +0.5% to 66.79 US cents

- Nikkei: +0.8% to 29,626 points

- Hang Seng: +2% to 20,028 points

- Shanghai: +1% to 3,303 points

- Dow Jones (Friday): Flat at 33,301 points

- S&P 500 (Friday): -0.2% to 4,124 points

- Nasdaq (Friday): -0.4% to 12,285 points

- FTSE (Friday): +0.3% to 7,755 points

- EuroStoxx (Friday): +0.4% to 465 points

- Spot gold: +0.2% at $US2,014/ounce

- Brent crude: -0.2% to $US73.98/barrel

- Iron ore (Friday): +3.6% to $US102.10/tonne

- Bitcoin: +4% at $US27,488

ASX posts small gain

By Stephanie Chalmers

Hello - Stephanie Chalmers jumping in to bring you the closing numbers.

The local share market has managed a gain for its first session of the week, but by no means a substantial one.

Nonetheless, a positive note to start on after posting a weekly gain last week.

The ASX 200 has closed up by 0.1 per cent, making some ground through the afternoon after a lackluster start.

Real estate, materials and energy were the best performing sectors of the session, while financials lagged, dragged down by losses for ANZ (-4%) and Macquarie (-2.4%) trading ex-dividend, as Michael explained earlier.

The standout stock of the session was Invocare, after it received an improved takeover offer from a private equity group.

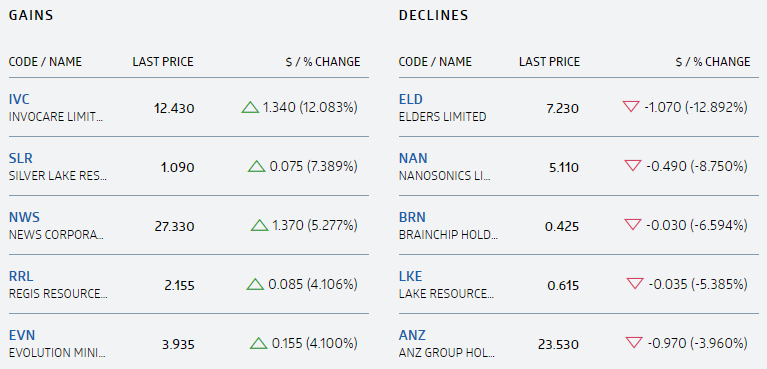

Here are the rest of the biggest movers:

Tomorrow, there'll be a bit of local data out, with the Reserve Bank board meeting minutes, which could provide some more insight into that unexpected hike in May, and Westpac's monthly consumer confidence index.

David Chau will be with you tomorrow morning with a wrap of all the overseas market moves.

Report into PwC will never be published

By Daniel Ziffer

A report into a scandal that has potentially cost taxpayers millions in lost tax revenue will never be published.

Former PwC tax expert Peter-John Collins was banned from his profession after helping the government write new laws to stop multinational companies avoid tax ... and then using that information to create strategies that were sold by the consulting firm to those companies.

Report by September

The consulting firm has announced former Telstra CEO Dr. Ziggy Switkowski will look into PwC Australia's "culture, governance and accountability" in the wake of the allegations.

Dr Switkowski has previously led inquries into Essendon FC's supplement saga and the idea of Australia starting a nuclear power industry.

In a statement the firm welcomed the recruitment of the respected business leader.

Dr Switkowski will consider all aspects of PwC Australia’s governance, accountability and culture, including how the firm applies its professional values and ethical standards across its work.

The independent review will look at the way in which decisions are made and overseen within PwC, including how financial goals, values and strategic objectives are balanced and prioritised. It will examine the way in which partners and staff are held accountable for their responsibilities, as well as assess the values and behaviours that exist at all levels within the firm.

The public will never see the full report, which should be done by September 2023.

When complete, PwC Australia will share a summary of these key recommendations to ensure transparency.

Former CEO Tom Seymour to leave PwC

The statement also announced that former chief executive Tom Seymour — who stood down last week — will leave the partnership in September.

The new boss, Kristin Stubbins, says the company is committed to "learning from our mistakes".

"Dr Switkowski will have access to all the people and information he needs to conduct a rigorous and robust review. We look forward to receiving his report and acting swiftly on its recommendations.”

The company's largest client is you: the taxpayer. It billed the federal government more than $500 million in contracts in the past two years.

