It has been a temperamental day for the Australian share market, which followed a mixed performance on Wall Street as investors bet on interest rates having to rise by more than they initially expected.

Meanwhile, the Australian dollar briefly fell to a two-month low of 66.96 US cents after the Bureau of Statistics released figures showing that the nation's economic growth slowed down considerably, but cost of living pressures are starting to ease.

See how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:25pm AEDT

By David Chau

The local share market struggled for direction — as it fell in and out of negative territory, before end its day practically unchanged.

- All Ordinaries flat at 7,456 (down 2 points)

- ASX 200 -0.1% to 7,252 points

- Australian dollar +0.4% to 67.5 US cents

- Dow Jones -0.7% to 32,657

- S&P 500 -0.3% to 3,970

- Nasdaq Composite -0.1% to 11,456

- FTSE (UK) -0.7% to 7,876 points

- EuroStoxx 600 -0.7% to 461 points

- Brent crude +0.5% to $US83.90 / barrel

- Spot gold +0.2% to $US1,830.60 / ounce

- Iron ore +1.2% to $US124.15 / tonne

China PMI data boosts Aussie dollar and Asian markets

By David Chau

China's manufacturing activity expanded at the fastest pace in more than a decade in February, smashing expectations as production zoomed after the lifting of COVID-19 restrictions late last year.

The manufacturing purchasing managers' index (PMI) jumped to 52.6 points (up from 50.1 in January), according to China's National Bureau of Statistics — above the 50-point mark that separates expansion and contraction in activity.

The PMI far exceeded an analyst forecasts and was the highest reading in 11 years (since April 2012).

The world's second-largest economy recorded one of its worst years in nearly half a century in 2022 due to strict COVID lockdowns and subsequent widespread infections.

The curbs were abruptly lifted in December as the highly transmissible Omicron spread across the country.

'Weak starting point' for China

Global markets cheered the big surprise in the PMI with Asian stocks and the Australian dollar reversing earlier losses.

The Australian dollar briefly fell to a two-month low (66.96 US cents) — after the ABS released inflation and GDP data which felle below market expectations.

But after China published PMI data which confirmed a manufacturing rebound, the Aussie dollar jumped 0.5% to 67.6 US cents (by 5:45pm AEDT).

Hong Kong's Hang Seng index surged 3.9%, while the Shanghai Composite gained 0.9%.

"The high PMI readings partly reflect the economy's weak starting point coming into this year and are likely to drop back before long as the pace of the recovery slows," said Julian Evans-Pritchard, head of China economics at Capital Economics.

"We had already been expecting a rapid near-term rebound, but the latest data suggest that even our above-consensus forecasts for growth of 5.5% this year may prove too conservative."

Mining stocks dominate the list of top performers

By David Chau

Only two sectors on the ASX 200 traded higher — energy and materials.

Strong gains in BlueScope Steel (+4%) and iron ore mining giants Rio Tinto (+2.5%), Fortescue Metals (+3.4%) and BHP (+2.3%) helped to keep the ASX steady.

Many of the top performing shares the on benchmark index were gold stocks, including Ramelius Resources (+6.7%), Perseus Mining (+4.8%), Evolution Mining (+4%) and De Grey Mining (+3.9%) and Newcrest Mining (+3.7%).

'Big four' banks drag ASX lower

By David Chau

Today's losses on the ASX 200 index were broad-based, with six out of every 10 stocks finishing lower.

While most sectors were in the red, real estate (-1.8%), technology (-1.6%) and financials (-1.2%) were the worst performing sectors.

The stocks which suffered the heaviest losses include Link Administration (-5.7%), InvoCare (-3.5%), Costa Group (-3.1%) and Blackmores (-3%).

However, the biggest drags on the market were the major banks Commonwealth Bank (-1.6%), Westpac (-2%), ANZ (-1.1%) and NAB (-2.1%).

Government blocks Yuxiao Fund's bid to increase its stake in Northern Minerals

By David Chau

The federal treasurer has quietly blocked a Chinese-linked investment fund from increasing its stake in a strategically crucial Australian rare earths producer, in another sign the government remains intent on building up trusted critical minerals supply chains.

