/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoFi Technologies (SOFI) shares are slipping today, even after the fintech company posted its first-ever billion-dollar quarter and issued impressive guidance for 2026. At the time of writing, SOFI is hovering around its 200-day moving average (MA) at the $22.69 level. A decisive break below this price may accelerate downward momentum in the near-term.

Versus its November high, SoFi stock is now down nearly 30%.

Is SoFi Stock Worth Investing in on Earnings Weakness?

Investors are bailing on SOFI shares despite a blockbuster quarterly release mostly on lingering dilution concerns from the company’s enormous $1.5 billion capital raise this month.

According to its chief executive, Anthony Noto, however, the recently executed share sale actually positions SoFi Technologies for long-term dominance in the fintech space.

Speaking this morning with CNBC, Noto revealed the offering was “immediately accretive to our tangible book value,” adding another $2 a share to the fintech’s equity base. SOFI will use that capital to grow faster through product roll-outs and strategic deals that bolster its footing against rivals — potentially creating shareholder value over time, he concluded.

SOFI Shares Stand to Benefit From Both Crypto and AI

Long-term investors should consider buying SoFi stock on the post-earnings dip also because it’s uniquely positioned to benefit from two supercycles: blockchain and artificial intelligence (AI).

The San Francisco-headquartered firm is using AI to boost underwriting efficiency, and its crypto offerings are bringing new members to the platform. SOFI added a record 1 million new members in Q4.

Moreover, while the firm’s forward price-to-earnings (P/E) ratio at north of 40x appears stretched, relative to its earnings growth (160% year-over-year in Q4), it may actually be a bargain for longer-term investors.

Note that SOFI’s relative strength index (14-day) currently sits at about 30, indicating the bearish momentum is now near exhaustion.

Wall Street Sees Significant Upside in SoFi Technologies

Wall Street analysts also seem to agree that the ongoing weakness in SoFi Technologies is a little overdone.

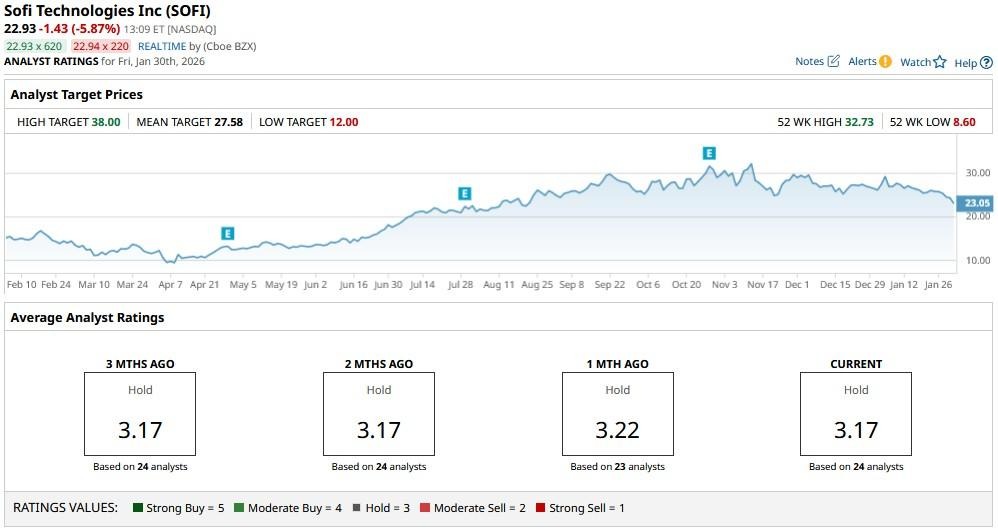

While the consensus rating on SOFI shares remains at a “Hold” only, the mean target of about $27.50 suggests potential upside of roughly 20% from current levels.