/Morgan%20Stanley%20logo%20and%20money-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Once written off as a fad, cryptocurrencies have morphed into a trillion-dollar market, luring Wall Street’s biggest names. Bitcoin (BTCUSD) alone commands over $2.2 trillion, and Ethereum (ETHUSD) adds another $500 billion. With regulators easing and retail demand surging, crypto has gone mainstream. Wall Street, once skeptical, is now racing to capture this fast-growing pie, with asset managers and brokerages alike viewing crypto adoption not as optional, but as strategic.

Morgan Stanley (MS), a global investment banking and wealth management giant with more than $7 trillion in client assets, is the latest heavyweight to join the chase. Known for serving institutions, corporations, and high-net-worth individuals, the firm is now widening its reach. Starting in early 2026, its E*Trade platform will allow trading in Bitcoin, Ethereum, and Solana (SOLUSD) through a partnership with Zerohash — an infrastructure provider for digital assets — giving its massive client base direct access to digital assets.

This move thrusts Morgan Stanley into direct competition with Robinhood’s (HOOD) expansive crypto menu and Charles Schwab’s (SCHW) Bitcoin- and Ethereum exchange-traded funds (ETFs). But with the field getting crowded, is MS stock a buy now? Or is it better left on the sidelines?

About Morgan Stanley Stock

Morgan Stanley, founded in 1935, has grown into one of Wall Street’s most respected names. Headquartered in New York and valued at a market capitalization of $255 billion, the banking firm serves everyone from global corporations to individual investors. Its footprint spans investment banking, wealth management, and investment management, making it a one-stop powerhouse for financial solutions.

What sets Morgan Stanley apart is its disciplined approach to risk and its ability to ride market cycles with resilience. Diversified revenue streams and a strong brand reputation have made it a go-to for clients seeking stability and expertise. Over nearly a century, the firm has balanced ambition with prudence, blending innovation with trust — a combination that keeps it relevant in an ever-evolving financial landscape.

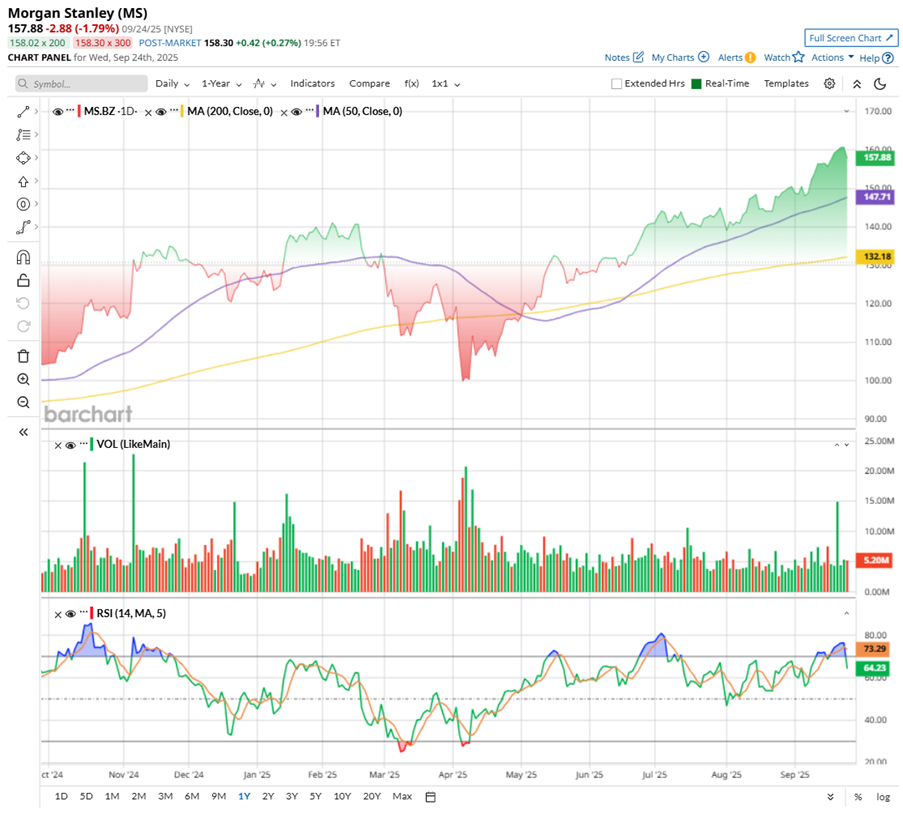

Shares of the investment banking giant have been on a tear, up 54% over the past 52 weeks and 39% over the past six months. MS stock hit a fresh all-time high of $163.93 on Sept. 23, fueled by excitement over its E*Trade crypto initiatives.

