President Donald Trump’s “One Big, Beautiful Bill” slashed incentives for solar and wind projects, taking a toll on several stocks in the sector.

Two leading solar stocks have similarly witnessed a significant decline in their Quality metrics in Benzinga’s Edge Stock Rankings over the past week, with the loss of incentives and subsidies that were part of the Inflation Reduction Act, signed by former President Joe Biden, being a major factor.

2 Solar Stocks Witness Sharp Drop In Quality Metrics

The Quality metric in Benzinga’s Edge Rankings essentially assesses a company’s operational efficiencies and financial health, alongside other relevant factors such as historical profitability and fundamental strength, before ranking it as a percentile against all other stocks.

See Also: The Analyst Verdict: First Solar In The Eyes Of 12 Experts

Here are two solar power stocks that have witnessed a decline in their Quality metrics over the past week, and the reasons behind the same.

1. Emeren Group Ltd.

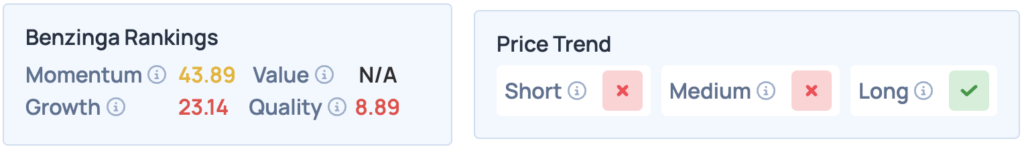

Pure-play renewable energy developer, Emeren Group Ltd. (NYSE:SOL), witnessed a sharp decline in its Quality score in Edge Rankings, dropping from 34.95 to 4.84.

This comes amid sharp declines in the company’s revenues, by 57% year-over-year during its recent second quarter results, alongside a string of misses on analyst consensus estimates. The company primarily attributes this to project execution delays and issues with governmental permits and approvals.

The stock scores poorly in Benzinga’s Edge Stock Rankings across the board, with an unfavorable price trend in the short and medium terms. Click here for deeper insights into the stock, its peers and competitors.

2. Enphase Energy Inc.

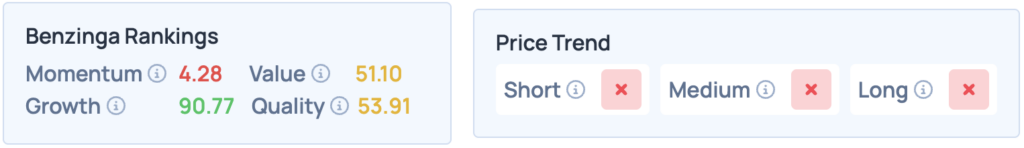

Enphase Energy Inc. (NASDAQ:ENPH) is a manufacturer of solar micro-inverters, battery energy storage, and EV charging stations, primarily for residential customers. As such, the company is set to face significant headwinds as residential solar tax credits get phased out by the end of 2025.

The stock’s Quality score is down 9.37 points, from 66.49 to 57.12, within the span of a week, and the stock itself is down 51.21% year-to-date.

According to Benzinga’s Edge Stock Rankings, the stock scores high on Growth, but does poorly on most other fronts, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the company, the industry, and its competitors.

Trump ‘Did Not Kill Solar’

Investor Chamath Palihapitiya said on Sunday that Trump’s “One Big, Beautiful Bill,” which axed several renewable energy subsidies and incentives, “did not kill solar,” adding that the “best-run solar businesses” have continued to thrive since the passing of the bill.

“What Trump did, precisely, is kill a bunch of Biden-era subsidies that were being taken advantage of by many companies to pervert a free market from well functioning to dysfunctional,” he said in a post on X.

Read More:

Photo courtesy: fuyu liu/shutterstock