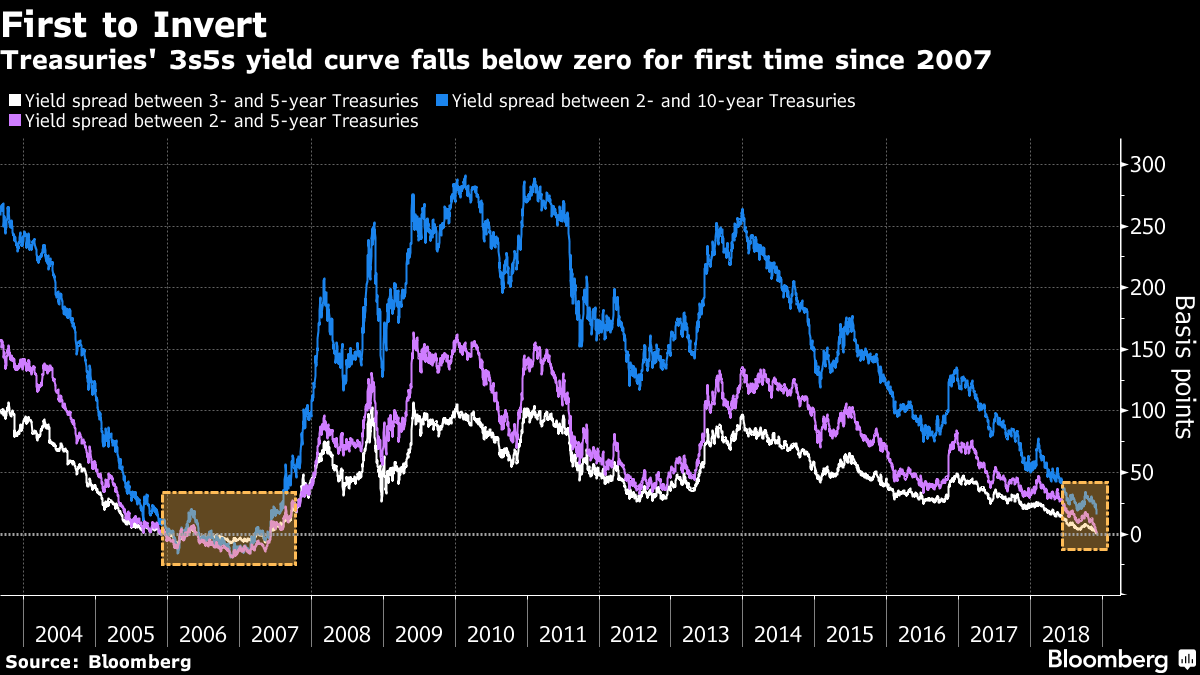

One section of the U.S. Treasuries yield curve just inverted for the first time in more than a decade. The spread between three- and five-year Treasury yields fell below zero on Monday, in what could be the first signal that the market is putting the Federal Reserve on notice that the end of its tightening cycle is approaching. The spread between two- and five-year rates is still on the cusp of inversion, while the 2s10s spread -- arguably the most closely watched section of the curve -- dipped below 16 basis points, the flattest since 2007.

To contact the reporters on this story: Sophie Caronello in Washington at scaronello@bloomberg.net;Katherine Greifeld in New York at kgreifeld@bloomberg.net

To contact the editors responsible for this story: Sophie Caronello at scaronello@bloomberg.net, Mark Tannenbaum

©2018 Bloomberg L.P.