Last year, Yuxiao Fund applied to the Foreign Investment Review Board to increase its stake in Northern Minerals Limited from just under 10 per cent to 19.9 per cent.

But Treasurer Jim Chalmers signed an order blocking the move on February 15 after the Foreign Investment Review Board recommended the application be turned down.

Mr Chalmers would not detail the reasons behind his decision.

For more on this, here's the story from Stephen Dziedzic and Daniel Mercer.

ASIC sues coal miner TerraCom over breach of whistleblower laws

By David Chau

The corporate regulator has filed a lawsuit against coal miner TerraCom, alleging it breached whistleblower protections.

This was after a former employee claimed TerraCom had falsified the quality of its coal for export.

The Australian Securities and Investments Commission (ASIC) has been investigating TerraCom over allegations of inflated coal quality in export documentation since claims were first aired in early 2020 as part of an unfair dismissal case.

TerraCom has said it "categorically denies" the allegations.

Australia is the world's second-largest exporter of thermal coal used in power stations, and the scandal has sparked calls for a federal review into the industry expected to reap $76 billion in sales this year.

ASIC filed its civil case in the Federal Court against the miner, two of its executives (managing director Daniel McCarthy and chief commercial officer Nathan Boom), and two former directors (former chair Wal King and former deputy chair Craig Ransley).

False or misleading statements

This marks the first time ASIC has taken action for alleged breaches of whistleblower provisions, ASIC deputy chair Sarah Court said on Wednesday.

"ASIC alleges that TerraCom and its senior company employees engaged in conduct that harmed a whistleblower who revealed the alleged falsification of coal quality certificates," she said.

"Whistleblowers perform a vital role in identifying and calling out corporate misconduct ... We take any indication that companies are engaging in conduct that harms or deters whistleblowers very seriously."

TerraCom said it will "vigorously" defend the proceedings, in a filing to the stock exchange.

Its shares fell as much as 5.3% before paring losses.

TerraCom has denied allegations by former general manager Justin Williams in several releases to the Australian stock exchange, saying a "forensic" independent investigation had concluded Williams' allegations were unfounded.

ASIC, which obtained a copy of the investigation, said directors had failed in their fiduciary duty by allowing the publication of false or misleading statements to the exchange.

What will the RBA do with interest rates?

By Gareth Hutchens

Meanwhile, with growth slowing in the back half of last year, and signs that inflation may have peaked, thoughts are turning to the Reserve Bank.

Will it still think it needs to keep lifting rates?

Marcel Thieliant, the head of Asia-Pacific at Capital Economics, still thinks the RBA will end up lifting the cash rate target from 3.35 per cent to 4.1 per cent in coming months.

"The RBA will need to see the next quarterly print due in late-April before it can conclude that inflation is on the decline," he's written in a note to clients today.

"GDP growth softened last quarter and inflation slowed sharply in January. But with inflation still very high, that won’t prevent the RBA from hiking the cash rate to a peak of 4.1% in May."

Why is inflation so feared?

By Gareth Hutchens

Would you mind explaining how high inflation damages the economy and why it is so feared?

- Bill

High inflation is a scourge for a number of reasons.

It destroys the value of peoples' savings.

Persistently high inflation can throw everyone's plans into disarray (since contracts are signed in nominal terms, high inflation can lock businesses into agreements that were originally profitable but are now ruinous).

Since most employers refuse to regularly increase their employees' wages in line in inflation, periods of high inflation mean the purchasing power of workers' wages can deteriorate rapidly.

Periods of high inflation, as we're seeing today, also redistribute income and wealth (and power) away from wage earners towards asset owners.

There's a whole list of reasons.

