/Netflix%20open%20on%20tablet%20by%20rswebsols%20via%20Pixabay.jpg)

After a powerful run that saw Netflix (NFLX) stock outpace the broader market, shares of the streaming giant are losing steam. NFLX stock has slipped 17.6% from its recent peak of $1,341.15, and more than 12% since it posted third-quarter results on Oct. 21.

In its latest quarter, Netflix continued to show impressive revenue growth, maintaining its double-digit pace. However, the bottom line was lower than expected. The company reported earnings of $5.87 per share, falling short of Wall Street’s $6.89 estimate and its own guidance of $6.87. The earnings miss was largely attributed to unexpected expenses tied to a tax dispute in Brazil. The increased costs related to the tax dispute squeezed Netflix’s operating margin, taking a noticeable bite out of its profits.

Beyond the one-time tax issue, valuation concerns are weighing on investor sentiment. Netflix has long traded at a premium to its peers, thanks to its dominant market position in streaming and robust subscriber growth. However, its high valuation left little room for error. Thus, investors reacted swiftly to its earnings miss, and NFLX stock closed over 10% lower following its Q3 earnings release.

However, with Netflix continuing to grow its membership base and expanding its ad-supported offering, is the current weakness a buying opportunity?

Netflix Poised to Deliver Solid Growth

Netflix is poised to deliver solid growth in the quarters ahead. The streaming giant’s revenue climbed 17.2% year-over-year in the third quarter, driven by rising memberships, price increases, and growing ad revenue. With engagement on the platform remaining robust, particularly in key markets like the U.S. and the U.K., this top-line strength will likely continue in the quarters ahead.

Content remains Netflix’s most powerful growth engine, and the upcoming fourth quarter promises to keep viewers hooked. The lineup features major releases such as the final season of Stranger Things, new installments of The Diplomat and Nobody Wants This, and Guillermo del Toro’s highly anticipated Frankenstein. Adding to the excitement are high-profile live events like the NFL’s Christmas Day games and the Jake Paul vs. Tank Davis boxing match. Such a strong content base is expected to boost engagement and attract new subscribers.

What continues to set Netflix apart is its ability to blend a diverse catalog of series, films, and even games to sustain engagement, support premium pricing, and minimize churn. The strong content has also paved the way for Netflix’s growing advertising business, which has rapidly scaled in recent years. Its business has gained considerable scale across all markets where it has been introduced, providing a solid base for future monetization. The company is expanding its ad sales and operations teams and has rolled out its own proprietary ad tech platform, the Netflix Ads Suite, to better serve advertisers and enhance user experience.

Management remains upbeat about the trajectory of this business, forecasting that ad revenue will more than double in 2025, albeit from a modest starting point. The momentum remains solid in the U.S. and with the Ads Suite now fully operational across all ad markets for a complete quarter, Netflix is unlocking new innovation opportunities, including advanced targeting and partnerships with major demand sources.

Overall, Netflix’s premium content and a growing ad business position it well to deliver strong growth.

Netflix Stock: Buy, Sell, or Hold?

Netflix’s top and bottom lines will likely sustain double-digit growth led by a solid content slate, growing member base, and higher ad revenue. This implies that NFLX stock is not a “Sell.” However, Netflix stock trades at a forward earnings multiple of 43x, which is a significant premium to its peers. While analysts project the company to deliver earnings growth of 26% in 2026, the forward P/E multiple suggests that much of the market’s optimism about growth is already baked into the stock.

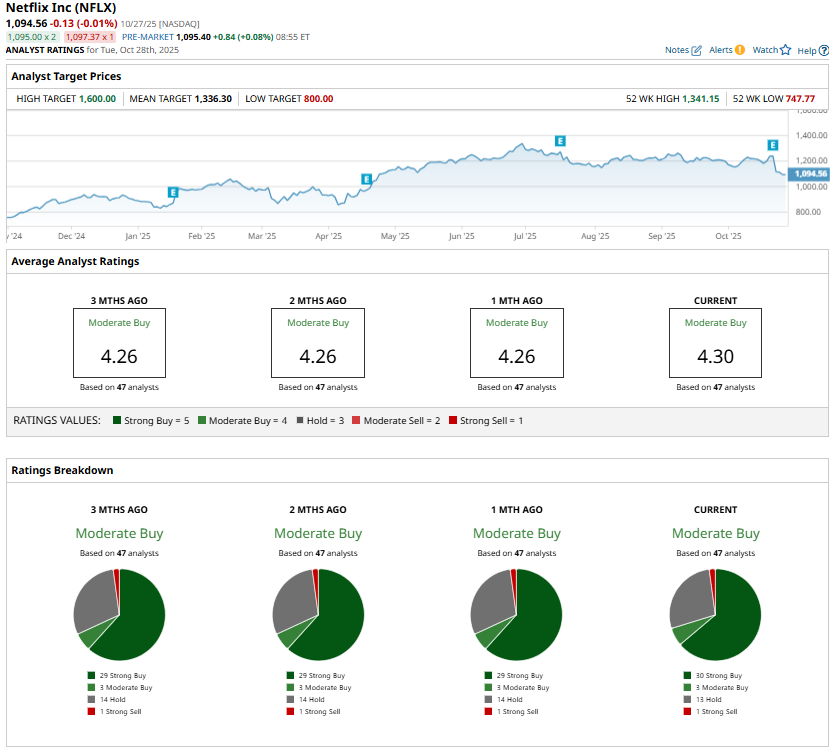

Moreover, Wall Street analysts maintain a “Moderate Buy” consensus rating on NFLX stock due to valuation concerns. In short, Netflix looks like a solid “Hold” for existing shareholders, but new investors may want to wait for a more attractive entry point.