/Spotify%20logo%20by%20Bastian%20Riccardi%20via%20Unsplash.jpg)

Spotify (SPOT) founder Daniel Ek is stepping back from his CEO role after nearly two decades to become executive chairman, effective Jan. 1, 2026. Taking the reins as co-CEOs are Gustav Söderström, the tech chief, and Alex Norström, who leads business operations.

The co-presidents have been running the show since 2023, so the new titles just make official what's already happening. As executive chairman, Ek will focus on big-picture strategy, capital decisions, and long-term planning while staying closely involved with the board and new CEOs.

Spotify Is Expanding Its Ad Business

Spotify is doubling down on its advertising business with multiple partnerships and tools that could boost revenue growth. The streaming giant announced a major deal with Amazon (AMZN) DSP, allowing advertisers to tap into Spotify's 696 million monthly users for the first time through Amazon's platform. This combines Amazon's massive shopping and browsing data with Spotify's engaged listener base.

Since launching the Spotify Ad Exchange in April, advertiser adoption has jumped 142%. Notably, campaigns focused on driving website traffic are seeing page views more than double compared to standard brand campaigns. App install campaigns are performing even better, with install rates over four times higher than non-optimized efforts.

Spotify is also rolling out new features, including split testing tools, and expanding partnerships with Yahoo DSP and Smartly to make ad buying easier for businesses of all sizes. The platform's advantage is clear: users spend over two hours daily on Spotify, and 65% say their time on the platform feels more positive than social media.

Spotify’s ad business diversifies revenue beyond subscriptions and taps into Spotify's unique positioning as an engaged alternative to traditional social media platforms.

A Solid Performance in Q2

Spotify's Q2 earnings reveal a company firing on multiple cylinders, as the streaming giant added eight million subscribers, surpassing guidance by three million. Monthly active users jumped to 696 million, beating expectations by seven million.

Users who consume multiple content formats spend significantly more time on the platform. Video podcast consumption is growing 20 times faster than audio-only, with 350 million users now watching video content. The AI-powered DJ feature has seen streams increase by 45% after adding conversational capabilities, and 65% of global music streams now occur on Spotify.

The company is investing heavily in AI infrastructure, retooling its entire tech stack for the era of generative AI. This creates a feedback loop where increased engagement leads to more accurate recommendations, which in turn drive further engagement.

What Is the SPOT Stock Price Target?