The technicals tell a bullish story, too — the 50-day moving average (MA) remains well above the 200-day MA, confirming a golden cross and strong upward momentum. Trading volume confirms healthy demand, although the 14-day RSI had spiked above 75, hinting at short-term overbought conditions, which signaled that a near-term cooling could follow MS's powerful rally. That warning played out, with the RSI cooling to 65 and MS stock pulling back slightly from its recent highs. Even with that minor retracement, Morgan Stanley remains in breakout territory, and the technicals suggest the bulls are still firmly in charge.

MS stock's rally has been nothing short of stellar, but the price tag raises eyebrows. Priced at 17.9 times forward earnings, the stock looks pricey against sector and historical averages. Yet, peek at the price-to-sales (P/S) ratio of 2.37 times and MS is the bargain hero, trading below sector and historical averages, offering a rare mix of momentum and relative value.

Morgan Stanley knows how to treat its shareholders right. The firm has paid dividends for 27 consecutive years, with 11 years of growth underscoring its reliability. The quarterly dividend was most recently increased 8% to $1.00, paid to shareholders back in August.

This brings the annual payout to $4 per share, translating to a forward yield of 2.52%, handily beating both the S&P 500 Financials Sector SPDR's (XLF) 1.36% yield and the S&P 500 SPDR's (SPY) 1.36% yield. Plus, with a payout ratio of about 40%, Morgan Stanley maintains a disciplined approach, delivering attractive income while preserving capital for future expansion.

A Closer Look At Morgan Stanley’s Q2 Results

Morgan Stanley’s second-quarter 2025 earnings results, released on July 16, showcased resilience. The bank generated net revenues of $16.8 billion, a 11.8% year-over-year (YOY) jump and well ahead of expectations. EPS amounted to $2.13, beating consensus estimates and last year’s $1.82 per-share profit.

What fueled the beat was trading. Equity trading soared 23% annually to $3.7 billion, while fixed income net revenues rose 9% annually, hitting $2.2 billion. The volatility around tariffs played right into Morgan Stanley’s wheelhouse.

Beyond the trading desk, Wealth Management demonstrated strength with 14% annual growth to $7.76 billion, fueled by fresh assets and rising fees. Investment Management also rose 12% to $1.55 billion, bringing client assets across wealth and investment platforms to a hefty $8.2 trillion.

But it was not all wins. Investment banking (IB) struggled, with advisory fees down 14.2% as M&A activity dried up. Fixed-income underwriting slid 21.2%, even as equity underwriting jumped 42%, leaving total IB fees down 5% YOY at $1.54 billion. Meanwhile, net interest income gained 14%, but expenses rose 10%, cutting into some of the margin shine.

On the balance sheet, the capital story stayed strong. Book value per share climbed to $61.59, with tangible book at $47.25. Tier 1 capital stood at a solid 17.6%. Shareholders also got the love. In addition to dividend increases, Morgan Stanley repurchased 8 million shares for $1 billion and announced a beefed-up $20 billion buyback plan.

All in, Morgan Stanley’s Q2 reads like a blend of trading dominance, wealth management strength, and steady capital returns, with investment banking still the drag.

Analysts tracking the investment banking giant predict its bottom line to improve this year and beyond. EPS is anticipated to grow 11.5% YOY to $8.86 in fiscal 2025, then rise by another 8.1% annually to $9.58 in fiscal 2026.

Direct Crypto Trading Marks a New Chapter for Morgan Stanley

Morgan Stanley’s leap into crypto through E*Trade marks more than just a new feature — it is a strategic reshaping of its wealth management arm. Slated for early 2026, the service will roll out spot trading in BTC, ETH, and SOL, backed by Zerohash for liquidity, custody, and settlement. This move could open access to roughly $1.3 trillion in trading volume.

