Canopy Growth (CGC) shares soared about 18% on Monday after President Donald Trump endorsed cannabidiol (CBD) as a potential breakthrough in senior healthcare.

CBD could “revolutionize senior healthcare,” Trump wrote on Truth Social over the weekend, reigniting speculation that marijuana may be reclassified under his administration.

Including today’s rally, Canopy Growth stock is up a little over 100% versus its year-to-date low.

Why Trump’s Social Media Post Is Positive for CGC Stock

Trump’s endorsement of CBD as a transformative healthcare solution, signaling plans of marijuana reclassification at the federal level, could prove meaningfully positive for CGC stock.

Why? Because a shift in U.S. policy could open the door for Canadian cannabis firms to access the U.S. market more freely, reduce tax burdens, and attract institutional capital.

Reclassification would also legitimize cannabis as a mainstream wellness product, lifting demand and investor sentiment.

With Canopy Growth already positioned in the U.S. via its stake in Acreage Holdings, regulatory reform could accelerate its expansion as well as its long-term revenue potential.

Why Canopy Growth Shares Still Aren’t Worth Buying

Trump’s remarks sure are positive for the cannabis sector, but there are several risks that warrant caution in buying Canopy Growth shares at current levels.

For example, the company continues to post steep losses with negative EBITDA and dwindling cash reserves. Its debt load is substantial, and dilution risk remains high due to frequent equity raises.

CGC’s core Canadian business is shrinking, weighed down by oversupply and price compression and its U.S. exposure via Acreage Holdings is limited and contingent on federal reform, which remains speculative.

Until Canopy Growth demonstrates consistent revenue growth, margin improvement, and balance sheet discipline, the cannabis stock is more hype than substance.

Momentum traders may bite, but long-term investors should tread carefully.

Wall Street Remains Positive on Canopy Growth

Despite the aforementioned concerns, Wall Street remains bullish on Canopy Growth shares.

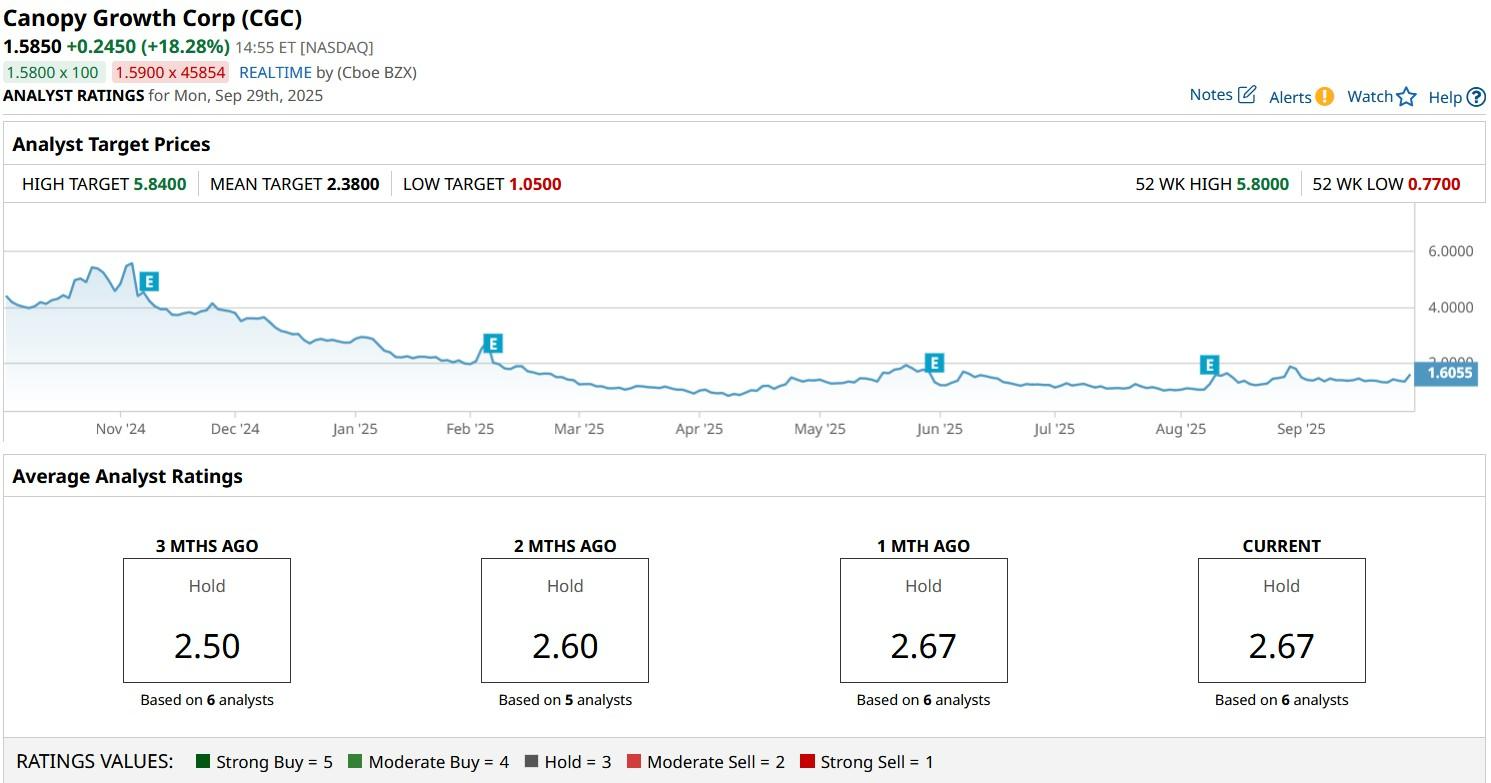

While the consensus rating on CGC stock currently sits at “Hold” only, the mean target of $2.38 indicates potential upside of another 50% from here.