Lithium is a crucial component for batteries, especially in electric vehicles (EVs). The global EV industry requires lithium, which is usually carried over long distances from extraction to battery cell production. The U.S. doesn’t play a significant role in this. The country currently produces less than 1% of the global lithium supply.

Amidst this, Washington is set to buy an equity stake in Lithium Americas (LAC), a lithium mining company. The stake will be worth 5% of the company and will draw upon the previously issued $2.26 billion loan from the U.S. Department of Energy (DOE) under the Advanced Technology Vehicles Manufacturing Loan Program, which financed the construction of the processing facilities at Thacker Pass. The government will be taking a 5% stake in Thacker Pass as well.

Thacker Pass, located in northern Nevada, is one of the largest known lithium reserves in the world. The project commenced construction in 2023, with a target of achieving initial production by 2027. On the news of the White House seeking a stake, the company’s stock almost doubled on Sept. 24.

As President Trump’s administration bets big on Lithium Americas, can it touch new heights?

About Lithium Americas Stock

Lithium Americas, based in Vancouver, Canada, is a leading mining company specializing in the development of lithium resources. It is principally advancing the Thacker Pass lithium project in northern Nevada, which is the largest known lithium deposit in the U.S. The project aims to produce battery-grade lithium carbonate, a vital component for electric vehicle batteries and clean energy storage.

The company’s goal is to establish a secure North American lithium supply chain that supports sustainable energy transitions through domestic production and manufacturing capabilities. Thacker Pass is poised to become a major player in the global lithium market by addressing critical supply needs. Lithium Americas has a market capitalization of $1.45 billion.

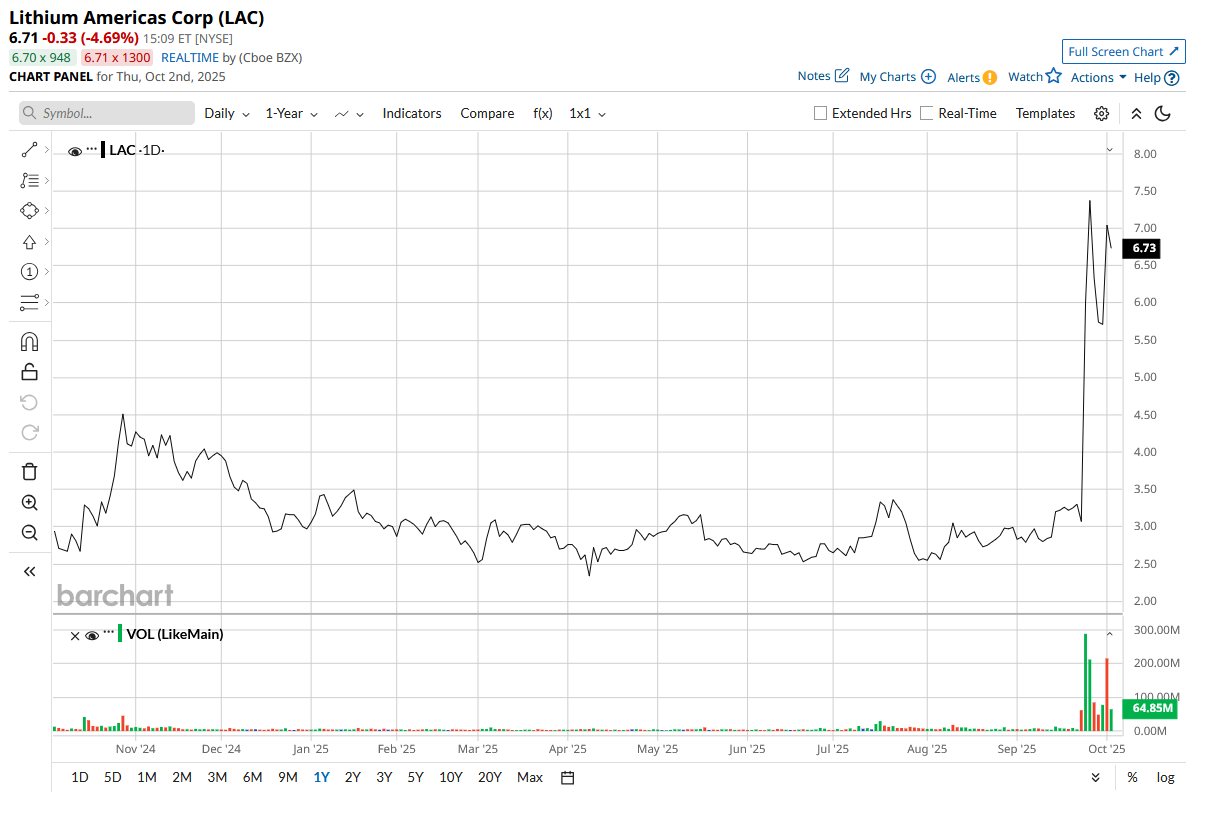

Over the past 52 weeks, LAC stock has gained 158%, while it is up by 125% year-to-date (YTD). The company’s development of its Thacker Pass lithium project has been the primary growth driver, as Lithium Americas prepares to bring the project into operation. After the news that the White House was seeking an equity stake in the company came to light, the company’s stock gained 95.8% intraday on Sept. 24.

Yesterday, Sept. 1, LAC stock saw a smaller but still significant 23.3% spike on the announcement of the White House following through with the investment.

The company’s price-to-book (P/B) ratio sits at 2.07 times, which is almost the same as the industry average of 2.08 times.

