DigitalOcean Holdings (DOCN) stock has been performing well this year, driven by strong earnings and growing optimism around its artificial intelligence (AI)- focused cloud offerings. Unlike giants such as Amazon's (AMZN) Amazon Web Services (AWS) and Microsoft's (MSFT) Azure, DigitalOcean specializes in serving developers, startups, and small to mid-size businesses, offering simple, scalable, and cost-effective cloud solutions tailored to this niche. Adding fuel to the rally were recent takeover rumors that ignited investor excitement.

The buzz comes from reports that suggested DigitalOcean could be attracting renewed takeover interest. In September 2024, Betaville reported that Cloudflare (NET) had explored a cash-and-stock deal valued at around $55 per share, although nothing materialized from the talks. Now, traders are speculating whether Cloudflare is back or a new suitor is circling.

With takeover rumors swirling, should you buy DOCN stock now?

About DigitalOcean Stock

Founded in 2012, New York-based DigitalOcean has built a reputation as a straightforward, scalable cloud platform that makes cloud and AI infrastructure more accessible to digital-native businesses worldwide. Focused on simplicity and efficiency, the company enables developers and growing enterprises to focus on innovation rather than infrastructure management. Today, more than 600,000 customers rely on DigitalOcean’s cloud, AI, and machine learning solutions to power and scale their digital operations.

Currently valued at roughly $3.6 billion by market capitalization, shares of this cloud infrastructure provider have had a strong run this year, especially after its latest earnings release on Aug. 5, which sent the stock soaring almost 29% in a single trading session. While DOCN stock is up 16% so far in 2025, its momentum has been even more striking over the past three months, with shares climbing 37%, leaving the broader S&P 500 Index’s ($SPX) 6.8% gain far behind.

A Closer Look at DigitalOcean’s Q2 Performance

Investors had plenty to celebrate after DigitalOcean’s standout second-quarter results in early August, which comfortably topped Wall Street’s expectations and underscored the company’s steady business momentum. Revenue rose 14% year-over-year (YOY) to $219 million, beating estimates of $217 million, while adjusted EPS jumped 23% to $0.59, well ahead of the expected $0.47.

Beneath the headline numbers, the fundamentals looked equally strong. Annual run-rate revenue (ARR) grew 14% (YOY) to $875 million, while incremental ARR hit $32 million, the highest since late 2022. Remaining performance obligations surged to $53 million from just $3 million a year ago, pointing to healthy demand ahead. The company also delivered $57 million in adjusted free cash flow, translating into a 26% margin, up from a 19% margin a year earlier.

Management credited the strong showing to robust performance across both its core cloud services and fast-expanding AI offerings. Notably, DigitalOcean rolled out over 60 new products and features during the quarter and also unveiled a key collaboration with Advanced Micro Devices (AMD), giving customers access to AMD Instinct GPUs through DigitalOcean GPU Droplets, empowering developers to seamlessly scale and optimize their AI workloads.

With confidence running high, management raised its full-year fiscal 2025 revenue outlook to $888 million to $892 million and boosted its adjusted EBITDA margin guidance to between 39% and 40%. On the bottom line, DigitalOcean projects non-GAAP EPS for the entire year to land between $2.05 and $2.10.

How Are Analysts Viewing DigitalOcean Stock?

Earlier this month, Canaccord Genuity turned more bullish on DigitalOcean, lifting its price target to $55 from $49 while reiterating a “Buy” rating. The firm pointed to clear signs of a business revival, highlighted by the company’s strongest incremental ARR in nearly three years and 76 successful cloud migration wins reported in the second quarter. Adding to the optimism, DigitalOcean also raised its full-year revenue outlook, reflecting growing confidence in its AI-focused and core cloud momentum.

Canaccord believes DOCN stock could “move materially higher” if revenue growth returns to the high-teens range, fueled by emerging opportunities in AI inference and steady expansion in its core cloud segment. Calling this “the early makings of a classic business turnaround” rather than a short-term rebound, Canaccord raised its fiscal 2026 and 2027 revenue projections on improved visibility into management’s targets.

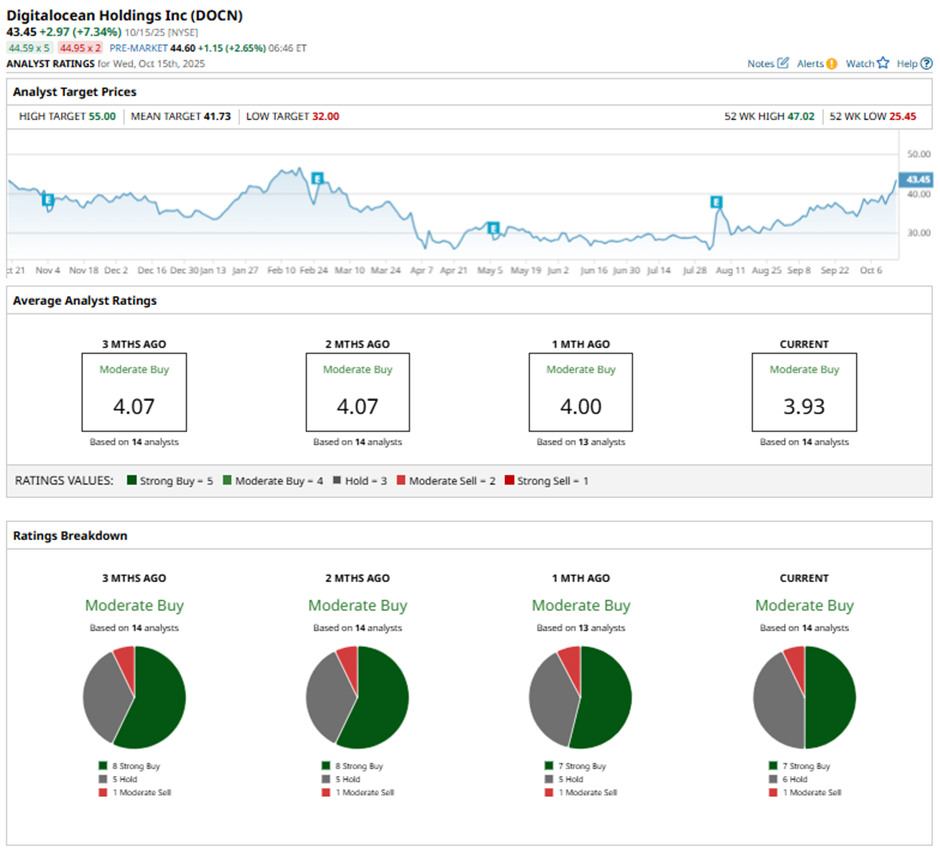

Meanwhile, Citizens JMP Securities echoed the upbeat sentiment, reaffirming a “Buy” rating with a matching $55 price target, signaling growing conviction across Wall Street. Overall, Wall Street’s tone on DigitalOcean leans positive, with analysts maintaining a cautiously optimistic stance and a consensus rating of “Moderate Buy.”

Of the 14 analysts offering recommendations, seven give DOCN a solid “Strong Buy,” six suggest “Hold,” and the remaining one issues a “Moderate Sell.” While DOCN stock trades slightly below its average analyst price target of $41.73, the Street-high target of $55 implies potential upside of 39% from current price levels.