Collectively the major consulting firms — including KPMG, EY, Deloitte, McKinsey & Co and others — are paid billions of dollars annually for work done on behalf taxpayers.

Invocare will accept upwardly revised private equity bid

By Michael Janda

It's not a dead certainty yet, but TPG's upwardly revised bid has won over the board of funeral operator Invocare.

The private equity firm looks set to have one foot in the grave, after Invocare's board indicated its support for the $13.00 a share bid, inclusive of a fully-franked dividend of up to 60 cents a share that could yield tax benefits for many shareholders.

The latest offer is a 45% premium to Invocare's share price immediately prior to the initial bid, but it's a relatively small increase on the initial $12.65 a share offer that was rebuffed.

The new offer has prompted Invocare to open up its books for TPG to do due diligence, but there's no guarantee a binding bid will arrive if the private equity firm finds any financial skeletons in the closet.

If it does go ahead the deal gives Invocare an enterprise value of $2.2 billion showing the business of death is in rude health.

ASX sneaks into the black as banks pare losses

By Michael Janda

This is seriously looking like Friday all over again. Why did I bother turning up today?

The ASX 200 index is now 0.1% higher at 7,262 points, with the All Ords flat at 7,454.

The big banks have trimmed their losses.

ANZ has still lost a little more than the value of its 81-cent dividend, but Macquarie would be trading up if it wasn't ex-dividend today.

National Australia Bank is a bit higher, although CBA is still 0.5% lower at $98.47.

The major miners have also extended gains since midday, with BHP up 0.9% at $43.88, while Rio Tinto is up 0.7% at $108.69.

'Debt ceiling debate approaches 11th hour' but ANZ confident US default will be avoided

By Michael Janda

ANZ economists Brian Martin and Tom Kenny have put together a useful summary of the US debt ceiling debate and risks of default.

They are a little more relaxed than Rabobank's global strategists, but only a little.

Here are some highlights (or lowlights):

"The Congressional Budget Office (CBO) projects that, if the debt limit remains unchanged, the government's ability to continue spending using extraordinary measures will be exhausted by early June. In that event, many government workers could not get paid, social security and other payments would be at risk and the Treasury would be unable to borrow. Recession risks would intensify sharply."

Just how bad could it get? Very, according to recent forecasts.

"The consequences of a default would be disastrous.

"US Council of Economic Advisors (CEA) estimates a short default would cause a 0.3% rise in unemployment and 0.6% contraction in GDP. A protracted default would cause a 5.0% rise in unemployment and 6.1% fall in GDP.

"A default would also provoke a sharp rise in yields and wreak havoc in all financial markets and the real economy in the US and internationally."

So what do the ANZ economists think will happen?

"We think the most likely scenarios are:

1. A longer-term agreement. We see a limited possibility (less than 10%) of a longer-term deal to lift or suspend the debt limit along the lines of the Republican bill. For now, the parties are too far apart and there is limited time in lawmakers' diaries to broker a deal before the X date.

2. A short-term compromise. We think a deal to suspend the debt limit by a few months is the most likely outcome (around 90%). This would be a similar outcome to what happened in October2021 when Democrats and Republicans agreed to increase the debt limit by USD480bn. This was said to be enough to provide funding till December 2021 or early January 2022. On 14 December 2021 the House and Senate passed a bill that saw the debt limit increased to its current level of USD31.4trn.

3. No agreement and the US defaults. According to the US Treasury this has never happened. Since 1960, Congress has acted 78 times to raise, temporarily extend or revise the definition of the debt limit. We think there is around a 1% chance of a default. A recent Chicago Fed paper claims Credit Default Swap (CDS) spreads data imply the probability of a default is 1%. This would likely be higher now, given that CDS spreads are a little higher compared to when the paper was published."

So, the most likely outcome is another kick of the can down the road.

'Picking up pennies in front of a steamroller'

By Michael Janda

Michael Every is not the only Rabobank analyst who has a way with words.

His Sydney-based offsider Benjamin Picton, offers some delightfully disturbing commentary on the growing divergence between returns on one and two month US Treasury bills as the debt ceiling approaches and the risks of a US government debt default in June mount.

"1-month T-bills are this morning paying 5.42% vs 4.78% for the 2-month note," he noted.

"There's a comical element in the market attempting to reflect increased credit risk for short-dated US government securities in traded yields. Once upon a time this situation would have been ludicrous, but we live in interesting times.

