Concerns over U.S. stock markets being overvalued, along with fears of a possible recession in the world’s biggest economy, have been persisting for quite some time now. The overvaluation chatter has received a fresh impetus after Fed Chair Jerome Powell said last month that stocks are “fairly highly valued.” His comments, which many see as akin to former Fed chair Alan Greenspan's 1996 warning about “irrational exuberance,” received backing from valuation guru Ashwath Damodaran.

U.S. Stock Market Valuations Look Stretched

To be sure, after the sharp rally from the 2022 depths, U.S. stocks do appear stretched on nearly all metrics, ranging from the forward price-to-earnings (P/E) ratio, the Shiller P/E ratio, and price-to-book (P/B) value. Even Warren Buffett’s favorite market cap-to-GDP ratio has surpassed 200%—a level the “Oracle of Omaha” once warned is like “playing with fire.” No wonder Berkshire Hathaway (BRK.A) (BRK.B) has been a net seller of stocks for 11 consecutive quarters and has even stopped share repurchases.

The counterargument to U.S. stocks being bloated would be that since tech companies—which usually have a higher P/E multiple than other S&P 500 Index ($SPX) constituents—account for a growing percentage of the S&P 500 Index, it won’t be prudent to compare the current market multiples to historical averages. Also, we are perhaps at the cusp of the next technological marvel with artificial intelligence (AI), and it could end up boosting productivity and economic activity as the advent of the internet did.

All said, stocks (and AI) getting near a bubble zone are not unfounded, and there is indeed froth in some pockets. Given the market backdrop, conservative investors might find solace in value stocks, particularly those with high dividend yields. With its nearly 8% dividend yield and tepid valuations, I find Energy Transfer (ET) to be a good buy, especially for those worried about broader markets getting overheated.

ET Stock Has Underperformed

To begin with, ET stock has underperformed in 2025 and has only seen a little more drawdown since the last time I covered the stock in August. The stock is now down nearly 15% for the year and is underperforming many of its midstream peers, with its return trailing the Alps Alerian MLP ETF (AMLP) as well as the broad-based S&P 500 Index.

Meanwhile, amid the underperformance, ET’s valuations have also corrected, and it trades at around 9 times its adjusted funds from operations (AFFO). The forward P/E multiple is 12.2x, while the P/E-to-growth (PEG) multiple is just 1x. The multiples look quite reasonable, especially given the growth opportunities that the company brings to the table.

Energy Transfer’s Growth Should Revive in 2026

Energy Transfer’s earnings growth has sagged in 2025, which is reflected in its price action. However, the company expects to spend $5 billion on growth capex in 2025, which is significantly higher than the previous year. The majority of these projects will come online next year, and their earnings will ramp up in 2026 and 2027. Energy Transfer expects its growth to stay strong through the end of this decade as the company invests to expand its portfolio.

Looking at some of the projects, the Nederland Flexport expansion project would enhance Energy Transfer’s export capabilities. Then we have the Lake Charles LNG project, which, in August, received an extension to commence liquefied natural gas (LNG) exports to non-free trade agreement countries. Granting the extension, Secretary of Energy Chris Wright said that it “furthers the Trump Administration’s priority of unleashing American Energy.” The U.S. is looking to push defense and energy exports in a bid to bridge the trade deficit with trading partners with whom it has a large deficit, which could be a structural tailwind for midstream energy companies.

Domestically, the artificial intelligence-fueled investments in power-guzzling data centers look like a structural tailwind for the energy sector, including midstream companies like Energy Transfer.

ET Stock Forecast

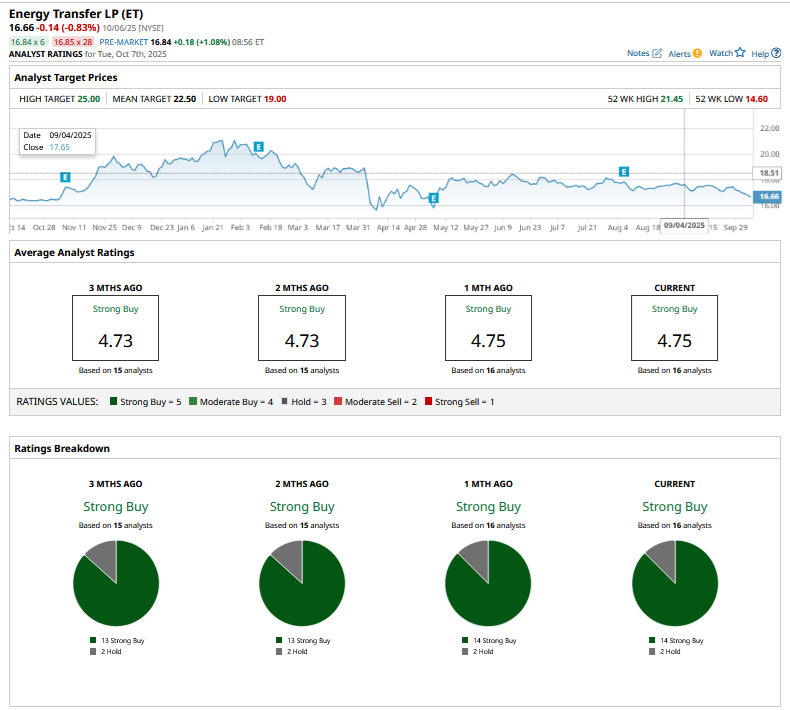

Earlier this month, Wells Fargo analyst Michael Blum added ET stock to his “tactical ideas” list for the final quarter of this year while maintaining an “Overweight” rating and $23 target price. Blum listed the final investment decision of Lake Charles, a possible announcement of a gas pipeline project with recently listed Fermi America (FRMI), which has signed a memorandum of understanding for pipeline capacity from Energy Transfer, and the expected expansion of the Desert SW pipeline to 3 Bcf/d as the triggers that can take ET stock higher in Q4.

The average sell-side analyst shares Blum’s optimism, and it has a consensus rating of “Strong Buy” with a mean target price of $22.50, which is not very different from Wells Fargo’s target for the stock.

Overall, I believe that ET stock is poised for a recovery rally in the final quarter of the year and can deliver decent returns in the medium term, driven by opportunities in AI and energy exports. The cherry on top is the healthy dividend yield of nearly 8%, which is well covered by its current earnings, and the payout is expected to rise by between 3% and 5% annually.