SoFi Technologies (SOFI) has built itself into a financial one-stop shop where 11.7 million members turn to borrow, save, spend, invest, and protect their money. But just when you thought the menu was full, the company has pulled another card from its sleeve.

The company is rolling out no-fee options products designed with retail investors in mind, especially those dipping their toes into the market for the first time. By removing fees tied to options exercise and assignment, SoFi is smoothing the edges of trading, making it more transparent, and cutting costs for active traders.

In the coming weeks, the perk will be unlocked for eligible SoFi Invest members. Those approved will step into Level 1 trading with covered calls and cash-secured puts, while Level 2 strategies remain on the table.

Alongside this move, SoFi added alternative funds from ARK, KKR (KKR), The Carlyle Group (CG), and Franklin Resources (BEN), spanning private credit, real estate, and pre-IPO firms. It also relaunched its robo advisor with BlackRock (BLK), adding portfolios that feature alternative assets.

Yet the company did not mince words with this move. SoFi warned that options trading carries significant risk and is not suitable for all investors.

With this development in mind, let's see what investors should know about SOFI stock.

About SoFi Stock

Starting as a student loan refinancing venture, SoFi Technologies has since reinvented itself into a digital financial powerhouse. From its home base in San Francisco, California, the company now stretches across three segments — Lending, Technology Platform, and Financial Services.

With a market capitalization of $34 billion, SoFi provides a full range of financial services, including loans, banking, investing, insurance, financial management, employee benefits, and marketplace solutions, all supported by platforms like Galileo and Technisys.

Markets, however, rarely move in straight lines. Over the past 52 weeks, SOFI shares have skyrocketed 212% and climbed 156% in just six months. But as the saying goes, every rally has its rain clouds. The stock tumbled more than 4% on Sept. 30 when fears of the U.S. government shutdown rattled confidence and sent investors seeking shelter.

Valuations only add to the intrigue. Trading at 88 times forward adjusted earnings and 12.5 times sales, SoFi sits at a premium well above industry averages. Investors know the numbers are rich, but as always, rich valuations can either signal strength or test conviction.

SoFi Surpasses Q2 Earnings

On July 29, SOFI stock jumped roughly 6.6% after the company unveiled its second-quarter fiscal 2025 results, which exceeded expectations with a flourish. Adjusted net revenue surged 44% year-over-year (YOY) to $858.2 million, marking the highest quarterly revenue in over two years, and leaving analysts scratching their heads after predicting $804 million.

The growth was powered by a record influx of new members, innovative products, and a noticeable lift in fee-based revenue. 850,000 new members joined SoFi's ranks in the quarter, up 34% YOY and bringing the total to 11.7 million. Meanwhile, SOFI added 1.26 million new products, also up 34% from the prior year, taking the total to 17.1 million.

Adjusted EBITDA climbed 81% from the year-ago quarter to $249.1 million, reflecting a 29% margin. Adjusted net income surged 459% to $97.3 million, while adjusted EPS jumped 700% to $0.08, topping analyst expectations of $0.06.

Riding the strong first half, management raised its full-year 2025 guidance. Adjusted net revenue is now projected at around $3.38 billion, $65 million above prior guidance, reflecting roughly 30% annual growth. Adjusted EBITDA is expected to be near $960 million, implying a 28% margin.

Net income and EPS are also predicted to climb, with estimates at $370 million and $0.31, respectively. Membership growth remains robust, with at least 3 million new members expected in 2025, up 30% from 2024.

Meanwhile, analysts predict third-quarter EPS to grow 60% YOY to $0.08, with the full fiscal year 2025 bottom line estimated to rise 113% from the prior year to $0.32. Fiscal 2026 is predicted to show further growth of 81% from the previous year to $0.58.

What Do Analysts Expect for SoFi Stock?

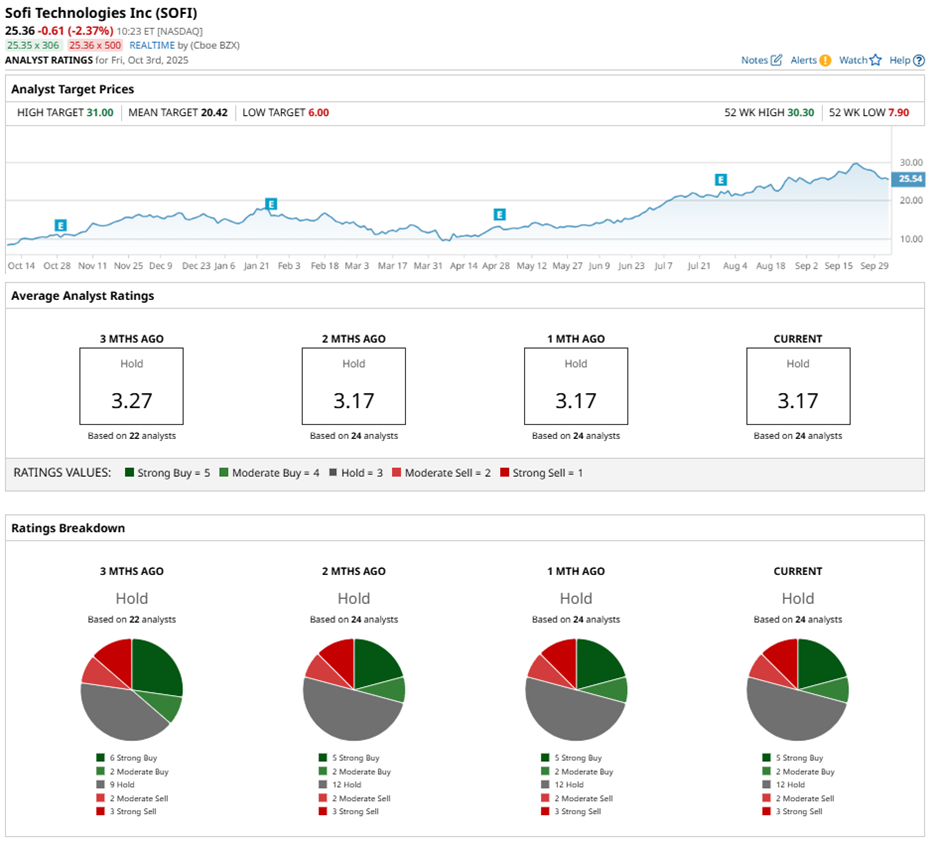

Needham analyst Kyle Peterson recently reaffirmed a “Buy” rating on SOFI stock, nudging the price target from $25 to $29, signaling that he sees clear skies ahead for the company. Still, the buzz around SOFI is a mixed bag, but intriguing all the same.

Out of 24 analysts tracking SOFI stock, five give a “Strong Buy” rating, two lean toward a “Moderate Buy,” and 12 provide a “Hold" rating. The skeptics are not silent either, with two calling for a “Moderate Sell” rating and three waving the “Strong Sell” flag.

SOFI shares have already broken past the average price target of $21.53. However, Mizuho raised its price target from $26 to a Street-high $31, reflecting a 15% potential gain from current levels.