The U.S. government has been going all-in on rare earth metals after China used them as a bargaining chip earlier this year. It exposed a significant vulnerability that the Trump administration is pulling as many levers as possible to rectify.

Earlier this year, many rare earth companies in the U.S. received considerable investments and support to ramp up their production. And now, the push to secure rare earths is expanding to U.S. allies, too. President Donald Trump has signed a landmark rare earth metals agreement with Australia. He and Australian Prime Minister Anthony Albanese signed an $8.5 billion critical minerals framework on Oct. 20, committing over $3 billion in government investments to boost rare earth production and processing.

Shares of Australian rare earth stocks are surging. One company is going to benefit disproportionately, as it is the only significant rare earth producer outside China.

The Hidden-Gem Beneficiary of the U.S.-Australia Rare Earth Deal

Lynas Rare Earths Limited (LYSDY) is the prime beneficiary of this historic $8.5 billion partnership. The company is Australia's flagship rare earth producer with a fully integrated supply chain that spans from mining to advanced processing.

Concentrates from Mt. Weld are processed at Lynas' Rare Earths Processing Facility in Kalgoorlie, Western Australia, and the advanced materials plant in Kuantan, Malaysia. This integrated approach gives Lynas complete traceability from mine to finished product.

The Trump administration is looking for a company that can get the job done fast in mining, separation, and processing, all of which are areas where Lynas already has expertise and the infrastructure for.

LYSDY stock has been climbing even before this recent announcement came, up 127% in the past six months. Analysts saw Australia as an alternative to China that the U.S. would eventually turn to.

Booming Production Growth

Lynas produced 6,558 tons of neodymium-praseodymium (NdPr) oxide, up 16% year-over-year (YoY). NdPr is essential for manufacturing high-performance permanent magnets used in various products. This includes electric vehicles (EVs), wind turbines, and defense hardware that Western governments are prioritizing.

Q4 fiscal 2025 revenue grew 32.25% to AUD 151.5 million.

It also helps that the USD has declined by ~5% against the AUD year-to-date (YTD).

CEO Amanda Lacaze said the investments made over the past five years as part of the Lynas 2025 growth plan had come to fruition. The Mt. Weld expansion project and full integration of the Kalgoorlie Processing Facility into global operations established the foundation for continued growth. Lynas also announced its "Towards 2030" strategy.

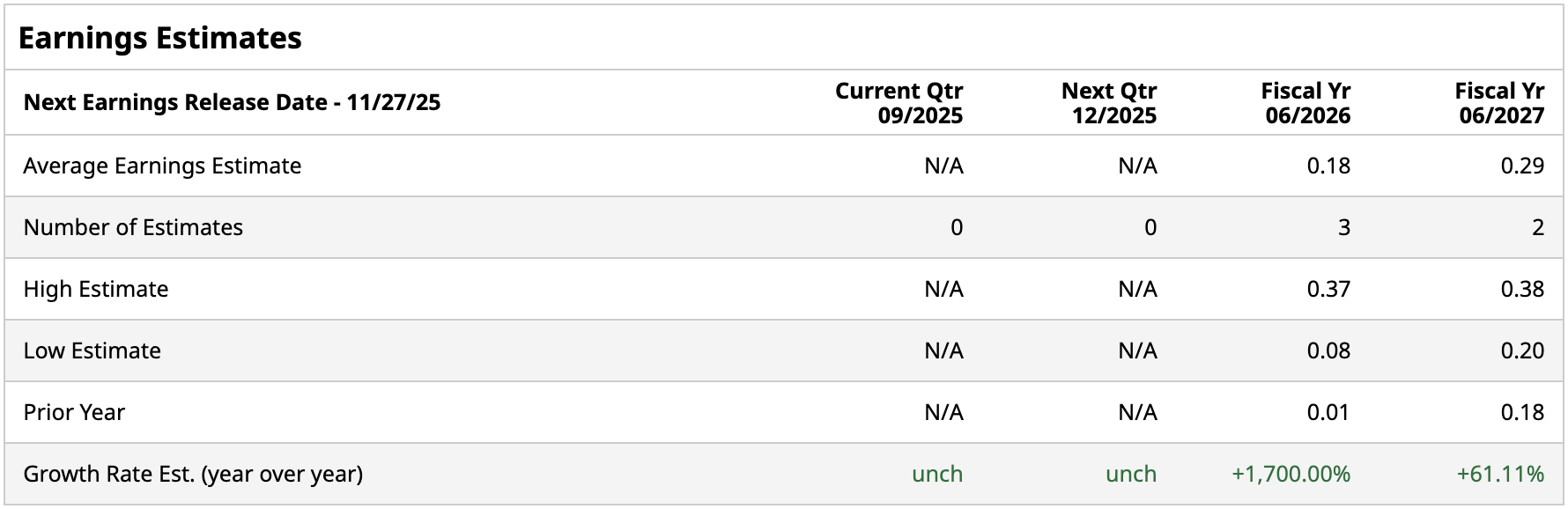

We're looking at EPS growing from just a cent in FY 2025 to 18 cents in FY 2026 and 29 cents in FY 2027.

Should You Buy LYSDY Stock Now?

You should keep in mind that the rare earth supply chain has been mostly centered around China. Nevertheless, the U.S. government seems committed to changing that.

Lynas Rare Earths is the only integrated rare earth producer outside China with proven heavy rare earth separation capability. Although Canada-based Aclara Resources (ARA.TO) just announced plans to open a rare earth separation facility in Louisiana by 2027.

Still, until that comes online, this means that as the U.S. pivots away from China and towards other suppliers, Lynas is slated to be one of the biggest winners until other rare earth companies like Aclara catch up.

With that in mind, I'd buy before the company starts scaling more to meet demand.