Shares of AST SpaceMobile Inc (NASDAQ:ASTS) are surging this week following a roller-coaster of news that ultimately left investors optimistic. Here’s what investors need to know.

What To Know: The stock’s major ascent was fueled by Wednesday’s announcement of a definitive commercial agreement with Verizon. Starting in 2026, the partnership will enable direct-to-cellular service from AST’s satellite network to Verizon customers’ standard smartphones, significantly extending coverage.

This landmark deal quickly overshadowed concerns from Tuesday when the stock dipped after the company filed to sell up to $800 million in stock through an at-the-market offering. While the potential for share dilution initially weighed on the stock, the strategic importance of the Verizon pact, which validates AST’s technology and commercial path, sparked a strong rally.

The week’s activity added to the stock’s remarkable gains, which have now surpassed 130% in the last month and over 300% year-to-date, as the company moves closer to launching its space-based broadband network.

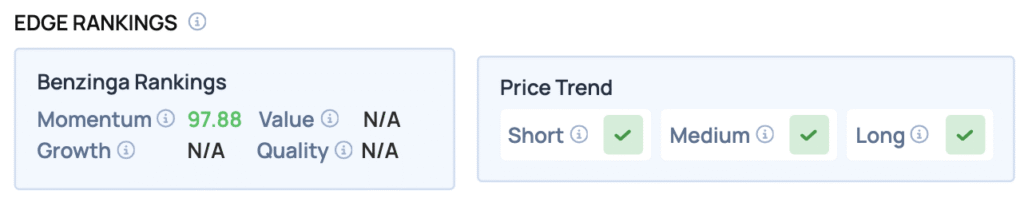

Benzinga Edge Rankings: Highlighting the stock’s powerful upward trajectory, Benzinga Edge proprietary rankings assign ASTS a near-perfect Momentum score of 97.88.

ASTS Price Action: AST SpaceMobile shares were up 0.43% at $87.01 at the time of publication Friday, according to Benzinga Pro.

Read Also: Space Stock Tracker: RocketLab Hits New Highs, AST Partners With Verizon

How To Buy ASTS Stock

By now you're likely curious about how to participate in the market for AST SpaceMobile – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock