For all his rhetoric about national security and curbing illegal immigration, Donald Trump's assertions about defense spending have been quite muted. Other than the “Golden Dome” project announced with much fanfare, in April, the President had vowed to allocate $1 trillion as the defense budget for the current year. Cut to May, and it was slashed to $892.6 billion.

While some may see it as backpedalling on the part of Trump, the government is looking to adopt a recent playbook to support the defense sector.

Going the Intel Way

After picking up a 10% stake in beleaguered chipmaker Intel (INTC) for an investment of $8.9 billion, the Trump administration is seeking to deploy the same strategy to pick up ownership stakes in defense companies.

On this, Commerce Secretary Howard Lutnick said, "Oh, there’s a monstrous discussion about defense." Then, speaking specifically about Lockheed Martin (LMT), Lutnick stated, "They are basically an arm of the US government. They make exquisite munitions. What’s the economics of that?"

This is an interesting development, as Lockheed Martin generates about 73% of its net sales from the government.

About Lockheed Martin

Tracing its origins back to 1912, Lockheed Martin emerged in 1995 from the merger of Lockheed Corporation and Martin Marietta. It is a leading American defense, aerospace, security, and advanced technologies firm that conducts research, design, development, manufacturing, integration, and sustainment of systems, products, and services for government and commercial customers.

Valued at a market cap of $106.1 billion, the LMT stock is down 6.1% on a YTD basis. Notably, the stock offers a dividend yield of 2.87%, which is higher than the sector median of 1.28%. Further, the company is on the cusp of becoming a “Dividend Aristocrat” as it has raised dividends consecutively for the past 22 years. And with a payout ratio of 44.81%, the target may be achieved.

Going back to the administration's stance of gaining a proposed stake in Lockheed Martin, how should common investors look at the company's stock? Irrespective of any stake by the Trump admin, any investment should be driven by the fundamentals, strategic initiatives, and future prospects of the company. Does LMT fare well on these fronts? Let's take a closer look.

Stable Financials but Lacks Growth

In a world where tech companies backed by the artificial intelligence (AI) megatrend are seeing scarcely believable rate of growth in both revenue and earnings, LMT's numbers may look disappointing. In fact, that is the case with the whole defense sector.

Over the past 10 years, Lockheed Martin's revenue and earnings have clocked CAGRs of 5.37% and 2.31%, respectively. Meanwhile, the results for the most recent quarter saw the company reporting a miss on both revenue and earnings.

In Q2 2025, LMT's revenues come in at $18.16 billion, which was almost flat when compared to the previous year's figure of $18.12 billion. While all the segments reported yearly growth, with the core aeronautics segment growing by 2% to $7.42 billion, only the rotary and mission systems segment saw a decline of 12% on a year-over-year (YoY) basis to $3.99 billion. The company attributed the decrease to lower net sales of $370 million on Sikorsky helicopter programs and a $145 million decrease on integrated warfare systems and sensors (IWSS) programs due to lower volume on radar and the Canadian Surface Combatant (CSC) programs.

However, the fall in earnings was much starker at 78.7% from the prior year to $1.46. Not only was this a considerable decline on a YoY basis, but it was also a wide miss when compared to the Street's estimate of an EPS of $6.52. Yet, when looked at over a longer period, LMT's earnings have missed Street expectations in just two instances over the past nine quarters.

Overall, guidance for 2025 remained unchanged at $73.75 billion to $74.75 billion for revenues, but EPS projections fell to $21.70 - $22.00 from $27.00 - $27.30 earlier.

Coming to cash flows, Q2 2025 cash flow from operations were at $201 million, much lower than the previous year's figure of $1.88 billion, a consequence of the stark decline in earnings. As a result, free cash flow turned into an outflow of $150 million compared to an inflow of $1.51 billion in the prior year. Overall, the company closed the quarter with a cash balance of $1.3 billion, which was much lower than its short-term debt levels of $3.1 billion.

Also, analysts are not that gung ho about the company's growth numbers with forward revenue and earnings growth rates pegged at 4.51% and 1.92%, compared to the sector medians of 4.85% and 9.98%, respectively.

Growth Drivers There but Issues to Overcome as Well

Lockheed Martin is aiming to strengthen its growth prospects by stepping up output in missile and missile defense systems, while also advancing in areas such as hypersonic weaponry and the Next Generation Interceptor initiative. Within its F-35 program, an expanding global fleet is expected to translate into higher sustainment revenue over time. For now, however, the most tangible near-term program appears to be the Golden Dome missile defense initiative, particularly against the backdrop of real-term reductions in overall defense spending.

