AST SpaceMobile Inc. (NASDAQ:ASTS) is advancing its mission to build the world’s first space-based cellular broadband network, with its technology now fueling eight contracts with the U.S. government while the company prepares to deploy 45-60 satellites by the first quarter of 2026.

Check out ASTS’ stock price over here.

What Happened: During the company’s second quarter 2025 earnings call, executives revealed that their unique satellite technology, designed for both commercial and government applications, is gaining significant traction within the defense sector.

“We are very bullish about the government and use cases,” said Abel Avellan, Chairman and CEO of AST SpaceMobile. He noted that multiple branches of the U.S. Armed Forces have already tested and are using the company’s operational satellites for both communication and non-communication applications.

The company's large phased-array satellites, approximately 3.5 times larger than previous models, offer superior capability at a much lower cost than traditional systems, a key factor in attracting government interest.

Despite missing the second quarter estimates, the company has ample cash to fund projects on its balance sheet.

“Given our pro forma balance sheet at the end of Q2 of over $1.5 billion, we do believe that we are fully funded now to reach the 45 to 60 satellite level,” said Andy Johnson, the company's CFO.

This capital will support an aggressive launch cadence, and the deployment is expected to enable continuous coverage in key markets such as the U.S., Europe, and Japan.

The company’s first next-generation Block 2 BlueBird satellite is set to ship this month, marking a pivotal step towards scaled commercialization.

Why It Matters: AST SpaceMobile reported second-quarter revenue of $1.16 million, missing analyst estimates of $7.52 million. Its adjusted loss of 41 cents per share missed the analyst estimates for a loss of 21 cents per share.

The President and Chief Strategy Officer, Scott Wisniewski, said that “We continue to expect quarterly bookings of approximately $10 million on average during the second half of 2025 as we begin to recognize revenue as and when gateways are installed and milestones are met.”

“We are reiterating our belief that we have a revenue opportunity in the second half of 2025 in the range of $50 to $75 million,” added CFO Johnson.

Price Action: ASTS stock fell 1.52% on Monday but rose 11.72% in after-hours. The shares were up 112.20% year-to-date and 132.74% over a year.

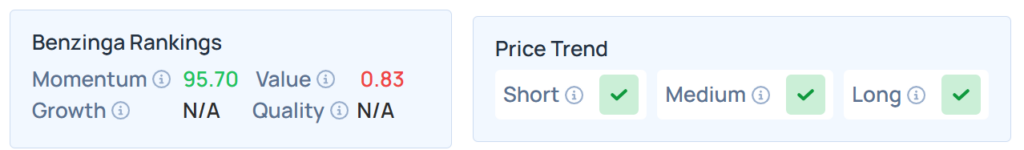

Benzinga's Edge Stock Rankings indicate that ASTS maintains a strong price trend in the short, medium, and long terms. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended lower on Monday. The SPY was down 0.20% at $635.92, while the QQQ declined 0.30% to $572.85, according to Benzinga Pro data.

On Tuesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: PJ McDonnell / Shutterstock