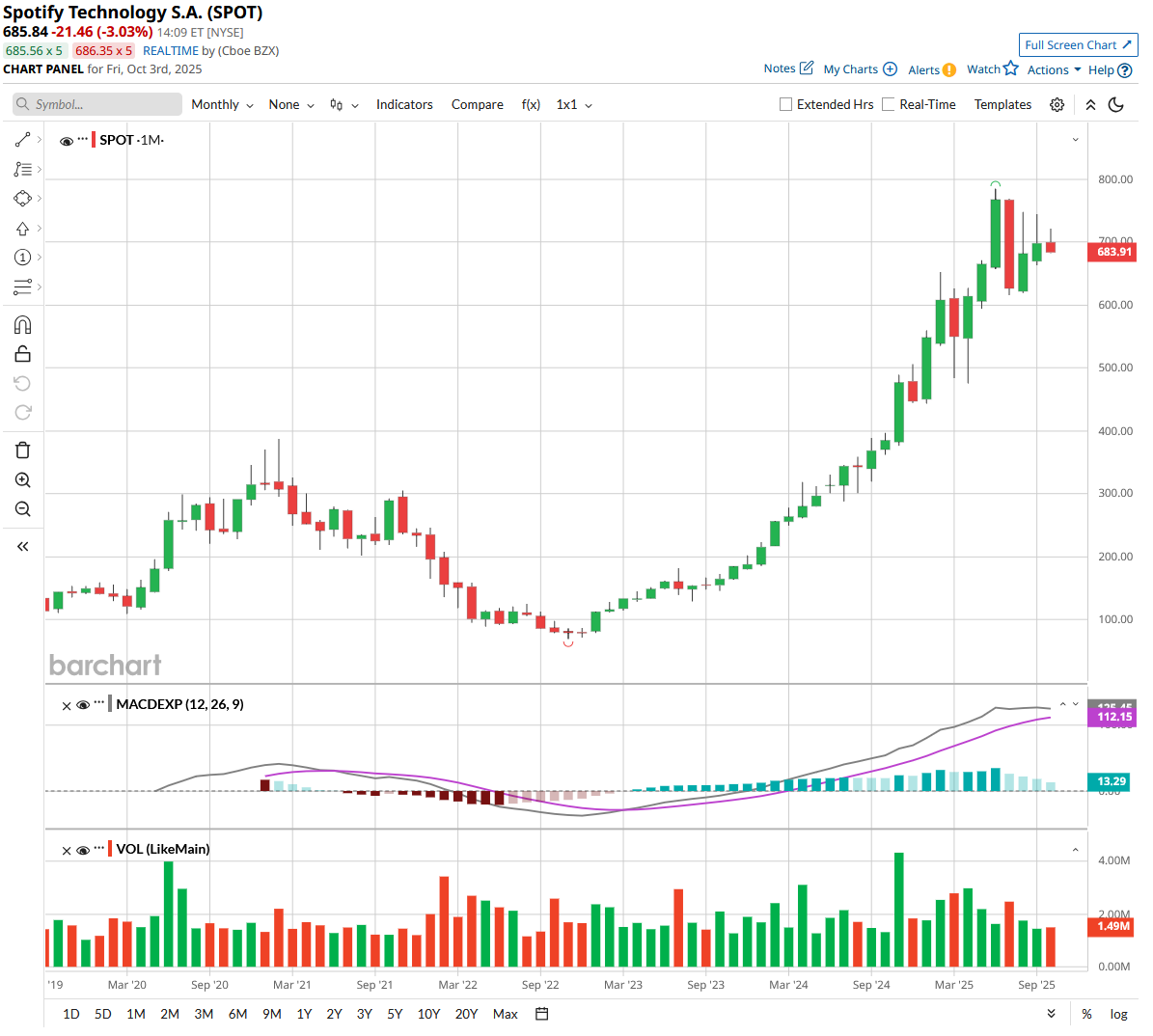

Looking ahead, flat year-over-year (YoY) ARPU in Q3 on a constant currency basis suggests pricing power may be temporarily constrained as Spotify expands in emerging markets. Management remains focused on lifetime value over quarterly optimization, which means near-term results may fluctuate.

Analysts tracking SPOT stock forecast revenue to increase from $16.28 billion in 2024 to $32.5 billion in 2029. In this period, adjusted earnings are forecast to expand from $5.71 per share to $22.61 per share.

Today, SPOT stock trades at 51x 2026 earnings, which is quite steep. If the tech stock trades at a lower price-to-earnings (P/E) multiple of 35x, it could gain 13% over the next two years.

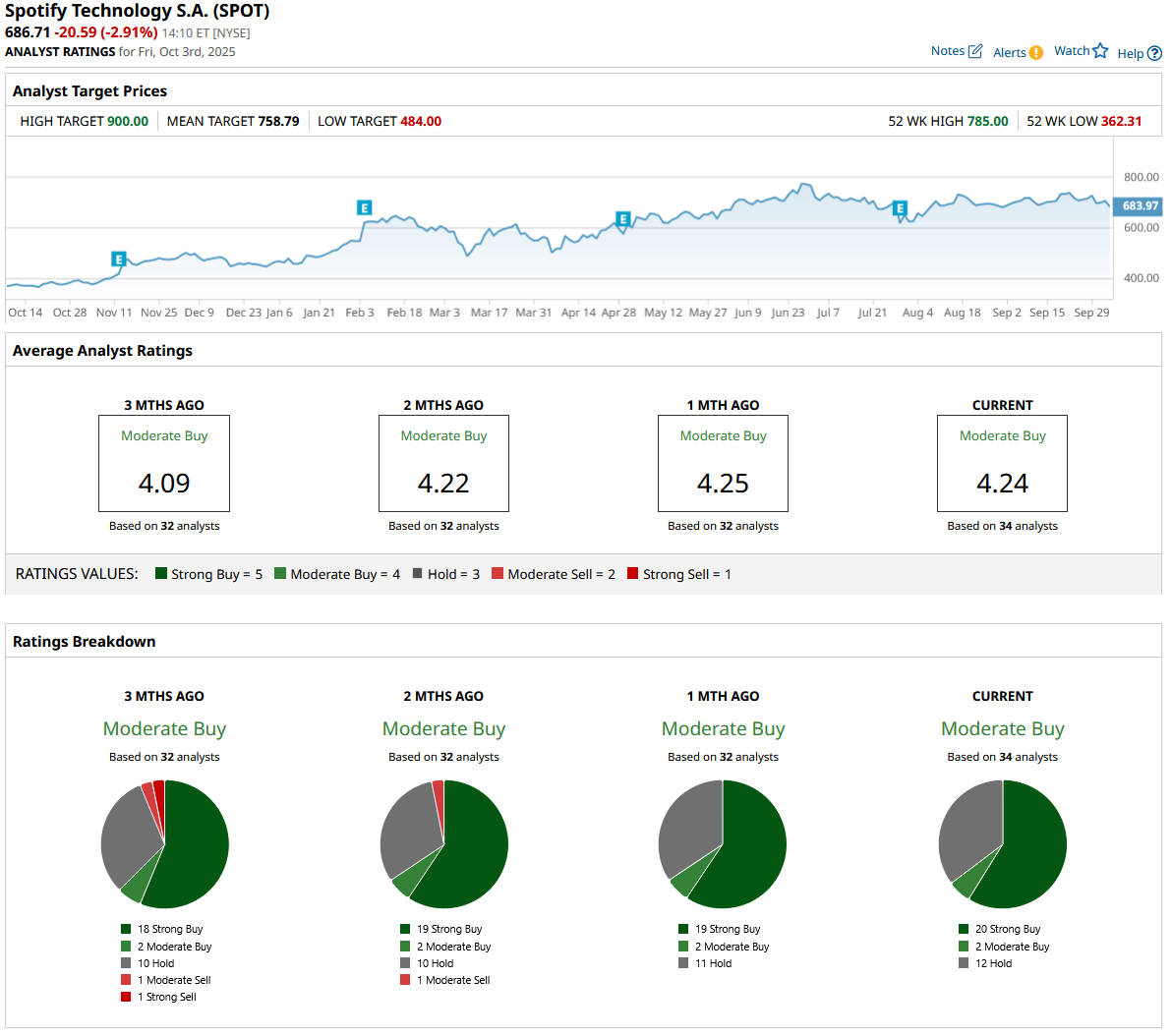

Out of 34 analysts covering SPOT stock, 20 recommend “Strong Buy,” two recommend “Moderate Buy,” and 12 recommend “Hold.” The average SPOT stock price target is $759, above the current target price of $686.