/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

Palantir (PLTR) recently announced that it is partnering with weather-intelligence pioneer Tomorrow.io to turn global atmospheric data into a machine-readable, decision-making engine for defense departments, airlines, supply-chain giants, and federal agencies.

At first glance, linking a company once known for tracking militants to something as prosaic as cloud cover feels almost whimsical. But keep in mind that weather data is increasingly important for satellite and drone-based surveillance, as well as drone strike missions. It’s also another customer win for Palantir, which is trying to spread its tentacles over as many government agencies and commercial enterprises as possible.

The U.S. tallied $183 billion in weather-related damages in 2024, so there is great incentive to leverage weather data in new ways.

Palantir’s Deal With Tomorrow.io

Most forecasters still don’t have their own constellation of small satellites purpose-built for atmospheric observation. Palantir is trying to solve not only that, but also build a proprietary AI stack that retrains itself and gives minute-by-minute forecasts.

The deal also includes onboarding Tomorrow.io on Palantir’s FedStart program. It is an accelerator that lets vendors run inside Palantir’s pre-cleared, FedRAMP-compliant cloud so they can sell to federal agencies without the typical security accreditation process. Tomorrow.io can now sell into the federal workforce, and Palantir adds another high-demand data stream to its ecosystem.

How Profitable Will This Be?

The climate impact is around $38 trillion annually globally. It’s rational to expect that Palantir could capture billions here in the long run if its weather product suite is good enough to court insurance, construction, offshore drilling, and most importantly, military-related clients. However, it remains to be seen just how significant Tomorrow.io will be for PLTR, as these are early days.

The Navy and Air Force could save a lot of money with an all-in-one AI weather platform. Most would be surprised to know that the Air Force has multiple weather squadrons. The USAF and USN are unlikely to disregard a product if it gives them a greater advantage.

Is PLTR Stock a Buy on the Weather Deal?

