Starbucks (SBUX) is the world’s largest coffeehouse chain, renowned for its specialty coffee offerings, inviting store ambiance, and strong brand loyalty. The company pioneered the premium café experience under Howard Schultz, transforming coffee drinking into a lifestyle centered around connection and community. The company’s global strategy combines a consistent brand approach with local adaptation, making Starbucks a defining force in the modern coffee industry.

Founded in Seattle in 1971, Starbucks operates over 38,000 stores in more than 80 countries.

Starbucks Continues to Struggle

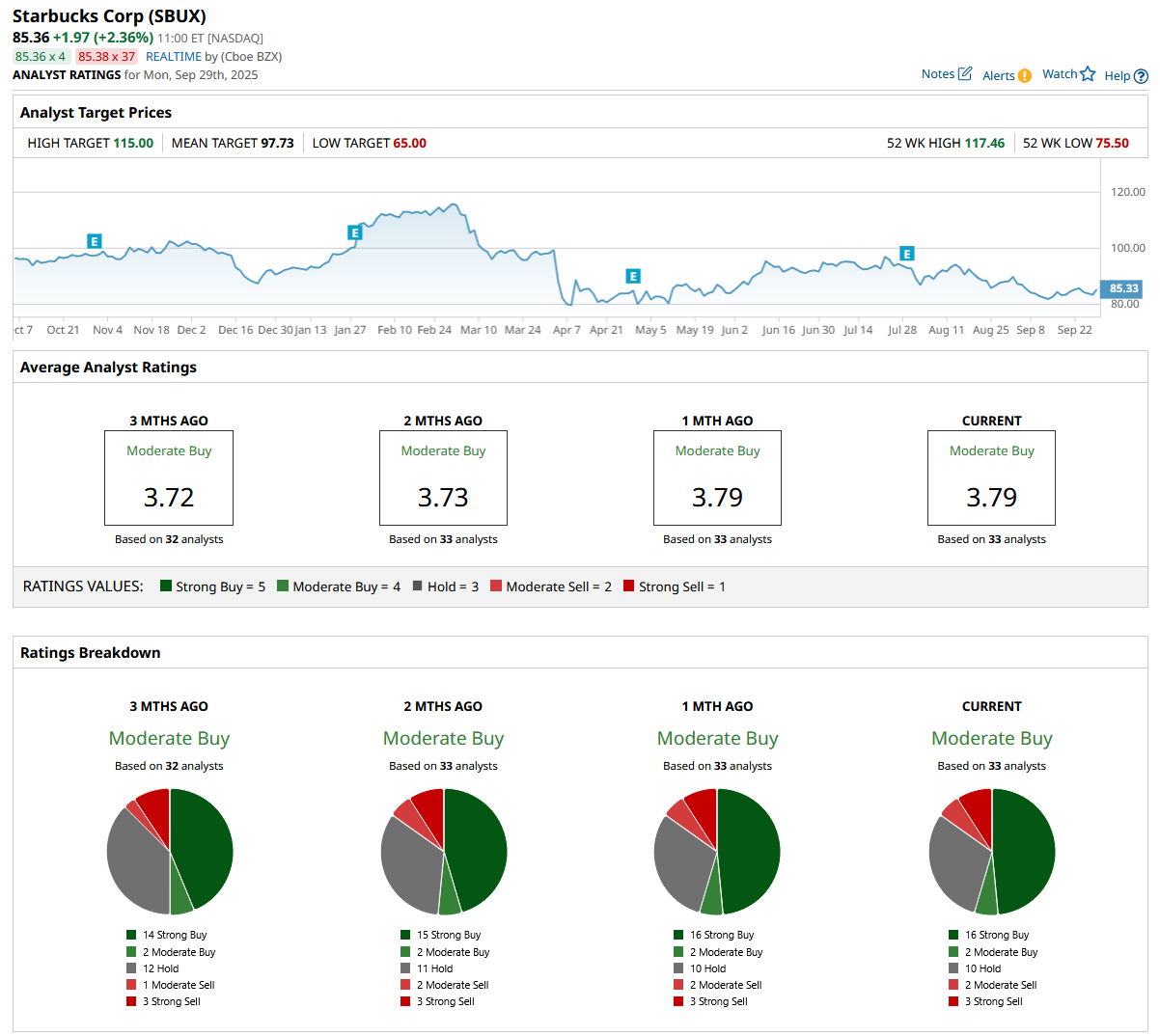

SBUX stock has declined 0.2% over the last five days and fallen 3.4% for the month. Over six months, it is down 13%, with a year-to-date (YTD) loss of 6.5% and a 52-week drop of roughly 13%.

The S&P 500 ($SPX), by comparison, gained around 12% over the same YTD period and nearly 15% for the past year, highlighting Starbucks’ underperformance against its benchmark. Persistent weakness has been fueled by declining same-store sales and lingering consumer demand concerns.

Starbucks Posts Mixed Results

Starbucks posted mixed fiscal Q3 2025 results on July 29. Earnings per share reached $0.50, falling sharply below analyst expectations of $0.65 and marking a 45% year-over-year (YoY) decline. Revenue, however, was a bright spot at $9.5 billion, surpassing analyst estimates of $9.29–$9.3 billion and reflecting a 3–4% annual increase, driven by expansion in company-operated stores and strength in key markets outside the U.S. Market reaction was muted, as the EPS miss overshadowed the revenue beat.

Key metrics showed global comparable sales dropping 2% and operating margin contracting to 10.1% from 16.6% a year before, impacted by higher labor costs and ongoing investments in operations. Net income for the quarter was $558.3 million, down from $1.05 billion last year. Starbucks continued to invest in operational improvements, allocating $500 million towards labor in North America, while maintaining a robust balance sheet with ample cash reserves and a solid investment-grade credit rating.

The company withheld specific full-year guidance but signaled caution for Q4, citing challenging consumer conditions. Management remains focused on operational upgrades and innovation, aiming to return to pre-pandemic operating margin levels in the medium term, and sees potential upside from digital initiatives and new product offerings.

Layoffs and Store Closure

Starbucks has unveiled a major restructuring plan, dubbed “Back to Starbucks,” which includes closing underperforming coffeehouses and reorganizing corporate operations. The company expects total restructuring costs to reach about $1 billion, with roughly 90% of those expenses relating to its North American business. The charges will cover $150 million in employee separation benefits, $400 million for write-downs and disposals of company-operated store assets, and $450 million linked to accelerated lease and related costs. Starbucks projects $400 million in non-cash charges and $600 million in future cash outflows tied to the restructuring.

Approximately 900 non-retail partner roles will be eliminated, and many open positions will remain unfilled. Affected store employees will be offered transfers where possible, with severance for those unable to be placed. The company expects that, after accounting for both new openings and closures, its total company-operated café count in North America will decline by about 1% in fiscal year 2025, ending with close to 18,300 locations across the U.S. and Canada.

Looking forward, Starbucks plans to increase its store count in fiscal 2026 and renovate over 1,000 stores in the next 12 months, aiming to enhance store design and customer experience. The restructuring is focused on investing in core locations and boosting profitability at existing stores.

Should You Get SBUX?

Presently, there is some mixed response from Wall Street on the coffee chain, with a consensus “Moderate Buy” rating and a mean price target of $97.73, reflecting an upside potential of 14% from the market rate.

The stock has been rated by 33 analysts with 16 “Strong Buy” ratings, two “Moderate Buy” ratings, 10 “Hold” ratings, two “Moderate Buy” ratings, and three “Strong Sell” ratings.