A rally on Wall Street has sent Australian stocks higher, while property values in the country have recorded the biggest fall in recent memory.

We brought you the latest on what was happening on the markets throughout the day in our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot

By Samuel Yang

This is where the market finished up at the close of local trade shortly after 4:00pm AEDT on Monday.

- ASX 200: Up 0.6 per cent to 7,153

- All Ords: Up 0.7 per cent to 7,357

- Aussie dollar: 69.23 US cents

- Nikkei: Up 0.6 per cent to 25,973

- Hang Seng: Up 1.6 per cent to 21,328

- NZ 50: Up 0.2 to 11,646

- Spot gold: Up 0.5 per cent to $US1,875.01 an ounce

- Brent crude: Up 1.2 per cent to $US79.48 a barrel

- Bitcoin: up 1.8 per cent to $US17,232.17

ASX closed up

By Samuel Yang

The ASX 200 has risen by 0.6 per cent on Monday.

Today's best performers include mining and energy stocks.

But it's nothing compared to a small lithium developer called Essential Metals, which surged by almost 40 per cent.

That's after it received a $136 million takeover bid from Tianqi Lithium Energy, which is a joint venture between a Chinese company and local mining firm IGO.

But the deal still needs foreign investment approval and the Treasurer's approval.

On the flip side, Fortescue Metals was down after its chief financial officer Ian Wells announced his resignation.

Here are the top and bottom movers at close.

That's all from our live blog today, hopefully you can join us again for all of tomorrow's market action.

Customers claim they were lured into foreign exchange trading and lost hundreds of thousands of dollars

By Samuel Yang

Former customers of an Australian company claim they were lured into the high-risk world of foreign exchange trading under false pretences and subjected to high pressure-sales tactics which contributed to them losing huge sums.

Read more from 7.30's Michael Atkin.

Asking to work from home is about to get easier

By Samuel Yang

As COVID-19 restrictions around the country were scrapped, many Australian employers told staff it was time to return to the office.

For employees keen for more flexible arrangements, laws passed in federal parliament in October — as part of the Secure Jobs, Better Pay bill — will make it easier to challenge a boss who refuses such a request.

Read more from business reporter Rhiana Whitson.

ICYMI: Sydney, Brisbane and Melbourne home values see the largest downturn

By Samuel Yang

Business reporter David Chau breaks down the latest CoreLogic data on property prices and what caused the downward trend.

Or you can read more by clicking the link below from Velvet Winter.

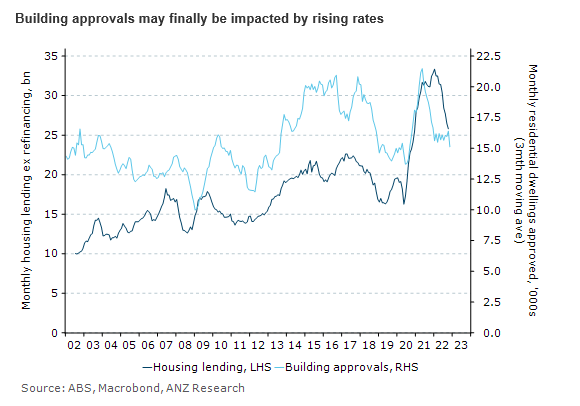

Building approvals fall in November

By Gareth Hutchens

The Australian Bureau of Statistics has released its latest data on building approvals.

In November, total dwellings approved fell by 9 per cent in Australia.

Across the country, total dwelling approvals fell in:

- New South Wales (-18.4 per cent)

- Western Australia (-17.5 per cent)

- Victoria (-12.7 per cent)

- Queensland (-5.6 per cent)

Although some states bucked the trend, with increases in:

- Tasmania (75.7 per cent)

- South Australia (10.0 per cent)

However, in the aggregate, it was the third-consecutive monthly decline in dwelling approvals.

Since August, approvals have declined by more than 21 per cent.

But looking under the headline figure, the decline in approvals has been driven by apartment approvals.

According to economists at ANZ, the decline in approvals in November may be an early sign of the impact of rising rates.

"In response to higher rates, housing lending has almost halved from its COVID peak," says ANZ's senior economist Adelaide Timbrell.

"The same impact was not seen in building approvals through most of 2022. This has started to shift. Total approvals are at their lowest level since January 2022."

More on housing...

By Samuel Yang

High home prices are boosting inheritances, meaning your position in society increasingly owes more to which family you're born into than to talent or hard work. But there are solutions.

Read more from Brendan Coates and Joey Moloney.

ASX rises on boost from miners, US jobs report

By Samuel Yang

Australian shares rose on Monday, led by miners as iron ore prices firmed, while last week's US jobs report showing a slowdown in wage growth eased investor worries about inflation outlook and the Federal Reserve's monetary policy stance.

The ASX 200 gained 69 points or 1 per cent, to 7,179 at 11:30am AEDT. The benchmark ended 0.7 per cent higher on Friday.

Data showed on Friday that the US economy added jobs at a solid clip in December, pushing the unemployment rate back to a pre-pandemic low of 3.5 per cent as the labour market stayed tight, although average hourly earnings rose 4.6 per cent in December from a year earlier, down from 4.8 per cent in November.

Local miners jumped 1.5 per cent as iron ore prices inched higher on optimism around China's stepped-up policy support for its ailing domestic property sector.

Heavyweights BHP and Rio Tinto jumped 1.8 per cent and 0.3 per cent, respectively.

Fortescue said that Ian Wells will step down as chief financial officer. Shares were down 0.5 per cent.

Essential Metals jumped 37.7 per cent, eyeing its best day since October 2021, after receiving a buyout bid from Tianqi Lithium Energy Australia, a joint venture between IGO and Tianqi Lithium Corp. IGO gained 2.3 per cent.

Gold stocks gained 1.7 per cent, as US Treasury yields and the US dollar fell.

Newcrest Mining and Northern Star Resources jumped 2 per cent and 1.3 per cent, respectively.

Energy stocks jumped 1.3 per cent even as oil prices fell.

Sector majors Santos and Woodside Energy advanced 1.2 per cent and 1 per cent, respectively.

Financials gained 0.6 per cent with the big four banks jumping between 0.4 per cent and 1.1 per cent.

National housing downturn into new territory: CoreLogic

By Samuel Yang

New figures released this morning show Australian home values have recorded their biggest and fastest drop in recent memory.

The median property price has fallen 8.4 per cent since hitting a peak in May last year, according to CoreLogic's latest numbers.

This result breaks the previous record which was a similar-sized drop between October 2017 and June 2019.

The key difference is that this time it took less than nine months to get to this point, whereas before it took almost two years.

It's mainly because the Reserve Bank lifted interest rates last year to their highest level in a decade and there will be more rate hikes to come.

However, this record fall in house prices isn't all that much, especially when you consider prices on average had jumped by about 30 per cent from their COVID low point in 2020 to their peak in May 2022.

ASX opens the week higher

By Samuel Yang

Good morning and welcome to our markets live blog, where we'll bring you the latest price action and news on the ASX and beyond.

A rally on Wall Street last Friday sets the tone for local market action today.

The Dow Jones index gained 2.1 per cent, the S&P 500 advanced 2.3 per cent and the Nasdaq Composite firmed 2.6 per cent.

The ASX 200 was up 63 points or 0.9 per cent to 7,110 at 10:10am AEDT.

At the same time, the Australian dollar was up 0.1 per cent to 68.83 US cents.

Brent crude oil was up 0.3 per cent, trading at $US78.87 a barrel.

Spot gold gained 0.1 per cent to $US1,866.40.