Lithium Americas (LAC) shares are up more than 25% on Wednesday after the U.S. government confirmed plans of taking a minority equity stake in the Vancouver-headquartered lithium miner.

The Department of Energy (DOE) has decided in favor of acquiring 5% of the company as well as its Thacker Pass project in Nevada, according to U.S. Energy Secretary Chris Wright.

Following today’s rally, Lithium Americas stock is up more than 200% versus its year-to-date low.

What Does a Federal Stake Mean for LAC Stock?

LAC stock pushed explosively to the upside this morning mostly because government involvement means added credibility, capital, and long-term policy support for the NYSE-listed firm.

Together with loan deferral terms, the DOE’s equity position extends Lithium Americas’ financial runaway, significantly reducing execution risk.

Thacker Pass is widely seen as a cornerstone in America’s push to cut reliance on China for critical minerals used in electric vehicles and renewable energy initiatives.

Wedbush analyst Dan Ives has already dubbed it a “massive opportunity” for the U.S. to strengthen its domestic supply chain.

The federal support not only de-risks the venture, but also signals confidence in Lithium Americas’ strategic importance in the aforementioned matter of national security.

Is It Too Late to Invest in Lithium Americas Shares?

While the DOE news sure is positive for Lithium Americas shares, investors must still tread with caution as the rally this morning may have priced in much of the near-term upside already.

LAC’s long-term potential remains strong, especially given enthusiasm for policy-driven growth, but execution risks, including permitting, production delays, and global lithium price volatility still loom.

Lithium Americas’ price-book (P/B) ratio of 2.08x at writing looks overly stretched also because the company is in the pre-production phase and doesn’t yet generate revenue or produce lithium at scale.

For those who missed the initial move, it may, therefore, be prudent to wait for a pullback or clearer visibility on project milestones before jumping in.

How Wall Street Recommends Playing Lithium Americas

Note that Wall Street also believes the LAC share price rally has gone a bit too far on Wednesday.

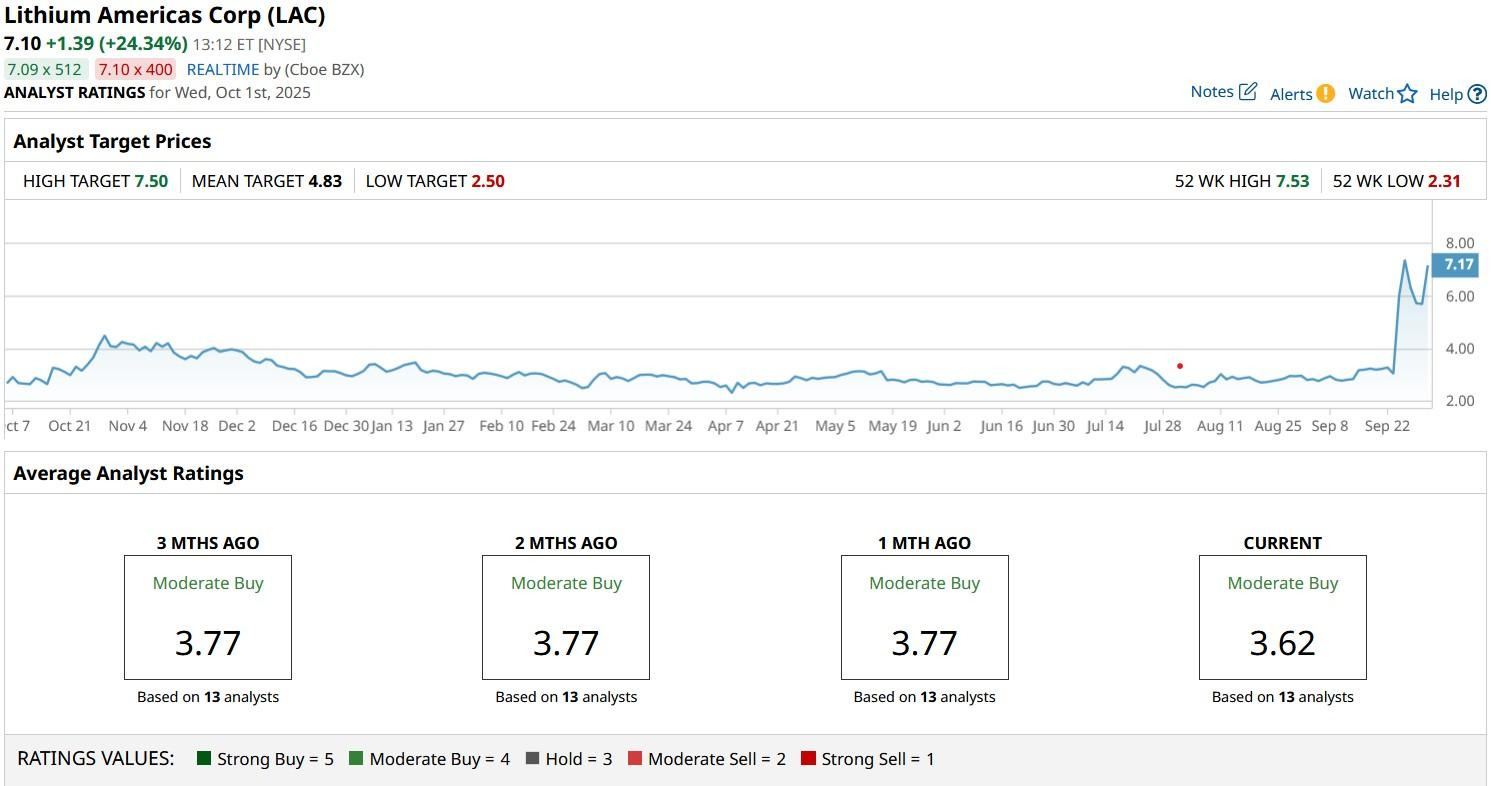

While the consensus rating on Lithium Americas stock remains at “Moderate Buy,” the mean target of $4.83 indicates potential for 35% downside from here.