/The%20logo%20for%20Wolfspeed%20displayed%20on%20a%20smartphone%20screen%20by%20T_%20Schneider%20via%20Shutterstock.jpg)

Wolfspeed (WOLF), a leader in silicon carbide chips for EVs and industrial power, officially exited Chapter 11 in late September 2025. Through the restructuring, Wolfspeed slashed roughly 70% of its debt and cut interest expenses by about 60%. The company simultaneously moved its incorporation from North Carolina to Delaware and installed five new board members (including chair Anthony Abate) to replace the prior directors. CEO Robert Feurle declared this the start of a “new era,” with much-improved financial stability and a scalable 200 mm fab platform ready to capture surging demand in AI, EV, and other markets.

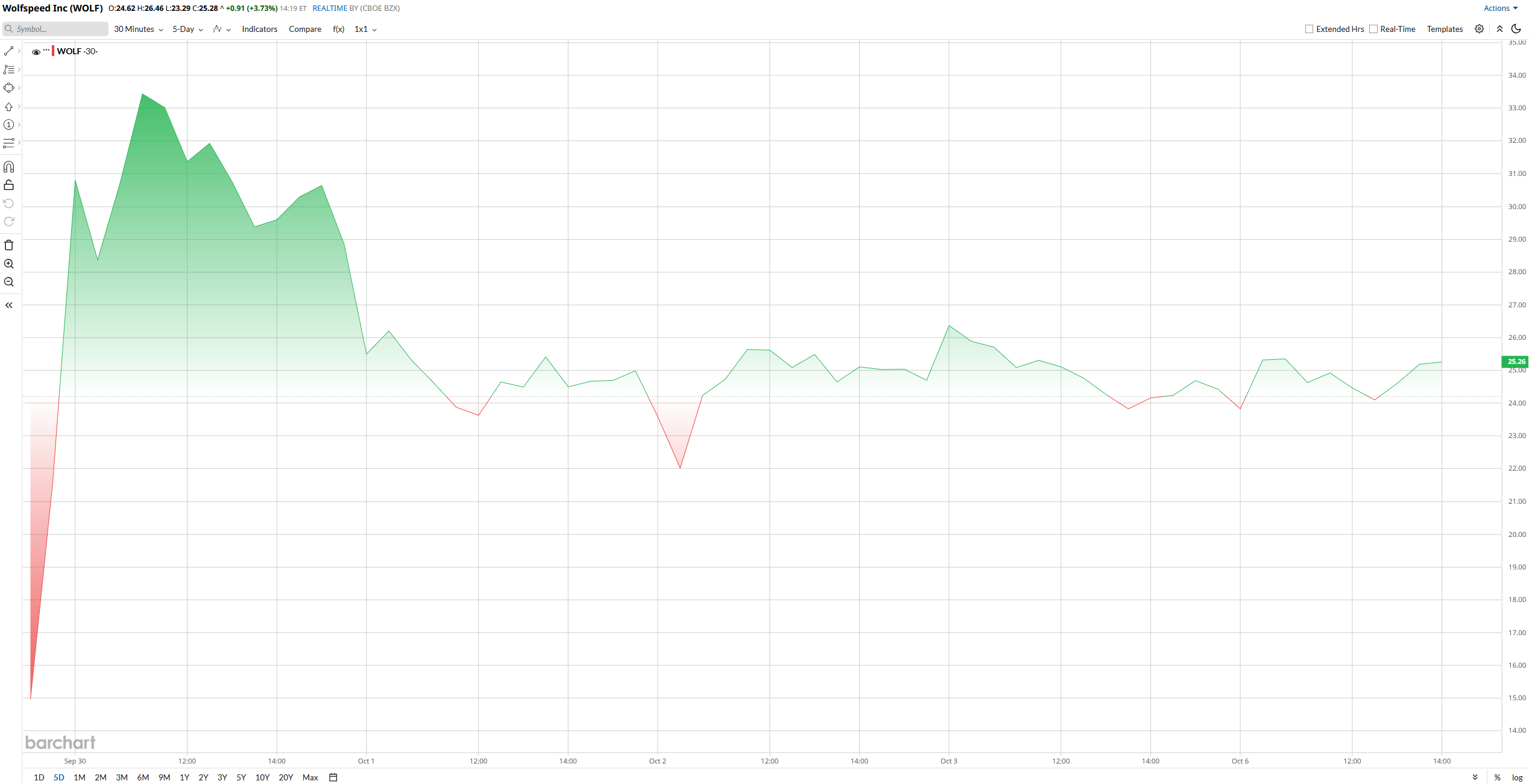

That optimism has translated into a sharp market reaction. Despite Wolfspeed’s modest $630 million market cap, its shares have soared more than 265% year-to-date (YTD) in 2025, largely driven by the company’s bankruptcy exit and the renewed confidence it has sparked among investors.