As John Maynard Keynes wrote in "The Economic Consequences of the Peace" (1919):

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

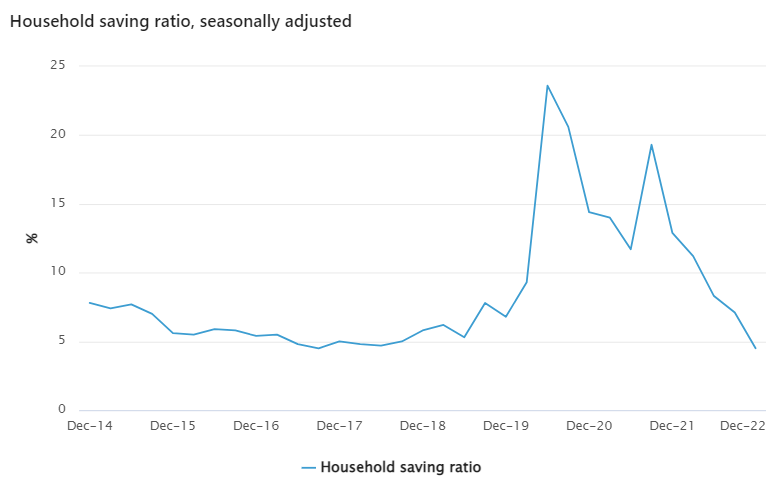

We're saving less and less

By Gareth Hutchens

This shows what's happening with the rate of household saving.

As the RBA aggressively lifts rates, and as some companies rake in record profits during this inflationary episode, households are saving less and less of their weekly income.

In the December quarter, the household saving ratio was back at levels last seen in September 2017.

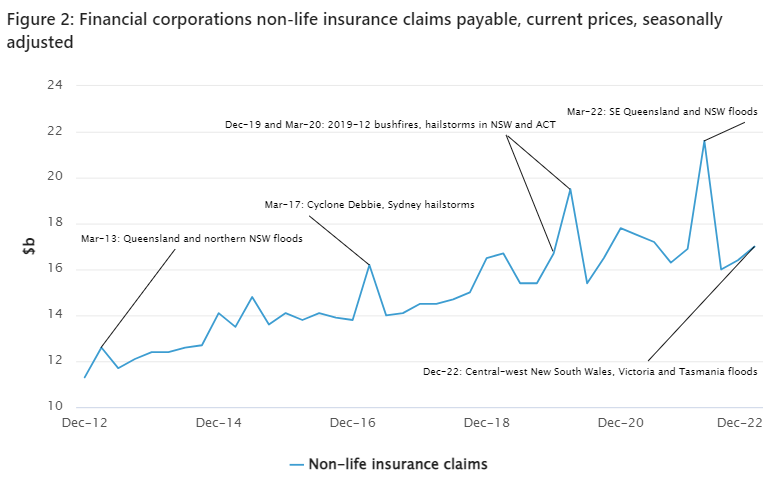

Impacts of flooding in December quarter

By Gareth Hutchens

The ABS has explained what impact our devastating floods had on economic activity late last year.

It says regional areas in New South Wales, Victoria, South Australia, and Tasmania experienced severe flooding in late spring that directly affected the agricultural industry.

There were further downstream impacts for the transport, manufacturing, and wholesale industries.

The mining industry also continued to feel the impacts of the wet weather over the quarter.

Loss and damage to grain production saw elevated commercial crop insurance claims.

However, household insurance claims were significantly lower than for the February 2022 floods, which reflected a greater impact to regional areas in the December quarter floods compared to the February floods.

See the insurance claims in this graphic.

Flood impact on economic activity in different industries in December quarter.

Mining

La Niña continued to hamper coal production, which declined 1.4% this quarter. There was excess water at open cut coal mines along the New South Wales north coast and the Hunter region.

Despite lower production, coal exports held up with the transportation of existing inventories to ports less affected by weather disruptions this quarter. Mining production in other parts of the country recovered from recent wet weather and shutdowns, particularly iron ore mining and oil and gas extraction.

Agriculture

Agriculture gross value added (GVA) decreased by 2.8% in the December quarter 2022, as livestock and grain production were constrained by the floods.

Livestock output decreased as flood waters prevented the transportation of cattle and lambs to abattoirs. Waterlogged grains led to reduced production, delayed harvests and reduced grain quality in the New South Wales and Victorian growing regions. This was partly offset by strong grain production in Western Australia and South Australia, which experienced favourable growing and harvest conditions.

Wet weather caused delays in the harvest and transportation from farms to grain storage. This resulted in farmers storing grain on site, driving a rise in farm inventories.

Transport, postal and warehousing

Flooding negatively affected transport output due to damaged road closures. This caused supply chain bottlenecks in the transport of farm goods, extended delivery times and increased freight costs.

