Kenvue (KVUE) faces significant regulatory and reputational headwinds as the Trump administration asserted, without evidence, a definitive link between acetaminophen, the active ingredient in pain reliever Tylenol, and autism during pregnancy. This represents a direct challenge to one of Kenvue's most important revenue drivers within its Self-Care segment, which includes trusted brands such as Tylenol, Motrin, and Benadryl.

The consumer health company, spun off from Johnson & Johnson (JNJ) in 2023, has responded to defend the safety profile of acetaminophen. CEO Kirk Perry personally met with HHS Secretary Robert F. Kennedy Jr. to dispute these claims, while the company emphasizes that "over a decade of rigorous research" shows no credible evidence linking acetaminophen to autism.

Leading medical organizations and even Kennedy's own FDA maintain that the drug is safe when used as directed during pregnancy. Kennedy has made autism a central focus of his HHS agenda, and any official government warning could impact consumer confidence and sales of Tylenol.

Valued at a market capitalization of $34 billion, Kenvue stock is down about 20% in 2025, as investors are concerned about market share erosion and litigation risks. Let’s see if you should buy the dip in KVUE stock right now.

Is Kenvue Stock a Good Buy Today?

Kenvue faces a challenging period marked by operational struggles and external political pressure. In Q2 of 2025, the consumer health company reported a 4.2% decline in organic sales, while adjusted earnings narrowed from $0.32 per share to $0.29 per share over the last 12 months.

However, the board's decisive leadership changes provide reasons for cautious optimism. Interim CEO Kirk Perry brings over 30 years of experience in CPG and technology, including successful turnarounds at P&G (PG) and leadership roles at Alphabet (GOOG) (GOOGL) and Circana. His appointment, alongside new CFO Amit Banati, indicates a strategic pivot toward operational excellence and consumer-centric execution.

Perry has identified key problems: excessive complexity across 115 brands with a long tail of low-performing SKUs, insufficient focus on e-commerce growth, and execution gaps despite substantial brand equity. His four-point turnaround plan emphasizes strengthening leadership capabilities, simplifying the operating strategy, improving execution across key moments of consumer interaction, and optimizing organizational structure.

Early signs of progress include sequential improvement in Neutrogena Face consumption, continued market share gains for Tylenol (12 consecutive quarters), and strong performance in EMEA and Latin American markets. Notably, the company maintains healthy gross margins of 60.9% and continues to invest in innovation. Further, the ongoing strategic review, supported by Centerview Partners and McKinsey, has the potential to unlock significant value through portfolio optimization.

Kenvue management has revised 2025 guidance downward to a low single-digit organic sales decline. However, a combination of new leadership expertise, streamlined focus, and potential strategic alternatives positions it as a compelling turnaround candidate in 2025.

Is KVUE Stock Undervalued?

Analysts tracking Kenvue stock forecast sales to rise from $15.46 billion in 2024 to $17.07 billion in 2029. During this period, adjusted earnings per share are expected to increase from $1.14 to $1.35 per share.

Currently, KVUE stock trades at a forward price-to-earnings (P/E) multiple of 16.1x, which is below its historical multiple of 18.1x. If KVUE continues to trade at 16x earnings, it should reach $21.6 by early 2029, indicating an upside potential of 25%. If we adjust for dividends, cumulative returns could be closer to 45%.

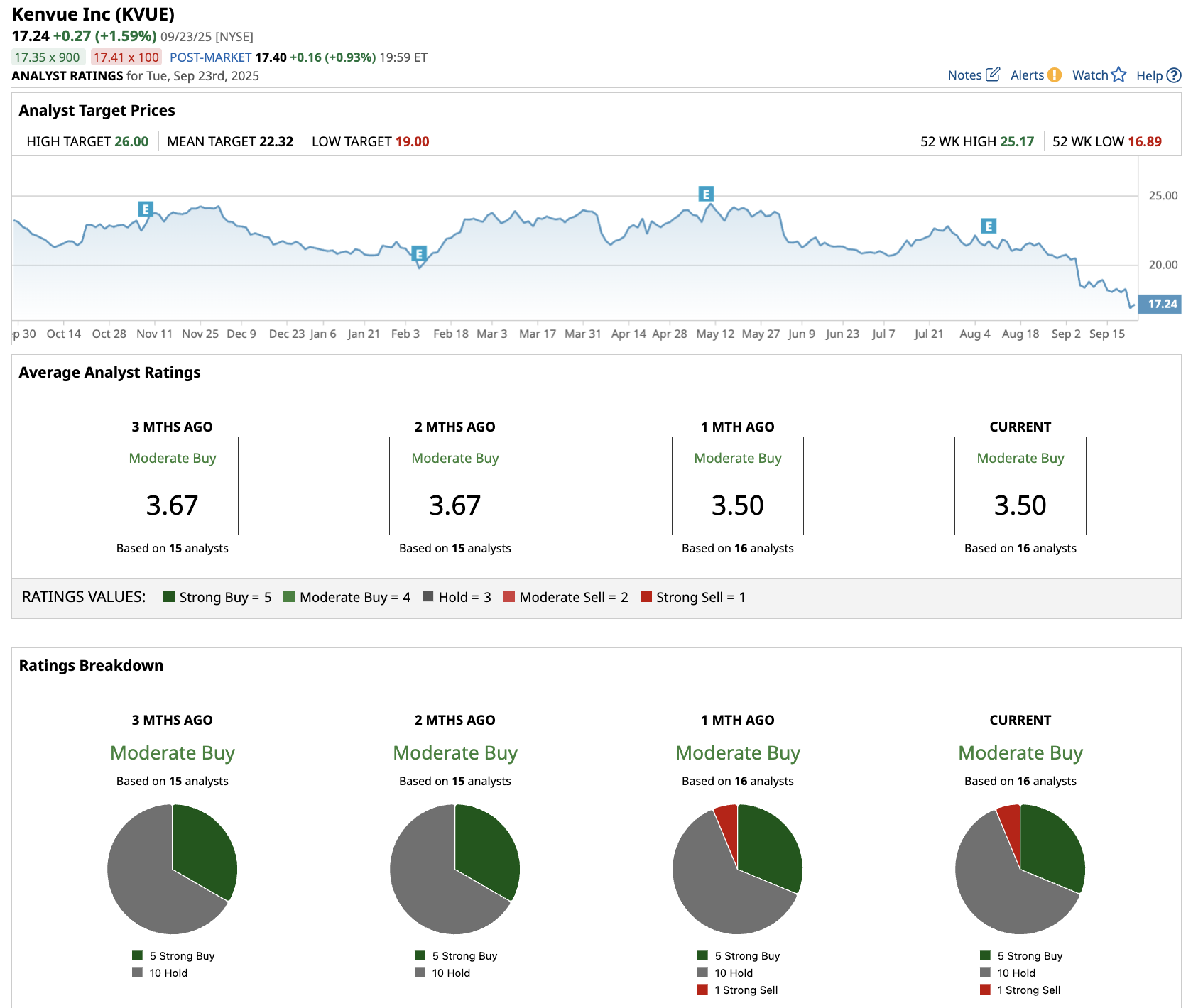

Out of the 16 analysts covering KVUE stock, five recommend “Strong Buy,” 10 recommend “Hold,” and one recommends “Strong Sell.” The average stock price target for KVUE is $22.30, which is above the current price of $17.24.