Shares of AST SpaceMobile Inc (NASDAQ:ASTS) surged to a new 52-week and all-time high of $99.05 on Tuesday, continuing a remarkable 350% year-to-date rally for the satellite-to-cellular company. Here’s what investors need to know.

ASTS shares are at critical resistance. Watch the momentum here.

What To Know: The stock’s recent ascent has been fueled by a landmark definitive agreement with Verizon, announced last week, which will utilize AST SpaceMobile’s network to provide direct-to-smartphone satellite service.

This strategic partnership, which is set to begin in 2026, has largely overshadowed concerns about a potential stock sale and has ignited investor optimism. The deal with Verizon validates AST’s technology and expands its future market reach.

Adding to the positive momentum is a general sense of enthusiasm across the space sector, partly influenced by ongoing developments and ambitious plans from industry leader SpaceX. As AST SpaceMobile moves closer to the launch of its space-based broadband network, investors are now focused on the company’s ability to execute its strategy.

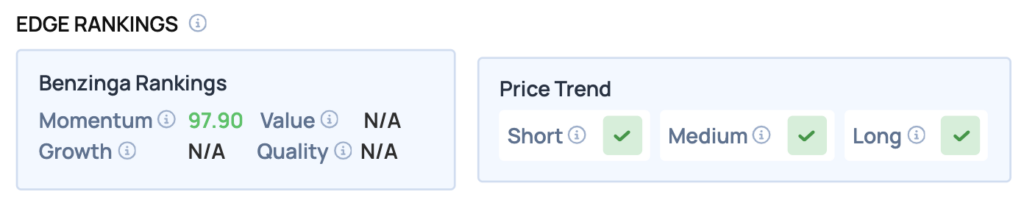

Benzinga Edge Rankings: This powerful rally is reflected in the stock’s Benzinga Edge rankings, which assign it a strong Momentum score of 97.90.

ASTS Price Action: ASTS Price Action: AST SpaceMobile shares were up 8.28% at $97.99 at the time of publication Tuesday, according to Benzinga Pro. The stock is trading near its 52-week high of $99.05.

The current price of $97.99 is well above the 50-day, 100-day and 200-day moving averages, which are $51.65, $47.26 and $36.09 respectively, suggesting a robust upward trend. Key support levels may be found around the recent low of $85.30, while resistance could be encountered near the intraday high of $99.05.

Read Also: Wells Fargo, Citigroup Jump; Powell Flags Jobs Risks: What’s Moving Markets Tuesday?

How To Buy ASTS Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in AST SpaceMobile’s case, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock