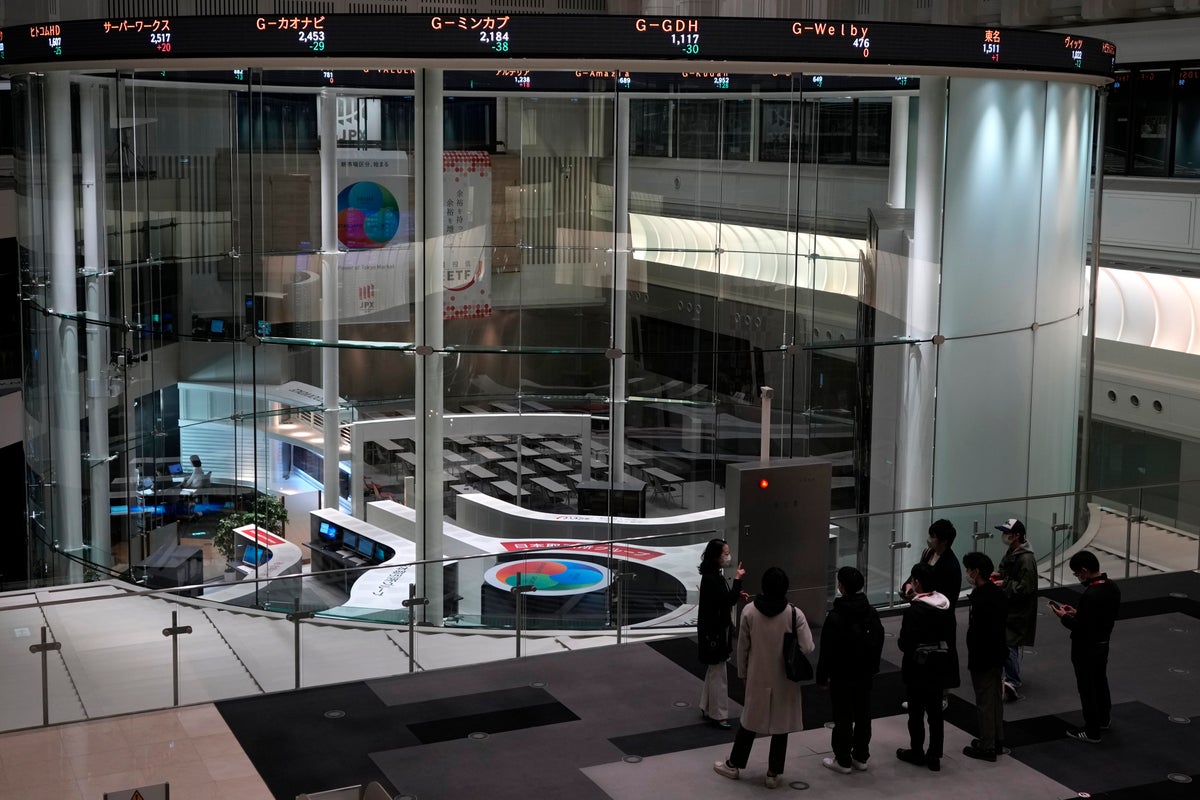

Shares rose Monday in Asia in thin post-Christmas holiday trading, with markets in Hong Kong, Sydney and several other places closed.

Tokyo's Nikkei 225 index gained 0.6% to 26,393.32 and the Kospi in Seoul added 0.2% to 2,318.54. The Shanghai Composite index rose 0.5% to 3,061.93 and the SET in Bangkok added 0.6%.

Bank of Japan Gov. Haruhiko Kuroda indicated in a widely watched speech Monday that the central bank does not intend to alter its longstanding policy of monetary easing to cope with pressures from inflation on the world's third-largest economy.

Last week, markets were jolted by a slight adjustment in the target range for the yield of long-term Japanese government bonds, viewing it as a sign the Bank of Japan might finally unwind its massive support for the economy through ultra-low interest rates and purchases of bonds and other assets.

A widening gap between interest rates in Japan and other countries has pulled the Japanese yen sharply lower against the U.S. dollar and other currencies and accentuated the impact of higher costs for many imported products and commodities.

But the BOJ has kept its key lending rate at minus 0.1%, cautious over risks of recession.

Kuroda told the Keidanren, the country's most powerful business group, that with economies facing likely downward pressure, and with Japan's economy not fully recovered from the impacts of the pandemic, the BOJ “deems it necessary to conduct monetary easing and thereby firmly support the economy. ..."

On Friday, the S&P 500 reversed a 0.7% loss to close 0.6% higher, at 3,844.82. With one week left of trading in 2022, the benchmark index is down 19.3% for the year.

The Dow Jones Industrial Average rose 0.5% to 33,203.93, while the tech-heavy Nasdaq edged 0.2% higher, to 10,497.86.

Small company stocks also rose. The Russell 2000 index picked up 0.4% to 1,760.93.

Mixed economic news weighed on stocks early on, but the indexes rebounded by late afternoon amid relatively light trading ahead of the long holiday weekend. U.S. and European markets will be closed Monday.

Markets are in a tricky situation where relatively solid consumer spending and a strong employment market reduce the risk of a recession but also raise the threat of higher interest rates from the Federal Reserve as it presses its campaign to crush inflation.

The government reported Friday that a key measure of inflation is continuing to slow, though the inflation gauge in the consumer spending report was still far higher than anyone wants to see. Also, growth in consumer spending weakened last month by more than expected, but incomes were a bit stronger than expected.

Last week's reports were the last big U.S. economic updates of the year. Investors will soon turn their focus to the next round of corporate earnings.

The Fed has said it will keep raising interest rates to tame inflation, even though the pace of price increases has continued to ease. The Fed's key overnight rate is at its highest level in 15 years, after beginning the year at a record low of roughly zero. The key lending rate, the federal funds rate, stands at a range of 4.25% to 4.5%, and Fed policymakers have forecast that the rate will reach a range of 5% to 5.25% by the end of 2023.

Given the persistence of high inflation, “many are starting to believe the main story is that there will be no scope for Fed cuts in the year ahead and that central banks will maintain these relatively high rates until underlying inflation is truly cracked — and that process will take time," Stephen Innes of SPI Asset Management said in a commentary.

The Fed's forecast doesn’t call for a rate cut before 2024, and the higher rates have raised concerns the economy could stall and slip into a recession in 2023. High rates have also been weighing heavily on prices for stocks and other investments.

In currency dealings, the U.S. dollar slipped to 132.62 Japanese yen from 132.82 yen late Friday. The euro rose to $1.0629 from $1.0614.