Over the past few years, video streaming has evolved from a simple form of entertainment into the digital heartbeat of modern life. As billions have flocked online, finding the right content has mattered just as much as creating it. Platforms rise and fall based on their ability to connect audiences with stories that resonate with them. Amid the streaming revolution, Rumble (RUM) has built its own corner of the internet as a haven for independent creators and less algorithmic control. But even disruptors face the same hurdle — helping users sift through endless noise to find what truly clicks.

Rumble just made a move to that end, teaming up with Perplexity, an artificial intelligence (AI) answer engine making waves in tech circles. It is more than a deal — it is Rumble rebuilding its search engine. Perplexity’s AI tools will soon power content discovery across the platform, cutting through digital noise to deliver precision-matched videos. The partnership also packs a dual punch via a bundled subscription pairing Rumble Premium with Perplexity Pro, as well as a marketing push for Perplexity’s new Comet AI browser.

Markets loved the news, sending RUM stock up nearly 16% on Oct. 3, hitting near overbought levels with soaring volume. Still, while momentum is hot and sentiment is bullish, is this AI-driven breakout a gateway to sustained upside? Or is it a cue for investors to lock in profits while RUM stock is still shining?

About Rumble Stock

Founded in 2013, Rumble has built a digital playground where creators thrive. The company empowers content makers with tools, monetization, and audience reach via its video and livestreaming hub. The Rumble Streaming Marketplace and Advertising Center redefine creator revenue, while Rumble Cloud offers enterprise-grade computing and storage. Operating in the U.S., Canada, and internationally, Rumble blends innovation with accessibility, shaping the way the world shares, watches, and supports digital content. Its market capitalization currently stands at $3.2 billion.

Shares of RUM stock surged on Oct. 3, jumping by mid-teens after news of the AI partnership with Perplexity. The surge came on heavy volume — 21.35 million shares traded — signaling serious market attention. Over the past month, RUM has climbed 7%. Yet on a year-to-date (YTD) basis, the stock still lags by 40%, reminding traders that this ride has twists at every turn.

Volatility remains Rumble’s hallmark. Several moves over 5% in the past year highlight how quickly sentiment can shift. After a 52-week rally of 45%, the stock’s wild swings reflect both risk and opportunity.

Rumble Surges Despite Missing Q2 Estimates

Rumble rolled out its second-quarter earnings report on Aug. 10. The market gave a muted cheer, with RUM stock popping 3% the next day despite the firm missing projections. Rumble posted $25.1 million in revenue, up 12% year-over-year (YOY), driven by a mix of Audience Monetization gains and stronger Other Initiatives revenue. The lift in Audience Monetization came from higher subscription sales and a spike in licensing and tipping fees, offsetting a dip in advertising revenue. Meanwhile, Other Initiatives revenue grew thanks to Rumble’s expanding cloud services and increased monetization of advertising inventory across its publisher network.

On the bottom line, the story was mixed. Net loss widened to $30.2 million from $26.8 million a year ago, but loss per share actually improved slightly to $0.12 from $0.13 in the year-ago quarter. Adjusted EBITDA painted a brighter picture, improving to a $20.5 million loss from a $28.7 million loss last year — a sign the company is tightening the screws on operational efficiency.

Engagement metrics told another chapter of the tale. Monthly active users (MAUs) hit 51 million, marking the eighth-straight quarter above 50 million, although the figure was down from 59 million in Q1 2025. Management attributed the slowdown to the natural ebb and flow of news and political commentary outside of a U.S. election cycle. Meanwhile, average revenue per user (ARPU) jumped 24% sequentially to $0.42, fueled by higher subscription and licensing revenue.

Rumble exited the quarter with $283.8 million in cash and cash equivalents as well as $22.6 million in Bitcoin (BTCUSD) holdings.

Looking ahead, the horizon is cautiously optimistic. Rumble Wallet, which is set to launch in Q3, is expected to drive growth via crypto tipping. Interest in Rumble's cloud business is also rising, with proposal requests from governments and corporate clients hinting at future opportunities.

Analysts tracking Rumble see the tide turning. They anticipate losses to shrink 58% YOY to a $0.39 per-share loss in 2025, then drop another 51% annually in fiscal 2026 to a loss per share of $0.19. The red ink is finally fading, and while challenges remain, Rumble’s mix of subscriptions, AI-driven engagements, and cloud ambitions suggests that this underdog is plotting a path toward profitability.

