/The%20logo%20for%20Kodiak%20Robotics%20displayed%20on%20a%20phone%20screen%20by%20T_%20Schneider%20via%20Shutterstock.jpg)

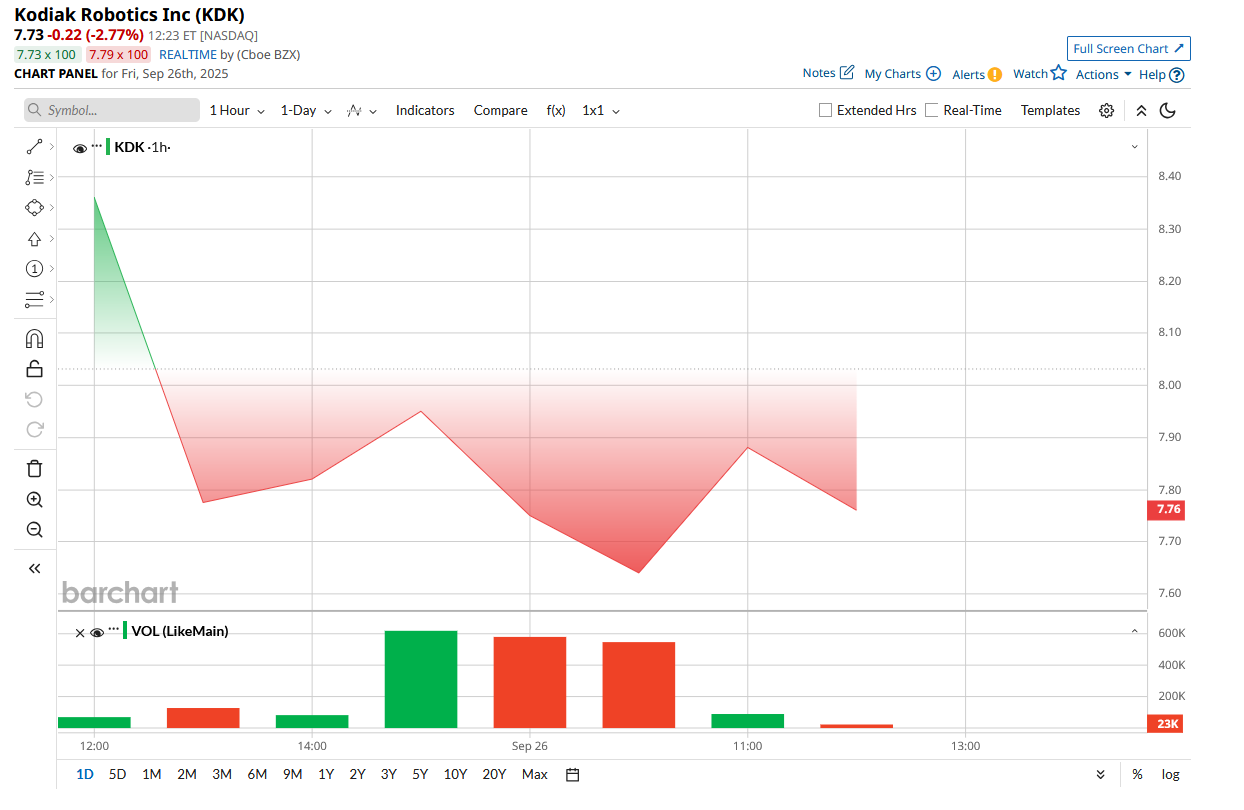

As the market for IPOs remains as hot as ever, the latest one to debut on the exchanges is Kodiak Robotics (KDK), or Kodiak AI, as it will be known after its new rebranding. Kodiak's market debut is brought about following a merger with SPAC Ares Acquisition Corp. II, a special purpose acquisition company (SPAC) sponsored by a subsidiary of Ares Management Corporation (ARES), a large global alternative investment manager.

Kodiak secured over $212.5 million from institutional investors through its merger with Ares Acquisition Corp. II, consisting of approximately $145 million in PIPE financing and about $62.9 million in cash from AACT’s trust account before expenses. The company plans to deploy the proceeds to scale its driverless fleet and increase investment in research and development to advance its autonomous driving technology.

Now, as an investment proposition, what Kodiak offers is indeed unique, as there has been considerable chatter about autonomous vehicles around personal mobility. However, for commercial vehicles like trucks, the scope for autonomous vehicles is less spoken about, and hence the avenues for public investments are also rare.

About Kodiak AI

Founded in 2018, Kodiak AI develops autonomous driving technology for long-haul trucking and freight logistics. It builds the software, sensing, and integration systems necessary to retrofit existing trucks (or work with partners) to drive autonomously on highways, coupled with a business model that includes Driver-as-a-Service (DaaS) or subscription/licensing fees.

Kodiak is operating in a growing market, with various credible reports supporting the fact. While this report pegs the market to reach $7.42 billion by 2034, globally, it is forecasted that the market will reach a value of $185.4 billion by 2035. The Ares Acquisition Corp. II estimate, meanwhile, sounds supremely bullish, expecting the market to reach $4 trillion.

But can Kodiak be a key player in this market? Well, Kodiak stands out in the autonomous trucking space with a business model that is already producing revenue. The company currently has autonomous trucks operating on real-world routes, hauling proppant and other materials for Atlas Energy Solutions (AESI). Although these vehicles presently run on a tightly managed corridor, Kodiak has a fleet of four trucks transporting frac sand to well sites in the Permian Basin under an agreement that envisions scaling up to 100 trucks.

To date, Kodiak’s trucks have logged more than 2.6 million autonomous miles, spanning a network of over 20,000 miles, and have completed more than 750 hours of paid driverless operations—underscoring the company’s operational maturity.

On a broader level, the company is well-positioned to benefit from the acute driver shortage in both the U.S. and Europe. CEO Don Burnette has outlined a path to deploying 1,000 trucks, which could translate into at least $150 million in annual revenue.

That said, the path forward won’t be without obstacles. Autonomous trucking remains a crowded field with well-capitalized competitors, some of which have already exited under pressure—TuSimple, for instance, wound down its U.S. operations in late 2023 and now trades as penny stock CreateAI Holdings (TSPH). Meanwhile, firms such as Applied Intuition have raised $600 million at a $15 billion valuation, and Einride secured $110 million, illustrating the depth of funding available to rivals.

Adding to the challenge, SPAC transactions have been a mixed bag for investors, with almost all the mergers losing value since their 2020 boom.

Final Take

More insights could have been drawn about Kodiak if its financials were available. However, since it was a private company before the SPAC merger, such financial details are not yet public, thus leading to a significant gap in the available data on the company's current fiscal position.

Notwithstanding that, Kodiak is operating in a rapidly growing market. Although the size it will reach is up for debate, what cannot be disputed is the growth potential. Further, Kodiak has substantial and proven operational heft in the space as well.

Thus, investors can dabble in KDK stock, but it is highly recommended to wait for at least one (if not more) round of quarterly results to get a better picture of the company.