"The scenario that we are now countenancing is deeply binary. The yield premium in short-dated bills looks a bit like picking up pennies in front of a steamroller in the context of a potential default that would reverberate through a world financial system predicated on US government IOUs constituting a 'risk free' investment.

"With commercial real estate and US regional banks already teetering from rapid monetary tightening, how much more debt brinkmanship can the nerves of traders handle? What price assets if risk free rates turn out to be full of risk?"

That last question in particular might be, and certainly should be, keeping a lot of investment managers and policymakers awake at night.

'Slow burn US banking crisis' based on a 'highly profitable strategy for speculators'

By Michael Janda

Some interesting observations on the US banking crisis from Jamieson Coote Bonds, an Australian investment house.

They believe we are in the midst of "a slow burn US banking crisis", which stems from rapid rate rises "starting a chain of events that will have no natural conclusion under current policy settings".

"Initially, this crisis was proceeded by large deposit outflows, exposing the weakness of fractional banking in a fast-moving digital world where deposit holders can switch from a low interest paying account to another bank or money market fund (or short-term bond with high yields) at a moment's notice," they wrote.

But they also argue the crisis has as much to do with short-sellers chasing quick profits as it does with the fundamental soundness, or otherwise, of the banks in question.

"Whilst fundamentals remain challenged (restrictive monetary policy) this is a highly profitable strategy for speculators, with the only material risks being a ban on short selling of equity or full guarantee of all bank deposits by US authorities – either of which would generate a large, short squeeze for those trying to profiteer from burning down the banks.

"Whilst such a policy shift may occur to counteract this short selling of regional banks, they do continue to face an ongoing problem regardless. People are not moving their money because of deposit loss fears − everyone assumes that unlimited insurance should be guaranteed in the end or a deal manufactured over a weekend, particularly as we approach the US Presidential election cycle; but they are moving their deposit money because it takes 30 seconds to transfer from a no interest savings or checking account to a money market account or a high quality bond that can yield north of 5.00%."

Perhaps Australia's banks, currently facing an Australian Competition and Consumer Commission inquiry into why many deposit rates are failing to keep up with the surging cash rate, might need to take note about the risks of deposit flight to chase more competitive returns.

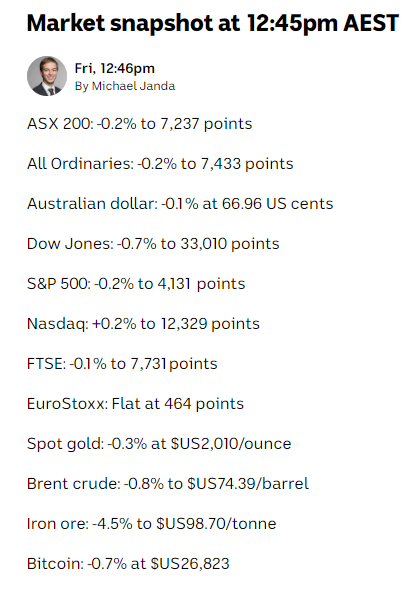

Market snapshot at 12:50pm AEST

By Michael Janda

ASX 200: -0.2% to 7,242 points

All Ordinaries: -0.3% to 7,433 points

Australian dollar: +0.2% to 66.57 US cents

Nikkei: +0.4% to 29,507 points

Hang Seng: Flat at 19,624 points

Shanghai: -0.6% to 3,253 points

Dow Jones (Friday): Flat at 33,301 points

S&P 500 (Friday): -0.2% to 4,124 points

Nasdaq (Friday): -0.4% to 12,285 points

FTSE (Friday): +0.3% to 7,755 points

EuroStoxx (Friday): +0.4% to 465 points

Spot gold: +0.1% at $US2,013/ounce

Brent crude: -0.7% to $US73.67/barrel

Iron ore (Friday): +3.6% to $US102.10/tonne

Bitcoin: +3% at $US27,232

ASX still pretty much where it started, as shares dip on ex-dividend banks

By Michael Janda

I'm having strong deja vu vibes today, having also done the markets blog most of Friday.

The market opened, fell slightly and continues to trade about 0.2% lower. The ASX 200 is on 7,241 points.

Sound familiar?

The only thing that could make it even more eerie is if it recovers late to finish slightly higher.

The big drag on the market today are two ex-dividend big banks, ANZ and Macquarie, while NAB was the only major bank to trade higher.

