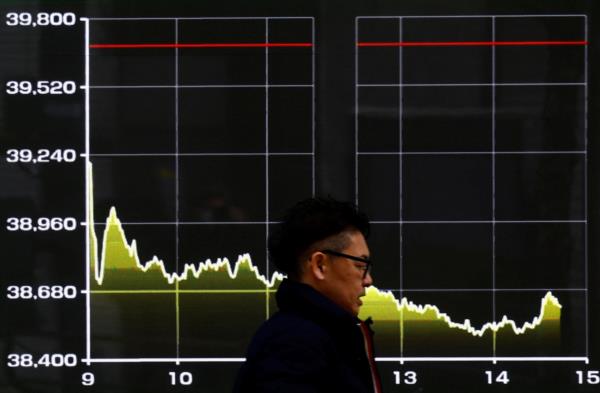

Global markets are facing pressure as investors keep a close eye on developments, particularly in China where house prices are a key focus. The Asian markets are expected to open cautiously as uncertainty looms.

China's house prices are a significant indicator for the overall health of the economy. Any fluctuations in the housing market can have ripple effects on various sectors, making it a closely watched metric by investors and analysts alike.

The ongoing trade tensions between the United States and China continue to add to the market volatility. Investors are closely monitoring any updates or developments in the trade negotiations between the two economic powerhouses.

Market participants are also keeping an eye on global economic data releases, looking for clues about the health of the world economy. Any signs of weakness or strength in key economic indicators could influence market sentiment and trading patterns.

The Asian markets are expected to reflect this cautious sentiment, with investors likely to tread carefully amid the prevailing uncertainties. Volatility in global markets could further impact trading activities in the region.

In summary, global markets are under pressure with a focus on China's house prices and ongoing trade tensions. Investors are advised to stay informed and exercise caution in their investment decisions amidst the current market environment.