Road transport gross-value-added declined 1.1% over the December quarter 2022.

New South Wales and Victorian rail lines were also affected, but experienced fewer delays as major lines transporting coal and grain remained operational.

Bumper harvests in Western Australia and South Australia experienced fewer rail disruptions, supporting rail output and exports of grains.

Wholesale trade

Crop damage across the eastern states lowered grain wholesaling activity, although this was offset by large harvests in Western Australia and South Australia. The latter drove a rise in exports of cereal crops (+3.4%) and a build-up in wholesale grain inventories.

Wholesale Trade gross-value-added recorded an overall fall, driven by machinery and equipment, with imports of machinery and industrial equipment declining 6.9%.

Would this work?

By Gareth Hutchens

One more post on this topic before we get back to the GDP numbers themselves.

Ken Henry, the former Treasury official, has been thinking about this very topic.

He's been working (with a bunch of other people) on a system of accounting for economic growth that could include environmental degradation (and improvement).

His solution is not everyone's cup of tea.

But it shows how mainstream the issue has become.

Annual inflation slows down to 7.4%

By David Chau

A measure of Australian consumer prices rose by less than expected in January — thanks to a drop in the cost of travel, clothing and fruit and vegetables, a promising sign inflation might be past its peak.

The latest data from the ABS also showed its monthly consumer price index (CPI) rose 7.4% in the year to January.

This was a big slowdown compared to its 8.4% surge in December (and well under the market's January forecasts of 8%).

The ABS said that prices excluding volatile fruit, vegetables and fuel, rose 7.2% in the year to January (down from 8.1% in December).

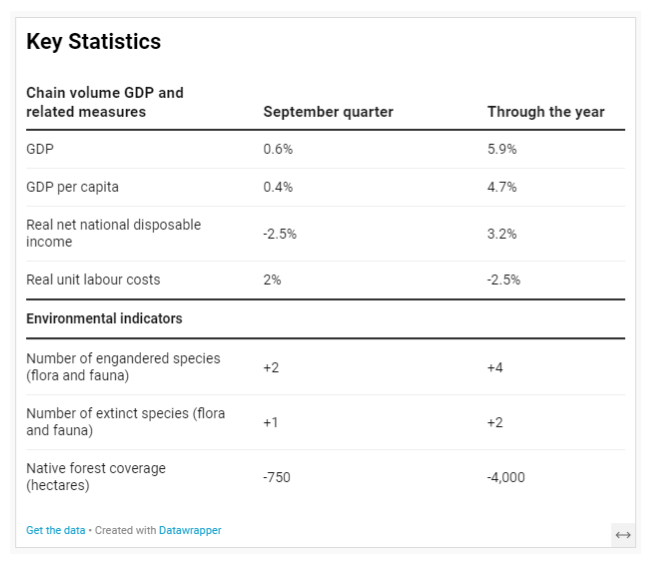

What's missing from the GDP numbers? The environment

By Gareth Hutchens

Economic growth equals planet destruction.

- Vandan McKenzie

Vandan is expressing a common view.

In recent decades, some economists have put a huge amount of work into developing alternative ways of supporting economic activity that won't destroy the environment.

The economist Herman Daly (who died in October, at 84) was instrumental in developing what's called "ecological economics," which is based on a pretty obvious truth: you can't have an economy without the environment.

More recently, Kate Raworth has become famous for her concept of "doughnut economics," which asks us to think about the social and planetary boundaries we face.

But one of the biggest obstacles those kinds of economists face in achieving real changes is getting governments and major economic institutions (like the UN) to stop relying so heavily on the accounting practice that generates the "GDP" number.

It's like asking a gigantic ship in the Suez Canal to turn around.

But we have to start somewhere.

And the point those economists make is that modern economic growth doesn't occur in a vacuum.

It still depends on the extraction and burning of fossil fuels and the exploitation of other elements of nature.

To achieve the latest quarter of economic growth, how many more hectares of native forest were logged, how many more animal species became extinct, and how much more plastic did we pump into the environment?

We're never told.

But .... imagine if that kind of environmental information was published alongside the quarterly GDP figure.

