Asian stocks are poised to drop for a fifth day after US shares declined in an echo of the prior session as concerns over American regional banks outweighed better-than-expected technology earnings.

Equity futures in Japan, Australia and Hong Kong are all lower, placing a gauge of the region’s equities on course for its longest run of daily losses this year.

Contracts for the S&P 500 and Nasdaq 100 edged higher in early Asian trading after results from Meta Platforms Inc. beat analyst estimates, pushing its shares 11% higher in after-hours trading.

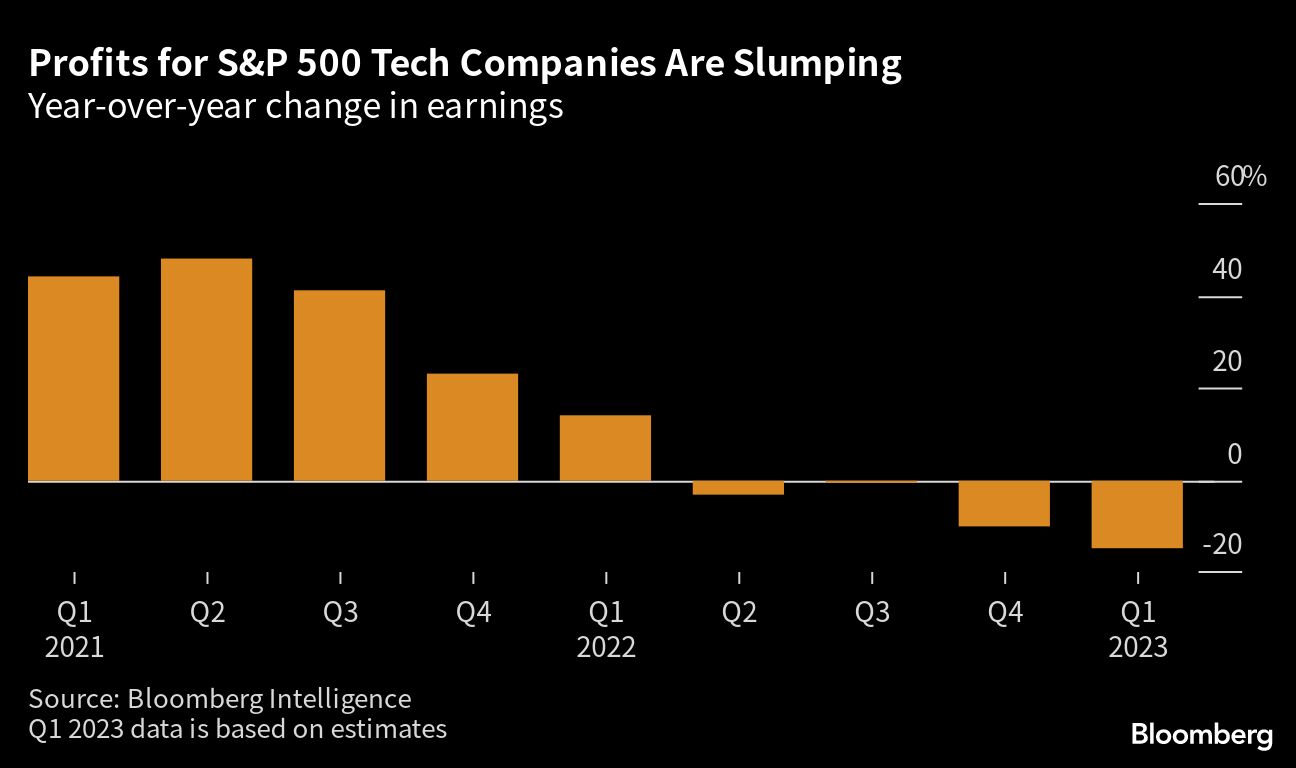

The advance for US futures followed a second daily decline for the S&P 500 Index with all sectors except technology falling. The Nasdaq 100 edged higher, helped along by upbeat earnings from Alphabet Inc. and Microsoft Corp. late Tuesday.

The Treasury 10-year yield climbed five basis points, while the policy-sensitive two-year yield was little changed, following a run of bond buying earlier in the week as investors sought havens amid further concerns over US lenders. Those worries persisted as First Republic Bank shares tumbled a further 30% after sliding 49% Tuesday.

The US regional bank faces potential curbs on borrowing from the Federal Reserve. The potential for a tightening of credit conditions linked to the banking turmoil may prompt the Fed to adjust the pace of its interest rate increases, Evercore ISI’s head of central bank strategy Krishna Guha wrote in a note.

“We cannot rule out the possibility developments around First Republic could unfold in a manner that would lead the FOMC to skip May, while signaling a hike in June,” Guha said.

US jobless claims and GDP data due Thursday will help identify the health of the US economy before the Fed’s preferred inflation gauge, the core PCE deflator, due Friday.

Elsewhere in markets, oil fell, gold slid, and Bitcoin pared an advance.

Here are some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 7:18 a.m. Tokyo time. The S&P 500 fell 0.4%

- Nasdaq 100 futures rose 0.5%. The Nasdaq 100 rose 0.6%

- Nikkei 225 futures fell 0.4%

- Hang Seng futures fell 0.1%

- S&P/ASX 200 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.1035

- The Japanese yen was little changed at 133.64 per dollar

- The offshore yuan was little changed at 6.9404 per dollar

Cryptocurrencies

- Bitcoin rose 0.6% to $28,574.17

- Ether rose 0.5% to $1,876.47

Bonds

- The yield on 10-year Treasuries advanced five basis points to 3.45%

- Australia’s 10-year yield declined 14 basis points to 3.30%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold fell 0.4% to $1,989.04 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Michael Msika, Tassia Sipahutar, Sujata Rao and Robert Brand.

©2023 Bloomberg L.P.