Resources companies are split. Take this example, gold miner Silver Lake Resources is one of the top gainers, up 7.4% to $1.09. Another company minus the "silver", Lake Resources (a lithium producer), is down 10% at $0.585.

Despite its name, Silver Lake mines gold, and those producing the precious metal are generally trading strongly today, no doubt getting a boost from Newcrest's acceptance of a takeover by North American giant Newmont.

Not only is that a sign of takeover interest in the sector that might spill over to other firms, but there is also talk that Newmont may want to split and sell-off some of Newcrest's non-core assets, potentially opening up buying opportunities.

Rural services firm Elders was a notable mover, dropping 12.1%, or a dollar, to $7.30 after releasing its first-half profit results.

No need to second guess what the market thought of its 42.4% slump in net profit to $48.8 million, which the company said was due to a "volatile" but also "more normalised" trading environment for agricultural commodities.

The Catch-22 that is likely to see many working people keep going backwards

By Michael Janda

How would you like your real disposable income cut?

From wage rises that are well behind inflation? From higher mortgage repayments? Or some combination of the two.

The latter is what most working mortgage borrowers have experienced over the past year.

Many will be hoping that the second half of this year offers some respite from further rate rises but, as David Taylor explains, that largely depends on their real wages continuing to go backwards for some time yet.

ATO issues warning to property investors

By Michael Janda

Continuing a trend from recent years, the Tax Office warns it'll have a razor sharp focus on deductions related to residential property investment this financial year.

"You can only claim interest on a loan used to purchase a rental property to earn rental income," says ATO assistant commissioner Tim Loh.

"Don't forget, if your loan also includes a private expense, such as for a new car or a trip to Bali, you can only claim an interest deduction for the portion relating to producing your rental income."

Mr Loh also warns that a little income on the side from your home could mean a little tax bill on the side when you sell your home.

"Generally, your main residence is exempt from CGT, however if you have used your home to produce income, such as renting out all or part of it through the sharing economy — for example Airbnb or Stayz — or running a business from home, then CGT [Capital Gains Tax] may apply."

As Nassim Khadem explains in this story, there are also changes to work-from-home deductions, how they are calculated and the evidence you need to back them up.

NAB warns RBA cash rate likely to hit 4.1%, possibly higher

By Michael Janda

The yo-yo rates forecasting of NAB continues.

The bank, which had pencilled in a 4.1% rate peak in February then backed away from that, eventually settling on a 3.6% RBA cash rate peak, before last month's surprise rate hike blew that out of the water.

NAB has now swung back to its February forecast, and expects the Reserve Bank to push through at least one more rate rise.

It has also blamed the RBA and its flip-flopping on communication for its frequently changing rate forecasts.

"The key uncertainty for our rate expectations has been the reaction function of the RBA, and monetary policy strategy of the RBA been marked by some mixed signals in 2023.

"However, it is clear that the near-term balance of risks on inflation remain to the upside, and the RBA is forecasting inflation to only return to the top of the target band by mid-2025.

"At least one additional rate rise is likely to be necessary to limit the risk this timeline slips any further. We wouldn't rule out the prospect of an additional rise to 4.35% if the data stays stronger for longer.

"Importantly, our rate call is not a response to the recent Federal Budget, which we judge to be broadly neutral in terms of its effects on inflation and implications for monetary policy."

For those already struggling with rapid rate rises on large mortgages, NAB offers a glimmer of hope.

"It remains our view that, as higher rates pass through to household cash flows and the wider economy, the economy will begin to slow more noticeably in the second half of 2023 and into 2024, seeing annual GDP growth slow to below 1% and the unemployment rate begin to rise, reaching around 4.7% in 2024.

"This makes it an increasingly difficult balancing act for the RBA to manage inflation lower without slowing the economy too much. We continue to expect the cash rate to return to a more neutral setting of 3.1% by mid-2024 as this slowdown takes hold."

So, NAB expects rates will come back down, but only after a few hundred thousand people lose their jobs.

If you're not one of those people, that will be good news for keeping up with your mortgage. If you are …

Big week for economic data on the workplace

By Michael Janda

There are two massive pieces of economic data out this week: wages and unemployment.

Both will be closely watched by the Reserve Bank as its board considers whether further rate rises are necessary to slow the economy to reduce inflation.

The wages data is for the March quarter and is out on Wednesday at 11:30am AEST. Economists expect the Wage Price Index to have risen 0.9% over the first three months of this year and 3.6% over the past year.

