As the minutes of the Federal Reserve’s June meeting were released on Wednesday, the word “uncertainty” reigned supreme amid the ongoing tariff turmoil and President Donald Trump‘s call to cut rates by 3 percentage points.

What Happened: The words “uncertain” and “uncertainty” appeared 28 times in the June 17-18 meeting minutes, and Fed Chair Jerome Powell mentioned the two words 19 times, as highlighted by Ed Yardeni from Yardeni Research.

“Most of the uncertainty faced by Fed officials has to do with Trump’s Tariff Turmoil (TTT). Collectively, they are leaning toward lowering the federal funds rate. But they are in no hurry to do so since they are worried that TTT might still boost inflation,” he said.

Meanwhile, the chief economist at LPL Financial, Jeffrey Roach, said that the key takeaways from the Federal Open Market Committee’s June 18 policy meeting suggested “The FOMC is comfortable remaining in wait-and-see mode. Despite headwinds, the economy continues to trudge along, giving policymakers time to assess the projected impact from tariffs.”

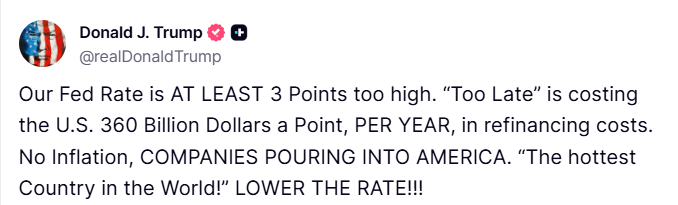

This comes amid Trump’s call for slashing the interest rates by 3%, highlighting that Powell was "Too Late" and it “is costing the U.S. 360 Billion Dollars a Point, PER YEAR, in refinancing costs.”

Trump has hinted at announcing Powell’s replacement and called for his resignation on multiple occasions because of the Fed’s “wait-and-see” stance.

On Wednesday, Trump also imposed 50% tariffs on Brazil, escalating the trade tensions between the two nations. This was followed by a slew of letters posted on his Truth Social account to Japan, South Korea and other countries, with a deadline of making a deal by Aug. 1.

See Also: Warren Buffett’s Quiet Dividend Play: 9 High-Yield Stocks Held By A Berkshire Subsidiary

Why It Matters: According to the Fed Minutes takeaways, the FOMC members were also concerned about stagflation risks if inflation proved persistent while employment weakened.

“Surprisingly, members thought the uncertainty about inflation and the economic outlook had decreased. Yet, committee members wanted to take a careful approach in adjusting monetary policy,” said Roach.

The FOMC members also acknowledged that lower and moderate-income households were switching to lower-cost items, and these households could be disproportionately affected by tariff-related price increases.

Roach added that at LPL, they expect next week's inflation data to show a reacceleration, giving the Fed more reason to keep rates elevated. “We don't expect inflation readings will improve until later this year,” he added.

Price Action: U.S. stocks climbed Wednesday, buoyed by Nvidia Corp.‘s (NASDAQ:NVDA) shares soaring to an unprecedented $4 trillion market capitalization and a fresh all-time high, pushing the Nasdaq to close at a record high.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Wednesday. The SPY was up 0.60% at $624.06, while the QQQ advanced 0.71% to $556.25, according to Benzinga Pro data.

Read Next:

Photo courtesy: Domenico Fornas / Shutterstock.com