Imagine if the ABS also told us that New South Wales lost another 1,300 koalas last quarter, and Victoria logged another 750 hectares of its native forests, and our ocean fish stocks shrank by another 0.5 percentage points.

A couple of months ago, I mocked up a table to show how that might look on the ABS website (see below).

It helps to put things in a different perspective.

Economic activity slows, as prices and interest rates rise

By Gareth Hutchens

So economic activity was slowing down in the last six months of last year as prices were increasing.

Consumer prices rose 7.8 per cent through 2022 - the annual increase in inflation was the highest since 1990.

And with the Reserve Bank aggressively lifting interest rates to try to stop households spending so much, people were saving less and less of their income.

According to the ABS, households only saved 4.5 per cent of their income during the December quarter, down from 7.1 per cent in the September quarter.

Interest paid on mortgages grew 23 per cent last quarter, following a 36.1 per cent rise in the September quarter.

GDP grows by 2.7 per cent through the year

By Gareth Hutchens

This shows you what happened to economic activity in the December quarter.

On the right-hand side of the graph, notice the blue columns?

They show that Australia has now recorded five consecutive rises in quarterly GDP, but growth has been slowing for the last two quarters.

Worse-than-expected Australian GDP

By David Chau

Australia’s economy grew 0.5% in the final three months of 2022, according to the official Bureau of Statistics figures.

This was well below most economists’ forecasts, although annual growth of 2.7% was in line with analyst expectations.

'Shifting the goalposts' on superanuation taxes

By David Chau

Australians with super balances of more than $3 million will have to pay more tax on their nest eggs from mid-2025.

Although the federal government's sudden change is broadly welcomed as necessary, there are complaints that the superannuation goal posts have been moved on what's meant to be a long term investment.

The ABC's senior business correspondent Peter Ryan looked into this matter, and spoke with Tony Negline, the superannuation leader from Chartered Accountants Australia & New Zealand.

Mr Negline says there's still plenty of uncertainty, like whether there will be changes to government policy regarding capital gains tax (CGT) on the family home, and Stage 3 tax cuts.

You can listen to the full radio interview here:

What is GDP, and how is Australia's economy faring?

By David Chau

The ABS will release an important set of figures in just under an hour — Australia's GDP for the December quarter.

It stands for "gross domestic product", and is the key measure of how quickly a nation's economy is growing (during good times), or shrinking (in times of recession).

Australia's economy is likely to have grown by 0.8% in the December quarter (and 2.7% over the year), according to a survey of economists conducted by Reuters.

It's a number with a huge amount of significance, but is often misunderstood.

So another one of my esteemed colleauges Gareth Hutchens explains how GDP is calculated (very simply) and why it matters. You can read his analysis right here:

ASX falls to a seven-week low

By David Chau

The local share market has opened slightly lower, and is trading around its lowest level since mid-January.

The ASX 200 index had dropped 0.5% to 7,226 points by 10:30am AEDT, with seven out of every 10 stocks in the red.

Almost every sector is down, with technology (-1.4%) and real estate (-1%) suffering the heaviest losses.

Some of today's worst performing stocks include Adbri (-5.6%), HMC Capital (-4.8%), Link Administration (-4.8%), Telix Pharmaceuticals (-4.6%) and Orora (-3.8%).

Some of the stocks posting the biggest gains include steelmaker BlueScope Steel (+2.4%), gold miners Ramelius Resources (+2.5%), Perseus Mining (+2%) and Newcrest Mining (+1.6%), along with lithium producer Pilbara Minerals (+1.8%).

The broader stock index, the All Ordinaries, is also down 0.5%, to 7,422 points.

The Australian dollar is steady at 67.3 US cents.

How will banks handle borrowers standing on the mortgage cliff?

By David Chau

Around 800,000 home borrowers will switch from fixed to variable rates in the second half of this year.

Many of those loans were taken out at fixed rates of under 2%.

Those borrowers are now facing a sharp increase in repayments as they roll onto variable rates (around 5 - 6%).

Jefferies banking analyst Brian Johnson spoke says different banks have different hardship provisions for the upcoming "mortgage cliff", and new borrowers will feel the most pain.

He spoke to The Business host Kathryn Robinson last night, and you can watch the full interview here:

ABC/Reuters