On Thursday, April's Labour Force data will be released by the ABS at 11:30am AEST. Economists expect the creation of 25,000 jobs to leave the unemployment rate at 3.5%.

The ABC's senior business correspondent Peter Ryan previewed the data with News Radio's Thomas Oriti.

What is a recession and is Australia likely to have one?

By Michael Janda

Late last week, we saw research from the Reserve Bank indicating that Australia has as much as an 80% chance of falling into recession.

But the definition the RBA used might not be the one for a 'technical recession' that you're familiar with, which is two consecutive quarters where the economy (as measured by GDP) shrinks.

Instead the RBA used a modified version of the Sahm Rule.

What's that? I hear you ask.

As is often the case with all things economic, Gareth Hutchens has some answers and explanation for you.

Market snapshot at 10:35am AEST

By Michael Janda

ASX 200: -0.2% to 7,242 points

All Ordinaries: -0.2% to 7,437 points

Australian dollar: Flat at 66.45 US cents

Dow Jones (Friday): Flat at 33,301 points

S&P 500 (Friday): -0.2% to 4,124 points

Nasdaq (Friday): -0.4% to 12,285 points

FTSE (Friday): +0.3% to 7,755 points

EuroStoxx (Friday): +0.4% to 465 points

Spot gold: Flat at $US2,011/ounce

Brent crude: Flat at $US74.16/barrel

Iron ore (Friday): +3.6% to $US102.10/tonne

Bitcoin: +1.4% at $US26,815

Forgetful me

By Michael Janda

We have comments... Hey Michael...

- Natty

I always struggle to remember to turn comments on.

Good morning Natty, thanks for joining us as usual!

ASX opens lower as ANZ and Macquarie go ex-dividend

By Michael Janda

The Australian share market is down in early trade, but things aren't as bad as they look.

While the ASX 200 is off 0.2% at 7,244 points and the All Ords down a similar amount at 7,439, much of the decline is down to ANZ and Macquarie.

Both banks are ex-dividend today, which means anyone who buys their shares from today on won't get their most recent shareholder distributions.

That's an 81-cent half-year dividend for ANZ and a $4.50 per share payment for Macquarie shareholders.

That's the main reason ANZ's shares are down $1.06, or 4.3%, to $23.44, while Macquarie's are off 3%, or $5.33, to $173.75.

The banking sector as a whole is a little on the nose, amid ongoing concerns about the crisis for many US regional banks, as well as more general worries about credit quality and earnings for banks with interest rates higher than they've been for more than a decade.

The financial sector on the ASX 200 was down 1.2 per cent in the first 25 minutes of trade, with industrials, education and technology also stuck well in the red.

On the flip side, mining and energy are having good mornings, with basic materials up 0.9 per cent.

South Korea a key customer for Australia's nascent hydrogen boom

By Michael Janda

My colleague Rachel Pupazzoni has just been over to South Korea on a media exchange funded by the two nations foreign affairs departments and organised by the Walkleys and Korean Press Foundation.

While over there, Rachel had the chance to talk with some of the key players in Korea's manufacturing and industrial sectors, who are relying on the prospect of Australian hydrogen to meet their net zero carbon emissions goals.

The key challenge seems to be, how do we get the hydrogen over there without losing a lot of the energy content in the process?

One solution is for Korean companies, and those from other energy customer nations, to set up some of their more energy intensive processing operations here, close to the source.

Read more in Rachel's article here, or watch her story on The Business tonight at 8:45pm AEST on ABC News Channel.

Newcrest board backs Newmont's latest takeover offer

By Michael Janda

After a pursuit over the past few months, US gold giant Newmont appears to have landed its Australian target, with Newcrest's board agreeing to back its takeover offer.

In the absence of a superior proposal emerging, Newcrest's board has unanimously supported the offer that will see its shareholders receive 0.4 Newmont shares for each Newcrest share they own.

Newcrest can also pay its shareholder a special franked dividend of up to $US1.10 a share prior to completion of the deal.

The Australian company says the deal values Newcrest at $29.27 per share, a 30.4% premium to prior to Newmont's initial offer being made.

The deal values Newcrest at an enterprise value of $28.8 billion, leaving its shareholders with a 31 per cent stake in the combined company.

Newcrest says it will leave the merged company as a "clear global leader in gold production" with a significant and growing presence in copper.

Aside from needing support from Newcrest shareholders, the deal will also need regulatory approvals from the Foreign Investment Review Board and other regulators in several countries.