On Wednesday, Dutch semiconductor firm ASML Holding NV (NASDAQ:ASML) reported stronger-than-expected third-quarter bookings.

ASML Q3 Beats Estimates With $6.3B Bookings And $8.7B Sales

AMSL said net bookings rose to €5.4 billion ($6.27 billion) in the third quarter.

This topped market expectations of €5.36 billion ($6.23 billion), noted Reuters, citing Visible Alpha.

Net sales reached €7.5 billion ($8.71 billion), with a gross margin of 51.6% and net income of €2.1 billion ($2.44 billion).

See Also: Google Tightens ‘Work From Anywhere’ Policy, With Even 1 Remote Day Counting As Full Week: Report

AI, EUV And Advanced Packaging Lead Growth

"We see litho intensity continue to develop positively as EUV adoption gains momentum," said CEO Christophe Fouquet. Extreme Ultraviolet Lithography is a process that utilizes short-wavelength ultraviolet light to etch ultrafine patterns onto silicon wafers used in the manufacturing of advanced semiconductor chips.

He noted the company's progress on High NA EUV technology and its first shipment of the TWINSCAN XT:260, an advanced packaging tool offering up to four times the productivity of existing systems.

Fouquet added that ASML's collaboration with Nvidia Corp (NASDAQ:NVDA)-backed Mistral AI is embedding artificial intelligence across its product portfolio to enhance chip yield and system performance.

Strong Outlook Despite China Headwinds

ASML forecasts fourth-quarter 2025 sales between €9.2 billion ($10.69 billion) and €9.8 billion ($11.39 billion), with a gross margin of 51%–53%.

For the full year, the company expects around 15% sales growth compared with 2024 and a gross margin near 52%.

Fouquet cautioned that China sales will likely decline in 2026 following strong demand in 2024 and 2025 but said overall revenue will remain stable. "We do not expect 2026 total net sales to be below 2025," he said.

Price Update: ASML Holding shares rose 0.19% to $985 in after-hours trading, according to Benzinga Pro.

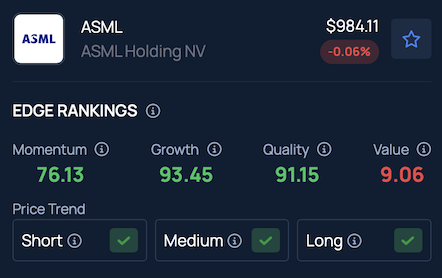

ASML ranks highly in Benzinga's Edge Stock Rankings for Growth, highlighting its solid price performance over short, medium and long-term periods. A detailed breakdown, including comparisons with peers and competitors, can be found here.

Read More:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Skorzewiak / Shutterstock.com