The on-again, off-again relationship between President Donald Trump and Tesla (TSLA) CEO Elon Musk witnessed a new plot twist when Trump posted on Truth Social that ”I want Elon, and all businesses within our Country, to THRIVE.” This is a startling development, to say the least, considering the very public nature of their fallout, which was sour for all involved.

Musk had been quite vocal about his opposition to Trump’s “One Big Beautiful Bill Act,” arguing it would only add to the country’s mounting debt. And specifically hurting Tesla is the removal of $7,500 tax credits on EV purchases, a stipulation of the tax-and-spending legislation.

So, amid all the noise around Tesla, is the company’s stock (-21.7% YTD) still one that warrants an investment? Let’s find out.

Q2 Was Somewhat Pleasant

Revenues for the quarter came in at $22.5 billion, down 12% from the previous year. Core automotive revenues again slipped on a YOY basis, this time by 16% to come in at $16.7 billion, as competitive pressure and Musk’s political activities continued to put pressure on sales. The energy segment witnessed a less sharp fall of 7% in the same period to $2.8 billion. The gross margin remained almost flat at 17.2% compared to the previous year’s 18%, which provided some comfort.

Total production was at 410,244 vehicles (vs. 410,831 in the year-ago period) while total deliveries fell by 13% in the same period to 384,122 vehicles, against expectations of 387,000, per FactSet.

Meanwhile, Tesla reported EPS of $0.40, which represented a yearly decline of 23%.

Tesla continued to remain cash flow positive, although its cash flow declined alongside revenue and earnings. Net cash from operating activities for the quarter was at $2.5 billion (-30% YOY), and free cash flow was at $146 million (-89% YOY). Overall, the company closed the quarter with a cash balance of $36.8 billion, up 20% from the previous year. This was much above its short-term debt levels of $15.2 billion.

Yet, what remains a cause of worry for Tesla investors is Musk’s recent remarks during the latest earnings call.

Downbeat Comments Cloud Long-Term Growth?

My thoughts on Tesla have been consistently cautiously optimistic, with the company’s long-term prospects sounding quite convincing, driven by artificial intelligence, Full-Self Driving (FSD), robotics, and energy, among others. However, Musk’s revelation that the EV leader will likely face “a few rough quarters” is concerning. Yet, what is even more worrying is his acknowledgement that the company’s outsized bets on humanoid robots is still a long way from contributing to the company’s bottom line.

This draws a question mark over other businesses as well, hurting its overall value, considering that most of the bullishness around Tesla is primarily due to the expectations that its operations in the above-mentioned businesses will create massive wealth for shareholders in the long run.

Specifically on robotics, Tesla has publicly shared a detailed time horizon for its robotics ambitions, with the Optimus 3 prototype slated to be ready by late 2025. Production ramp‑up is expected to begin in early 2026, targeting monthly volumes of 100,000 units within five years, scaling to one million annually by 2030, and eventually aspiring toward a long‑term goal of 1 billion robots per year.

That said, Tesla’s track record of meeting Musk’s ambitious timelines has been inconsistent. A prominent example dates back to his 2019 assertion that 1 million robotaxis would be operational by 2020. Reality diverged substantially. Robotaxis just launched in Austin in a limited pilot in June 2025.

However, the opportunity remains as scaling beyond a company-owned fleet is essential to unlock true network effects for the robotaxi business. With millions of Teslas already on the road, the company could enable private owners to contribute vehicles to the robotaxi platform, a monetization opportunity few other automakers can match.

Meanwhile, Tesla’s in‑house AI training infrastructure is also evolving rapidly. The Dojo 2 supercomputer, expected in 2026, is projected to deliver computing power equivalent to roughly 100 000 H100 GPUs. Built for vision-centric workloads essential to autonomy and robotics, it supports large‑scale real‑world simulation. Tesla is already working toward hardware convergence across edge and cloud, from Dojo servers to on‑device chips, with next‑generation AI6 and Dojo 3 already in early planning stages.

Overall, this combination of proprietary data, in‑house chip design, scalable compute infrastructure, and integrated deployment gives Tesla full control over the AI stack. It enables scaling from fleet data to trained models to real-world applications, a vertically integrated strategy that few companies can replicate.

Analyst Opinions on TSLA Stock

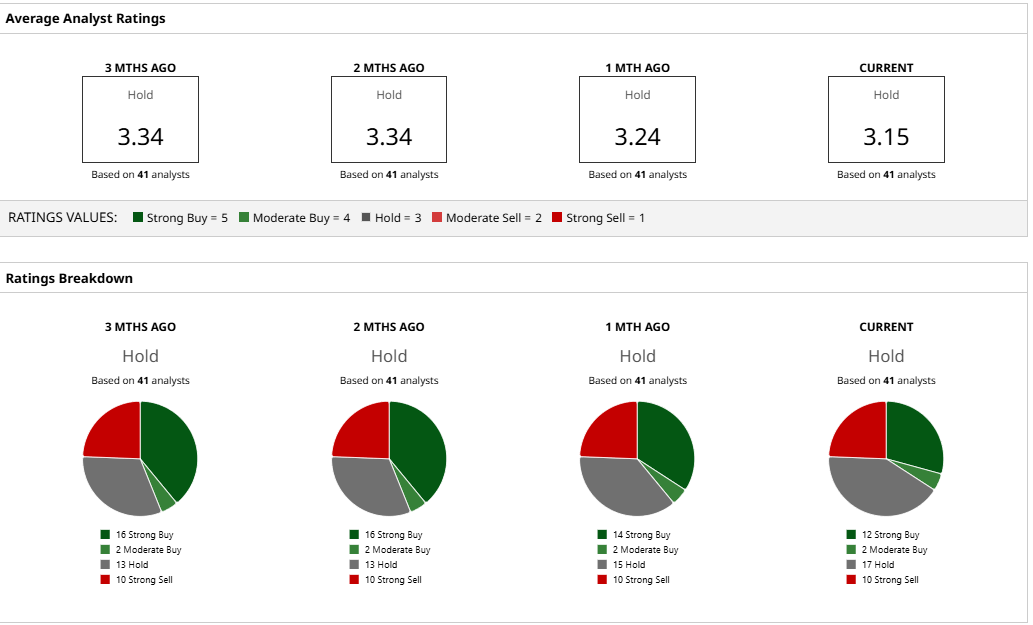

Taking all of this into account, analysts have deemed the TSLA stock a “Hold,” with a mean target price of $299.94, which has already been surpassed. However, the high target price of $500 denotes upside potential of about 56% from current levels.

Out of 41 analysts covering the stock, 12 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 17 have a “Hold” rating, and 10 have a “Strong Sell” rating.