The Golden Dome could offer a strategic opening for the company, given its production of the Terminal High Altitude Area Defense (THAAD) interceptor, the only American system capable of engaging incoming threats both inside and beyond the atmosphere. Lockheed Martin also develops radar platforms that could integrate effectively into this defense architecture. Notably, Lockheed Martin has publicly detailed a range of its products and capabilities that could play a role in supporting the Golden Dome’s deployment.

Outside the United States, shifting priorities in Europe are generating fresh demand. Italy has recently increased its commitment to the F-35, lifting its total order to 115 units. Austria, Portugal, and Spain are also holding discussions to procure the aircraft. Additionally, in response to heightened interest, Lockheed Martin is expanding missile production facilities across the continent to ensure supply keeps pace with orders.

Further, the company’s portfolio includes the storied Skunk Works division, which has been responsible for some of the most advanced aircraft in aviation history, including the SR-71 Blackbird and the U-2 reconnaissance plane. Through its Sikorsky subsidiary, it also manufactures the well-known Black Hawk helicopter.

Despite these strengths, certain programs have weighed on results. The Aeronautics segment reported losses in its Classified Program due to issues in design, integration, and testing, alongside other performance setbacks. The Canadian Maritime Helicopter Program also recorded substantial charges. As a result, segment operating margin contracted sharply from 11.3% a year earlier to just 3.1%.

Order conversion has also been slower, and a dip in new contracts is raising concerns. At quarter-end, backlog stood at $166.53 billion, down from $176.04 billion at the close of 2024, a change that could indicate potential demand softening in the future.

Lastly, the flagship F-35 line has encountered additional hurdles tied to the rollout of its Technology Refresh 3 upgrade, which aims to deliver more processing capability, expanded memory, enhanced displays, improved target identification, upgraded electronic warfare functions, and greater weapons integration capacity. Adding to the pressure, the U.S. Department of Defense has trimmed its near-term procurement request for the fighter by roughly half compared with earlier plans.

Final Take on LMT Stock

For investors seeking a dividend-paying counter with a long history of dividend growth, backed by long-term government contracts (and now maybe a stake) and somewhat stable financials, LMT may be a good bet. Although, heavy investment in the stock is not recommended due to lack of significant growth and headwinds. On another note, with the company mulling taking stakes in defense companies, it will be interesting to see whether it considers one in the high-flying defense startup Palantir (PLTR), which also derives substantial revenues from the government.

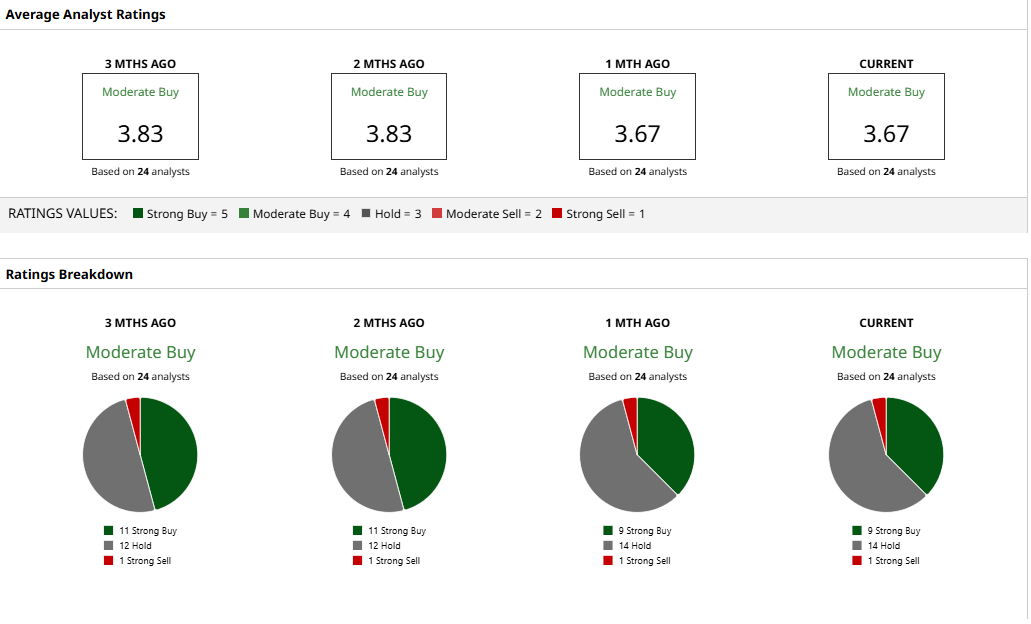

Overall, analysts remain cautiously optimistic about the LMT stock, earmarking for it a rating of “Moderate Buy” with a mean target price of $491.45. This denotes an upside potential of about 7.7% from current levels. Out of 24 analysts covering the stock, nine have a “Strong Buy” rating, 14 have a “Hold” rating, and one has a “Strong Sell” rating.