Rumble-Perplexity Deal to Fuse Video Discovery With AI Precision

Rumble’s latest partnership with Perplexity, the fast-rising AI answer engine, aims to supercharge how users discover videos and creators find their audiences. The news marks a strategic leap for Rumble into the AI-driven content era. The collaboration centers on integrating Perplexity’s advanced search and discovery tools directly into the platform, a move to enhance user engagement and tackle one of digital media’s toughest challenges: Relevance.

Beyond the tech integration, the deal introduces a bundled subscription pairing Rumble Premium with Perplexity Pro, offering users a dual ecosystem of video and AI-powered search. Perplexity will also promote its upcoming AI browser, Comet, across Rumble’s audience, leveraging the platform’s user base.

For Rumble, the tie-up is not just about innovation — it's a play to sharpen its algorithmic edge and deepen monetization opportunities, while positioning itself firmly at the intersection of AI and video discovery.

What Do Analysts Expect for RUM Stock?

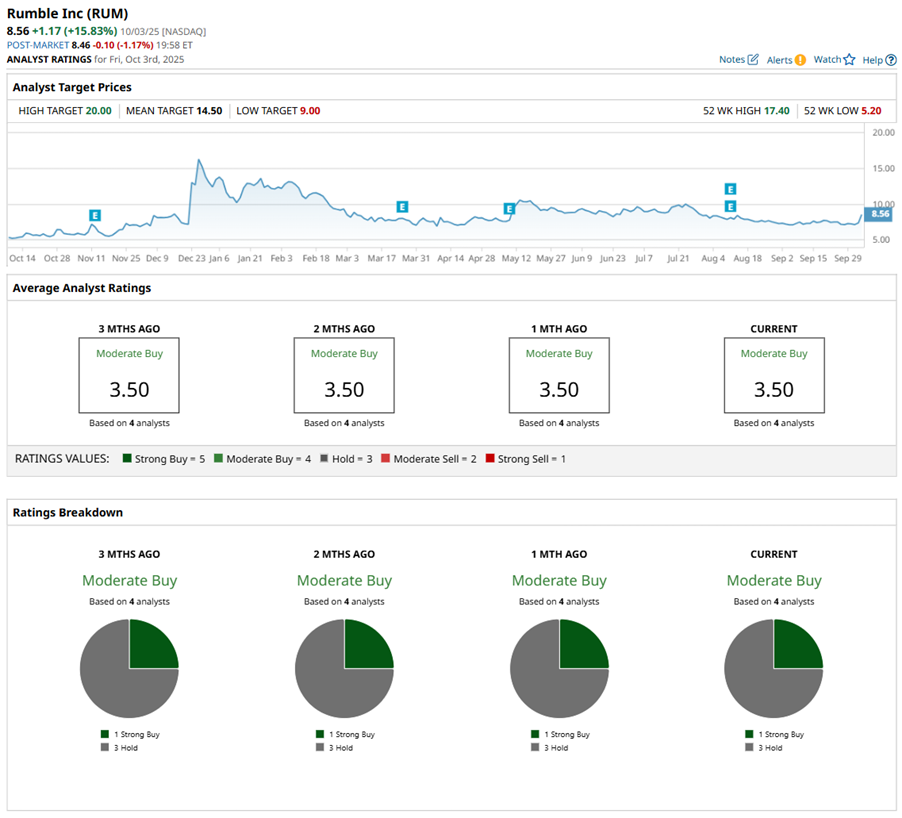

Wall Street’s take on this video-sharing platform feels like a mix of excitement and restraint. Analysts see potential, but they are not going all-in just yet. RUM stock sits at a "Moderate Buy" consensus rating. Of the four analysts with coverage, one calls it a “Strong Buy” while the remaining three remain cautious with a “Hold" rating.

The average analyst price target of $14.50 suggests that RUM stock could rebound by 85% from current levels. Meanwhile, the Street-high target of $20 implies potential upside of 155% from here.

Final Note on RUM Stock

The Rumble-Perplexity AI deal could be the catalyst that finally sharpens Rumble's edge in the creator economy. By fusing Perplexity’s search intelligence with Rumble’s content ecosystem, the platform stands to boost both engagement and monetization. Smarter discovery means stickier users, and stickier users mean stronger top and bottom lines. If the integration hits its stride, this deal could redefine how audiences find and creators grow on Rumble, setting it apart from algorithm-heavy rivals.

But RUM stock is already rising impressively, volume is exploding, and technicals are running hot. Traders are zeroing in on news flow and momentum spikes, watching whether RUM stock can hold its AI-fueled gains or if the froth will trigger short-term profit-taking. For now, the move in RUM stock looks promising, but timing your shot may matter just as much as believing in the story.