But executives are clear that this is just “phase one.” A proprietary wallet is in the works, designed to let clients hold and manage digital assets directly alongside traditional portfolios.

That kind of integration is no small move for a bank generating nearly half its revenue from wealth management. By eliminating third-party managers, Morgan Stanley strengthens client stickiness, trims fees, and positions itself as a one-stop shop for both conventional and digital assets.

In an increasingly crowded space where prominent names already circle, this initiative could give Morgan Stanley the edge, pulling institutional and retail investors into its orbit and cementing its role at the crossroads of Wall Street and Web3.

What Do Analysts Expect for MS Stock?

Wells Fargo lifted its MS stock price target to $165 from $145, keeping an “Equal Weight” rating. Analysts argued that their EPS forecasts had been too conservative, and capital markets are now aligning more with their bull case. With upside surprises likely concentrated among the largest banks, Wells Fargo sees Morgan Stanley repeating its recent streak of outperformance — proof that, in this market, “Goliath is winning.”

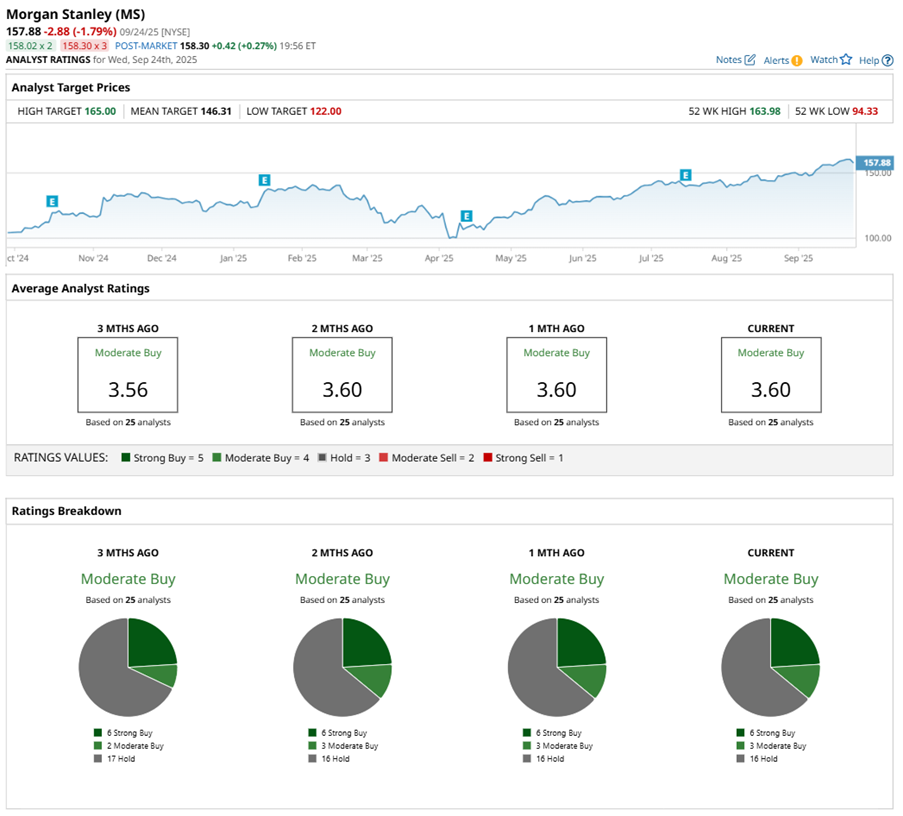

Wall Street’s view on MS stock is like a story of cautious optimism with sparks of excitement. MS stock holds a “Moderate Buy” consensus rating overall. Out of 25 analysts covering MS, six now rate it a “Strong Buy,” three call it a “Moderate Buy,” and 16 analysts play it safe with a “Hold" rating.

After climbing sharply in recent weeks, MS stock now trades above its mean price target of $146.31, signaling robust investor interest. When MS touched a new all-time high recently, it edged near Wells Fargo’s Street-high target of $165. Following its modest pullback, MS now has roughly 3% potential upside back toward that target.