Lithium Americas’ Cash Pile Is Growing

Lithium Americas last reported its second-quarter results for fiscal 2025. The company is not generating revenue at the moment. For the quarter, the company’s net loss climbed by 102.1% year-over-year (YoY) to $13.25 million.

However, the company is gaining in cash. For the first six months of 2025 (the period that ended June 30), the company’s cash, cash equivalents, and restricted cash at the end of the period stood at $509.14 million, up 35.4% from the prior-year period’s $376.12 million. Net cash provided by financing activities climbed 21.2% YoY to $317.85 million.

Last year, Lithium Americas entered into a joint venture (JV) with General Motors (GM) for the construction and operation of the Thacker Pass mine. As of the closing of the JV on Dec. 20, 2024, Lithium Americas owns a 62% majority equity interest in the JV, while GM owns a 38% interest in the JV.

Wall Street analysts have a mixed view about Lithium Americas’ ability to reduce its losses. For the current year, the company’s loss per share is expected to decrease by 9.5% YoY to $0.19, while for the next year, loss per share is expected to increase by 21.1% annually to $0.23.

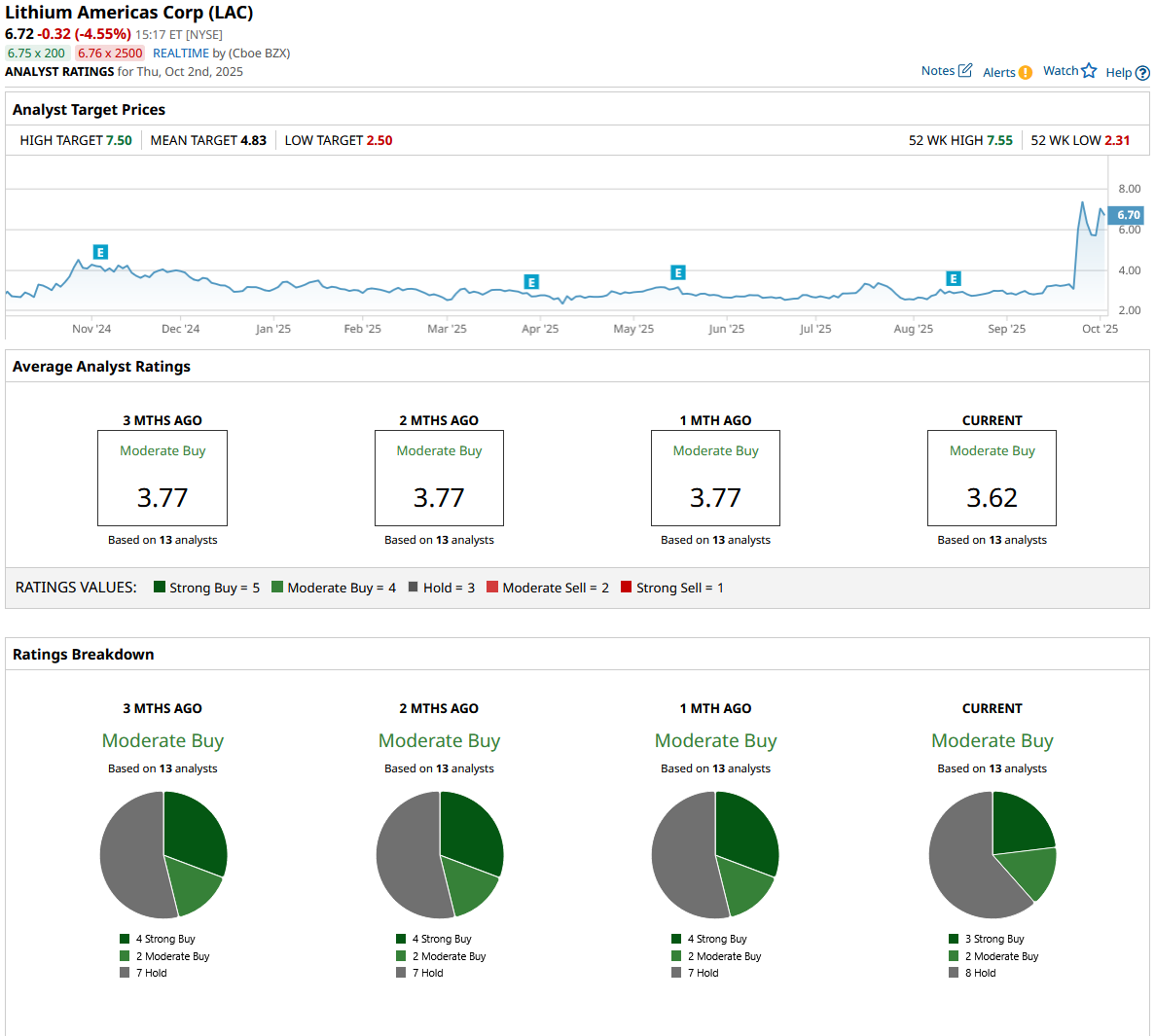

What Do Analysts Think About LAC Stock?

Wall Street analysts are moderately bullish on LAC stock. Recently, the company’s stock was maintained at a “Buy” rating by analysts at Jefferies. However, the price target was lowered from $8 to $7 due to the news of the DOE loan re-evaluation.

Analysts hold a consensus “Moderate Buy” rating overall on the stock. Of the 13 analysts rating LAC stock, three gave a “Strong Buy” rating, two a “Moderate Buy” rating, and eight a “Hold” rating. The consensus price target of $4.83 represents a 28% downside from current levels. However, the Street-high price target of $7.50 means a 12% upside from current levels.