Opendoor Technologies' (OPEN) C-suite has been looking more like a revolving door lately. First came the shake-up at the top, with Kaz Nejatian stepping in as CEO, a move that sent OPEN stock soaring more than 70% and signaled a bold attempt to stabilize the company in a shaky housing market. Then came Friday’s twist. CFO Selim Freiha exited, with Opendoor shares dipping. Meanwhile, one of the company's chairman openly suggested that the iBuyer is “bloated,” hinting at steep workforce cuts ahead.

Into this storm walks Christy Schwartz. The dip reflected immediate investor unease — leadership turnover at such a critical role can often stir doubts about stability, especially in a sector as volatile as real estate. But Schwartz is not new to the post. Having previously served as interim CFO, she brings familiarity with Opendoor’s financial framework, which could be a stabilizing factor. Her return is more than a placeholder — it’s a bid for continuity and steady hands as Opendoor pushes its artificial intelligence (AI) powered tools like RiskAI and Repair Co-Pilot.

With Schwartz in finance, Nejatian steering the ship, and co-founders back on deck, leadership has lit a spark of investor optimism. But after a stellar surge over the past couple of months, should investors buy OPEN stock now? Or has Friday’s stumble signaled caution?

About Opendoor Stock

Founded in 2014 and based in San Francisco, Opendoor set out to transform the housing market. By pioneering iBuying, it eliminated the frictions of traditional real estate — agents, delays, and endless paperwork — replacing them with instant offers and digital convenience. Over the years, it has expanded nationwide, serving tens of thousands of sellers and buyers. Going public through a special purpose acquisition company (SPAC) merger in 2020, Opendoor today boasts a market capitalization of $5.2 billion.

Not long ago, OPEN stock was on the brink, trading under $1 for over 30 days and staring down a Nasdaq delisting warning. The company scrambled with a reverse stock split proposal in June, but the real spark came later. A meme-stock frenzy, insider buying, and hedge fund chatter, including Eric Jackson’s bullish voice, flipped sentiment almost overnight.

From a June low of $0.51, OPEN has rocketed more than 20 times, briefly hitting $10.87 on Sept. 17 — its three-year high — and marking a 414% year-to-date (YTD) gain. Investors are rallying around OPEN stock as the company shakes up leadership, reinstates its founders on the board, and charts a bold turnaround plan.

Over the past three months, the stock has skyrocketed nearly 1400%, fueled by hopes of lower interest rates and whispers of short squeezes.

Technically, the stock is showing pronounced strength. OPEN trades well above its 50-day moving average, and the 14-day RSI sits at 67.3, signaling robust bullish momentum while edging toward overbought levels.

Despite the rally, Opendoor still seems to be hiding in plain sight. The stock trades at just 1.2 times forward sales, a fraction of the sector average. On paper, that discount makes OPEN look like a bargain — the kind of setup bulls love to chase.

But valuation cuts both ways. The gap also reflects a market that has not fully bought into Opendoor’s comeback story. After years of unsteady profits and shaky housing cycles, investors remain cautious, rewarding the company with momentum but not yet with trust.

Opendoor’s Q2 Earnings Snapshot

On Aug. 5, Opendoor released its second-quarter earnings report, and it was another reminder that iBuying is still a tough game to win. At first glance, the numbers showed progress. Revenue came in at $1.6 billion, up 4% year-over-year (YOY) and slightly ahead of Wall Street’s expectations. The bulk still came from home sales and related services, proving that Opendoor can still move serious volume in a cooling housing market.

The digital real estate player sold 4,299 homes in the quarter, up modestly from 4,078 a year ago. But purchases — the lifeblood of future sales — collapsed to 1,757 from nearly 4,800 in the prior year. That sharp drop pulled inventories down to 4,538 homes versus 6,399 in 2024. Fewer acquisitions and shrinking stock hint at a demand slowdown, troubling at a time when expected rate cuts should be making real estate more affordable.

Earnings also carried mixed signals. Losses narrowed to -$0.04 per share from -$0.13 last year, a clear improvement but still wider than the consensus -$0.03 estimate. Over the past five years, revenue growth has averaged just 3.03% annually, and Opendoor has yet to post a yearly profit. Still, one notable milestone is that adjusted EBITDA swung positive at $23 million. That signals operating discipline is finally paying off.

