Shares of Dutch semiconductor firm, ASML Holding NV (NASDAQ:ASML), has declined 7.54% during Wednesday pre-market trading, after the company expressed concerns over its 2026 growth prospects.

What Happened: ASML’s CEO, Christophe Fouquet, voiced his apprehensions during the company’s Q2 results announcement. He said, “while we still prepare for growth in 2026, we cannot confirm it at this stage,” attributing the uncertainty to geopolitical and macroeconomic developments.

Fouquet recognized the strong fundamentals of ASML’s key AI customers but underscored the looming threat of tariffs. “Tariffs on new systems and parts going into the U.S., as well as reciprocal measures from other countries, could impact our gross margin,” he cautioned.

Despite these concerns, ASML posted robust quarterly bookings of $6.4 billion, exceeding the consensus estimate of $5.6 billion. However, its Q3 sales outlook—projected between $8.6 billion and $9.2 billion—came in below analysts’ expectations.

ASML reported second-quarter sales of $8.9 billion, surpassing the consensus estimate of $8.7 billion, while net profit came in at $2.66 billion, ahead of expectations of $2.37 billion.

SEE ALSO: Bitcoin, XRP, Dogecoin Dip But Ethereum Outperforms After Inflation Report – Benzinga

Why It Matters: The semiconductor industry is facing a lot of uncertainty, especially concerning chipmaking equipment. Although semiconductors were exempt from President Donald Trump‘s “Liberation Day” tariffs, the situation remains precarious.

Earlier, in June, ASML unveiled its plans to develop advanced lithography machines to serve the next-generation chip industry. The company, along with its exclusive optics partner Carl Zeiss, was studying designs for machines that could print circuits with a resolution like 5 nanometers in a single exposure.

Notably, KBC Securities analyst Thibault Leneeuw lowered ASML to “hold” from “accumulate” and slashed the price target to €686 ($801) from €703 ($816.68), reported Market Watch. The analyst warned that ASML could lose market share this year due to delays in the adoption of extreme ultraviolet lithography, noting that recent industry signals suggest only limited and selective use of high NA (Numerical Aperture) technology.

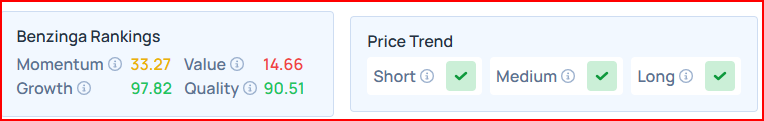

ASML offers poor Momentum and Value, while scoring well on the Quality and Growth metrics as per Benzinga's Proprietary Edge Rankings.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.