/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Space-based operations company AST SpaceMobile (ASTS) recently announced its plan to deploy 45 to 60 satellites into orbit by 2026. With six satellites in orbit — five of which are fully operational and one a test satellite— the company's target is quite hefty. AST SpaceMobile plans to make orbital launches “every one to two months on average” during this year and the next.

The company is also on target to complete 40 satellites equivalent of microns by early 2026 to support multiple space-based cellular broadband services. The company is also set to gain new spectrum priority rights, as it has announced the acquisition of global S-Band spectrum priority rights held under the auspices of the International Telecommunication Union (ITU).

With such operational strides, how should you play this space giant?

About AST SpaceMobile Stock

Founded in 2017 and headquartered in Midland, Texas, AST SpaceMobile is a satellite communications company that develops a space-based cellular broadband network designed to connect directly to standard mobile phones without the need for ground-based infrastructure. The company operates low Earth orbit (LEO) satellites, which enable seamless mobile coverage in remote and underserved areas of the world. AST SpaceMobile also has a growing rivalry with SpaceX. The companies compete to deliver space-based internet, with AST targeting phones directly and SpaceX focusing on satellite broadband via Starlink.

By partnering with leading mobile network operators worldwide, AST SpaceMobile’s operations blend advanced space technology with telecommunications to provide low-latency, high-speed mobile service directly from space. The company currently has a market capitalization of $15.8 billion.

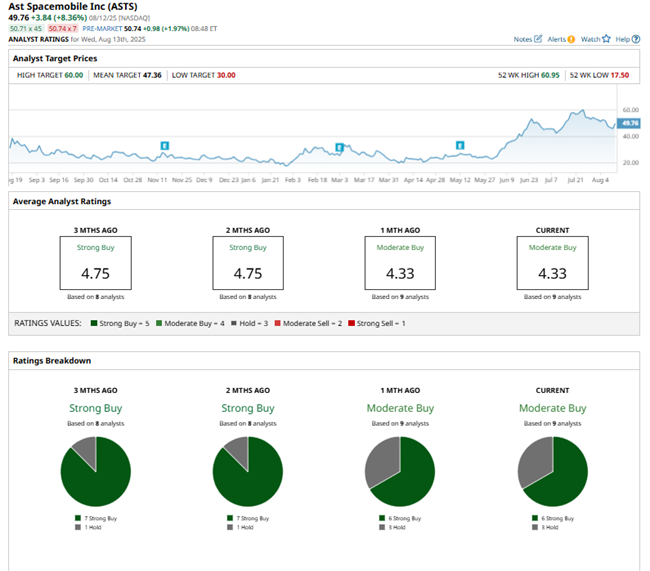

ASTS stock has enjoyed significant investor attention over the past year. Over the past 52 weeks, shares have gained 131%. Just for comparison, the broader S&P 500 Index ($SPX) has gained only 18% over the same period. Strong market sentiments led ASTS stock to a 52-week high of $60.95 in July. So far this year, the stock is up by 128%. After plans of the satellite launches were revealed, shares increased 8% intraday.

AST SpaceMobile’s Topline Is Growing

On Aug. 11, AST SpaceMobile reported its second-quarter results for fiscal 2025. The company’s quarterly revenues increased by 28% from the prior-year period to $1.16 million. While AST continues to post deep losses, investors have taken note of its operational strides.

AST SpaceMobile’s attributable net loss climbed 37% year-over-year (YOY) from $72.55 million to $99.39 million. However, its loss per share declined from $0.51 to $0.41 over the same period.

Last month, the company closed a private offering of $575 million aggregate principal amount of convertible senior notes due 2032. The financing would be used to scale and develop its operations. As of June 30, 2025, AST SpaceMobile had cash, cash equivalents, and restricted cash of $939.4 million, with over $1.5 billion in balance sheet cash, cash equivalents, and restricted cash, pro forma for convertible notes offering and sales under the now-terminated at-the-market (ATM) facility.

Wall Street analysts expect AST SpaceMobile to reduce its losses in the future. For the third quarter, the company’s loss per share is expected to narrow by 29% from the year-ago value to $0.17. Next year, loss per share is forecast to improve by 28% to $0.73.

What Do Analysts Think About AST SpaceMobile Stock?

Wall Street analysts remain cautiously optimistic about AST SpaceMobile. Recently, analysts at Scotiabank lowered the price target from $45.40 to $42.90. However, the firm did not change its investment thesis and still maintains a “Sector Perform” rating on ASTS stock.

Analysts at BofA Securities initiated coverage on AST SpaceMobile stock with a “Neutral” rating and a $55 price target. BofA Securities analysts based their prediction on “early stage, high projected growth," and the “outyear free cash flow generation nature of the business.”

B. Riley Securities is bullish on the company’s prospects. Analyst Mike Crawford raised the price target on the stock from $44 to $60, while maintaining a “Buy” rating, following the company's announcement of its private offering.

Wall Street analysts are soundly optimistic about AST SpaceMobile, giving it a consensus “Moderate Buy” rating overall. Of the nine analysts rating the stock, a majority of six analysts rate it a “Strong Buy,” while three analysts take a middle-of-the-road approach with a “Hold” rating. The consensus price target of $47.36 is below current levels. However, the Street-high price target of $60 indicates potential upside of 27%.

Key Takeaways

There are reasons to be excited about AST SpaceMobile’s prospects, as the company remains on track to grow significantly in an emerging space. While the satellite plans are ambitious, they are also fully funded. The company’s cash balance also remains at a solid level. Therefore, ASTS stock might be a solid buy now.