Rare-earth magnets are essential components in electric vehicles (EVs), drones, missiles, and other high-tech and defense systems. For decades, China has held a dominant grip over their production, prompting growing concerns in Washington about supply chain vulnerabilities.

In April 2025, those concerns escalated to the highest level. Recently, President Trump signed an executive order triggering a Section 232 investigation into U.S. dependence on imported processed critical minerals. The order followed China’s suspension of exports of key heavy rare earths and magnets, a move widely viewed as an attempt to weaponize trade and disrupt U.S. industry.

Against this backdrop, the U.S. government is doubling down on efforts to secure a domestic magnet supply chain. MP Materials (MP) recently struck a high-profile deal to supply rare-earth magnets to Apple (AAPL) from its Texas plant, signaling strong commercial demand for local production.

USA Rare Earth (USAR), meanwhile, is racing to establish itself as a homegrown leader, building out its Oklahoma facility and securing upstream resources to support America’s strategic independence. With breakthroughs in domestic processing and bold expansion plans, USAR is emerging as a key player in the domestic rare-earth resurgence.

About USAR Stock

Founded in 2019, USA Rare Earth (USAR) is a micro-cap company working to build a fully integrated U.S. supply chain for neodymium-iron-boron (NdFeB) magnets. Its mission is to bolster domestic production, from mining rare-earth elements to manufacturing finished magnets, and reduce America's dependence on foreign suppliers.

Over the last 52 weeks, USAR stock has surged nearly 29%, climbing from the low single digits to a market capitalization of approximately $1.32 billion. Much of the rally stemmed from investor enthusiasm following MP Materials’ high-profile Apple deal, which sparked speculation that USAR could land similar partnerships, despite no official announcements.

However, the stock's soaring valuation has drawn attention. With a forward price-to-earnings ratio of 73, far above the sector median of 17, USAR now trades at a significant premium, having spiked 146% from its March year-to-date lows.

USAR Ambitious Projects

USA Rare Earth, which went public via a SPAC merger, is rapidly building a fully integrated U.S. supply chain for NdFeB magnets, crucial for defense and clean energy technologies. The company is constructing a 310,000 sq. ft. magnet plant in Stillwater, Oklahoma, aiming to produce 5,000 metric tons annually and generate up to $800 million in revenue. The facility will utilize equipment from a decommissioned Hitachi magnet line.

USAR also controls the Round Top deposit in Texas, which is rich in heavy rare earths like dysprosium and terbium. In early 2025, it produced high-purity dysprosium oxide from Round Top ore, marking a key milestone in in-house processing.

Among its key milestones set recently, the company has launched an Innovations Lab; signed its first customer memorandum of understanding (MOU); and raised over $100 million this year - including a $75 million PIPE deal - to fund its expansion. CEO Joshua Ballard calls the effort a “Manhattan Project” to reestablish U.S. dominance in rare-earth manufacturing.

Financial Overview

Despite USAR's lofty valuation, the company remains pre-revenue, with no sales reported to date as it continues to build out its magnet production facilities.

In Q1 2025, USAR posted net income of $52,000, largely driven by one-time accounting items. On an adjusted basis, the company recorded a $12 million loss, or $0.19 per share, due to rising R&D and project expenses.

USAR has raised over $100 million in 2025, including $75 million through a PIPE deal, providing capital to advance its Stillwater magnet plant.

On the balance sheet, the company held $23.4 million in cash and cash equivalents, up from $16.8 million at year‑end 2024. It used $10.3 million in operating cash and $3.1 million on investing activities in the quarter, while financing activities provided $20.0 million, resulting in a net cash increase of $6.6 million for the period.

Is USAR Stock a Good Buy?

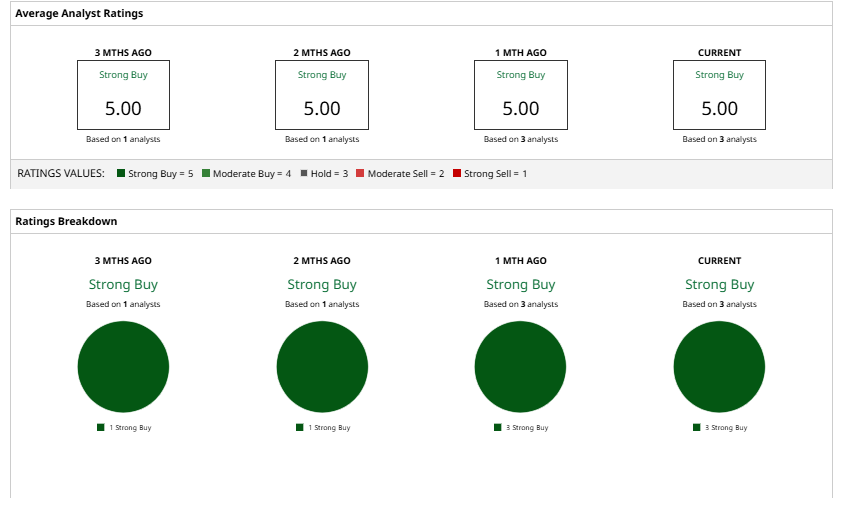

Wall Street analysts are bullish on USAR’s growth potential, with all three in coverage giving the stock a unanimous “Strong Buy” rating. They have set an average price target of $17.33, implying a potential upside of about 26.7% from current levels.

As the U.S. ramps up efforts to break China’s rare-earth dominance, USA Rare Earth is building critical infrastructure at a pivotal moment. Backed by federal momentum and investor capital, USAR is aggressively expanding its footprint. If it secures commercial deals, this under-the-radar stock could deliver explosive upside for early backers - though given its pre-revenue status, USAR is best reserved for investors with a long time horizon, and a healthier-than-usual appetite for risk.