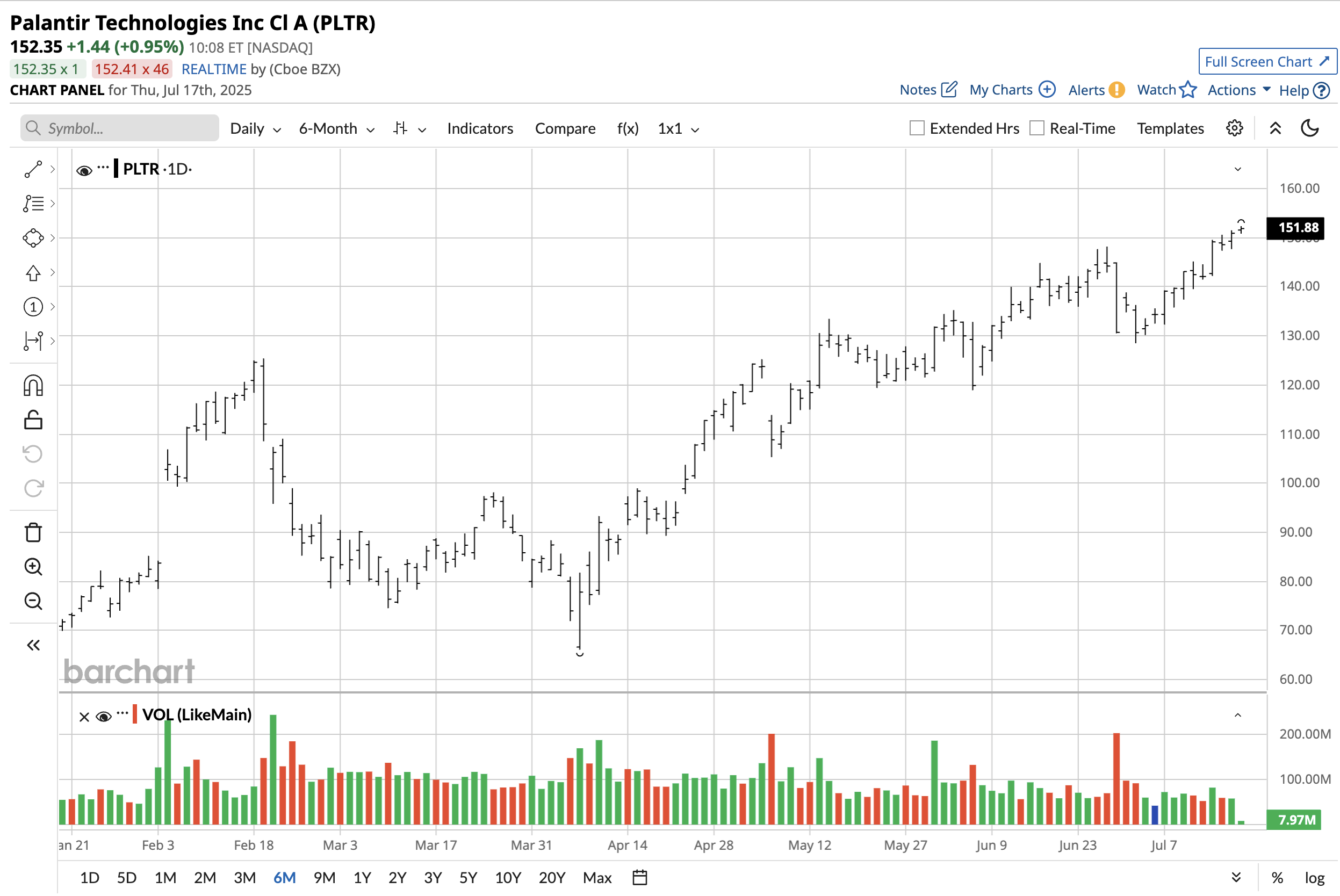

This weather deal alone won’t lead to a paradigm shift when valuing Palantir, but the relentless execution from management to win more business needs to be considered. Palantir’s growth has been off the charts, and the company is consistently beating and raising every quarter.

Wall Street no longer cares about the price-earnings ratio here. Instead, most analysts are looking at the horizon and the cash flow. It’s a good idea to start doing the same so as not to fall behind.

The Verdict

Here’s how I see PLTR stock now.

Palantir’s trailing 12-month free cash flow margin is at 42.3%, better than 97.19% of companies in the software industry. It has given free cash flow guidance between $1.6 billion and $1.8 billion on $3.89 billion to $3.9 billion in revenue for 2025. In all likelihood, this is a lowball guidance due to Palantir’s tendency to beat.

But if we take that $1.8 billion FCF figure, you’re paying 199 times forward FCF. Analysts expect the FCF margin to hold around 40% in the years ahead.

Now, if we look a year ahead, analysts see $5 billion in full-year 2026 revenue. Again, it’s likely to be higher if we take the current momentum into account. Regardless, I expect FCF to be around $2.2 billion in 2025 if we take the higher band of revenue estimates.

That’s 162 times 2026 earnings. And so on for the years ahead…

If Wall Street holds the current FCF multiple, PLTR stock could shoot well past $200 next year.

However, I’d still give it a “Hold” rating due to the downside risk once the market cycle turns. That could happen well before 2026 rolls around.

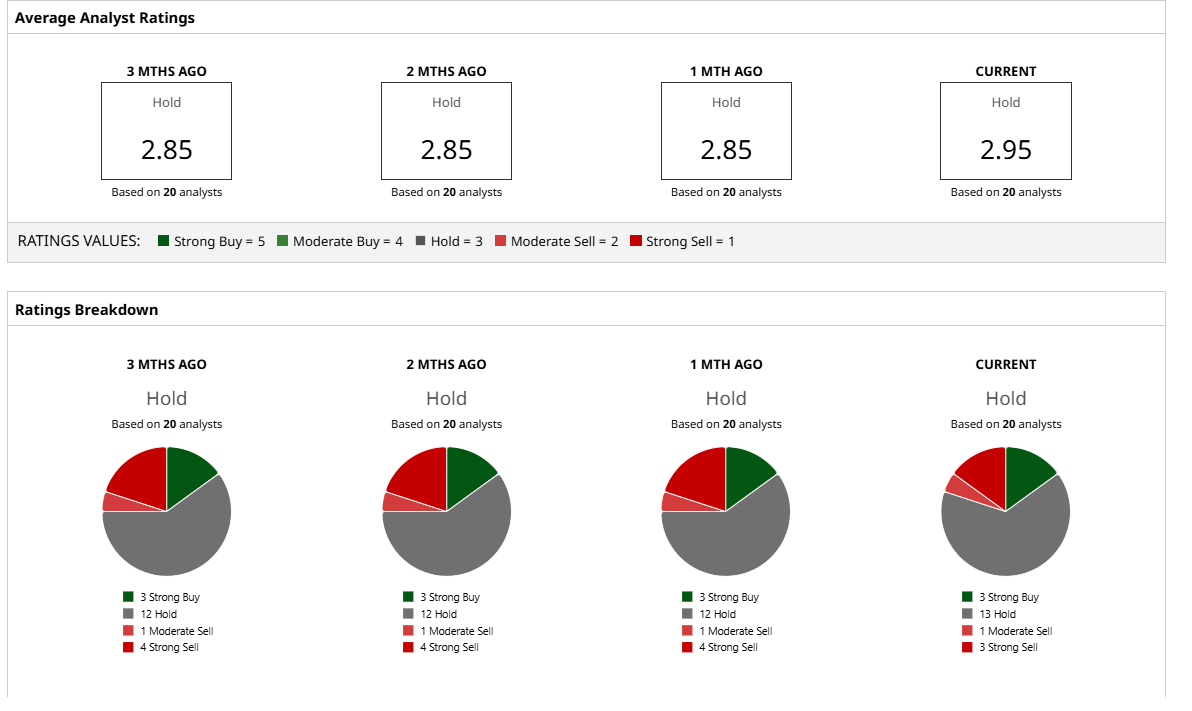

Analysts agree and have a consensus “Hold” estimate on shares.