Wolfspeed Resets Balance Sheet

Wolfspeed officially emerged from bankruptcy with a much cleaner balance sheet, but the company is still far from “out of the woods.” Through restructuring, Wolfspeed cut roughly 70% of its debt, pushed major debt maturities out to 2030, and lowered annual cash interest costs by about 60%. That gives the company breathing room to focus on operations.

As part of the plan, the old common shares were cancelled, and 25.8 million new shares were issued. Legacy equity holders received a small slice (about 1.3 million shares) and could get more if Japanese chipmaker Renesas secures regulatory approval to become the largest shareholder.

The stock swung wildly after the exit, and an adjusted one-day drop of 85% was followed by a rally from an $8.05 intraday low to a $34.28 high the next day, about an 1800% gain.

WOLF Missed Q4 Earnings Estimate

Wolfspeed’s operations remain in the red. For Q4 FY2025, consolidated revenue came in at $197 million, down slightly from $201 million a year earlier. The net loss for the quarter widened to $669 million, or $0.85 per share, compared with a $285 million, $0.84 per share, loss in Q3.

Gross margins are nearly nonexistent, with full-year gross margin falling from 13% in 2024 to just 2% in FY2025.

Cash flow was also under pressure last year. Wolfspeed burned $242.5 million in operating cash during Q4 alone, bringing the full-year total to around $885 million. Capital expenditures, however, are finally winding down: Q4 capex was $211.6 million, a sharp drop from $645.8 million a year earlier, as the company completed its large 200 mm fab build-outs.

Wolfspeed reported about $955 million in cash and short-term investments at the end of June, but heavy operating losses, high capex, and restructuring fees mean that cash likely fell to $500 to $600 million by quarter-end. If converts and warrants are exercised, Wolfspeed could raise roughly $118 million and eliminate about $535 million of convertible debt, but that would also add millions of new shares.

Analysts’ Rating and Final Words

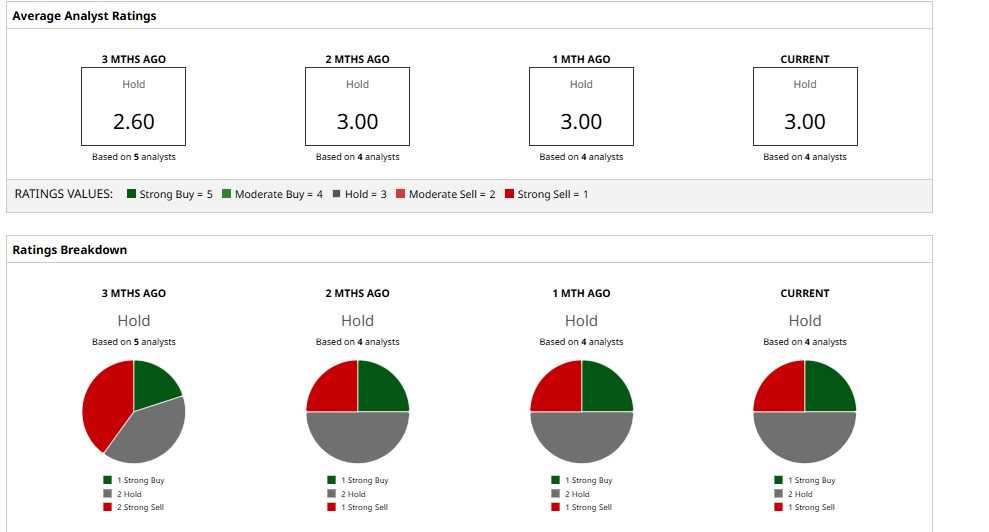

Wall Street is taking a cautious stance on Wolfspeed. Coverage is thin, just four analysts, and the consensus is a “Hold.” The current rating mix shows one “Strong Buy,” two “Hold,” and one “Strong Sell,” a split that underscores wide disagreement about the company’s outlook after restructuring. The stock already surpassed both the mean and high target prices and is now facing about 84% downside risk from its mean price target of $3.75.

The bankruptcy of Wolfspeed is a theatrical rebirth; however, it puts a business still struggling to make ends meet. Its balance line is purer and its leadership is renewed, but profitability challenges are there. The recent surge in the stock price indicates a sense of relief and hope, but considering WOLF stock is being rated significantly low by the analysts, any new stock investor will have to evaluate the possibility of such an upsurge against the risk, which could easily happen due to failure to meet the targets. Most people would go for a wait-and-see position. This is only done by the most bullish and risk-takers, as you can make a resounding bet on a rebounding position at these levels.