Margins, though, continue to weigh heavily. Contribution margin slipped to 4.4% from 6.3% a year ago. For a company still chasing profitability, weaker unit economics suggest Opendoor is moving fewer homes at slimmer returns, a risky mix even with revenue beating estimates.

Cash flow offered a brighter spot. In the first half of 2025, Opendoor generated $544 million from operations, a major turnaround from a $577 million outflow last year. It ended the quarter with $789 million in cash and equivalents, though short-term debt of $557 million leaves only a modest cushion.

But clouds linger. Outgoing CEO Carrie Wheeler acknowledged in the shareholder letter that housing activity weakened as the quarter wore on. Guidance confirmed the caution: Q3 revenue is expected between $800 million and $875 million, with adjusted EBITDA projected back into the red at a loss of $28 million to $21 million.

The pivot toward a leaner, asset-light model is underway. But until it gains traction, compressed resale margins and volatile demand could keep Opendoor’s story in choppy waters.

Analysts see Opendoor edging toward firmer ground. They anticipate fiscal 2025 losses to narrow 41.5% YOY to -$0.31 per share, with another 29% improvement foreseen in fiscal 2026 to $0.22 per share. It is not a profit story yet, but the trend suggests a slow and steady crawl toward financial stability.

What Do Analysts Expect for OPEN Stock?

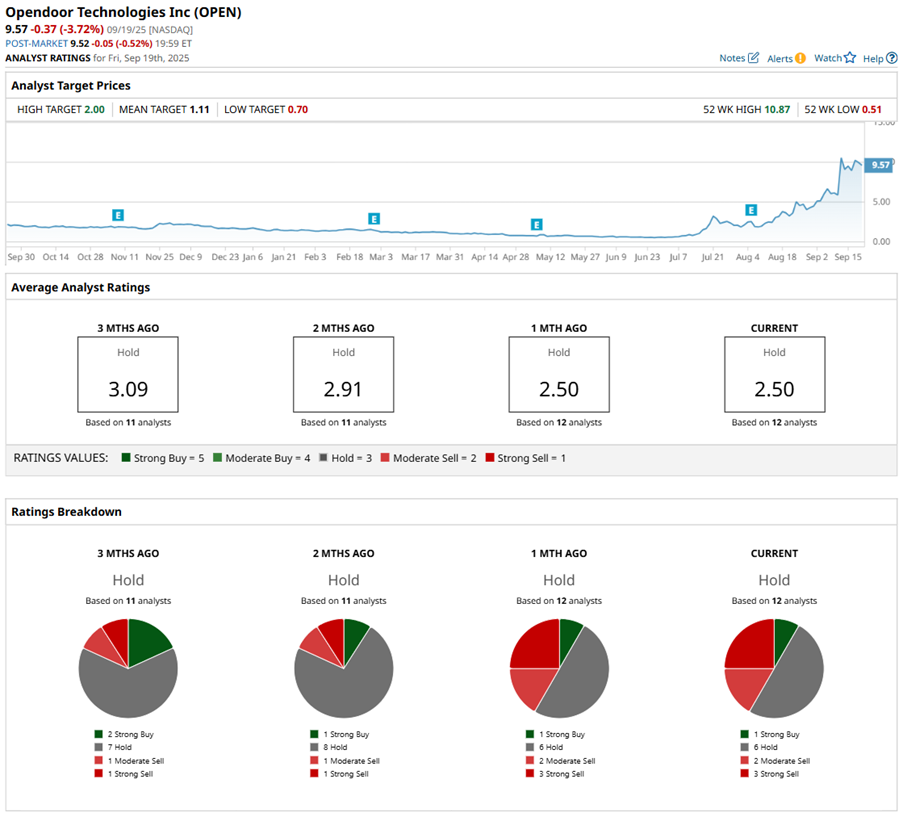

Wall Street’s stance on OPEN stock is cautious, and the ratings make that clear. Overall, OPEN stock has a consensus “Hold” rating. Of the 12 analysts offering recommendations, one analyst has a “Strong Buy,” six play it safe with a “Hold” rating, two advise a “Moderate Sell,” and the remaining three are outright skeptical with a “Strong Sell" rating.

Yet, the stock market seems to be telling a very different story. OPEN has already raced past its $1.11 average price target and is now trading at more than four times the Street’s highest target of $2. At this point, it feels like it's less about spreadsheets and more about momentum, memes, and market defiance.