/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Intel (INTC) shares are extending gains on Thursday morning following reports the chipmaker has approached Apple (AAPL) for a strategic investment.

The market is reading the news as part of INTC’s broader commitment to regain relevance in the global semiconductor industry.

Intel stock has been in a sharp uptrend ever since it secured a multibillion-dollar deal with the U.S. government. Last week, Nvidia (NVDA) threw it a $5 billion lifeline as well.

At the time of writing, INTC shares are up nearly 90% versus their August low.

Why Apple Investment May Not Be the Lifeline Intel Stock Needs

Apple’s involvement will likely prove a symbolic win for INTC stock, but it may not be the operational lifeline bulls are hoping for.

What Intel so desperately needs at the moment is a major customer for its foundry business, and there’s no indication so far that a potential deal with AAPL will include a foundry deal.

After all, Nvidia’s investment did not include that part of the company’s business either.

Even with Apple’s backing, therefore, Intel may continue to face delays in advanced node delivery; its foundry unit may remain a laggard to Taiwan Semiconductor (TSM) and Samsung.

An investment from the iPhone maker, if it materializes, will be more strategic than transformative.

In short, capital alone is hardly a fix for Intel’s core challenges. Without a clear roadmap to volume production and customer wins, the enthusiasm my fade quickly.

Where Options Pricing Suggests INTC Shares Are Headed

According to options data from Barchart, contracts with expiration date set at Dec. 19 signal Intel shares will trade within the range of $26.77 and $39.69 over the next few months.

In the near term, the expected move through the end of next week is 7.11%, with the upper price pegged at $35.59.

However, the overall sustainability of INTC gains hinges on it securing a major foundry customer. Without one, the downside is much more likely to play out.

For meaningful recovery, the semiconductor stock needs more than headlines. It needs execution, customers, and technological leadership.

Wall Street Sees Significant Downside in Intel

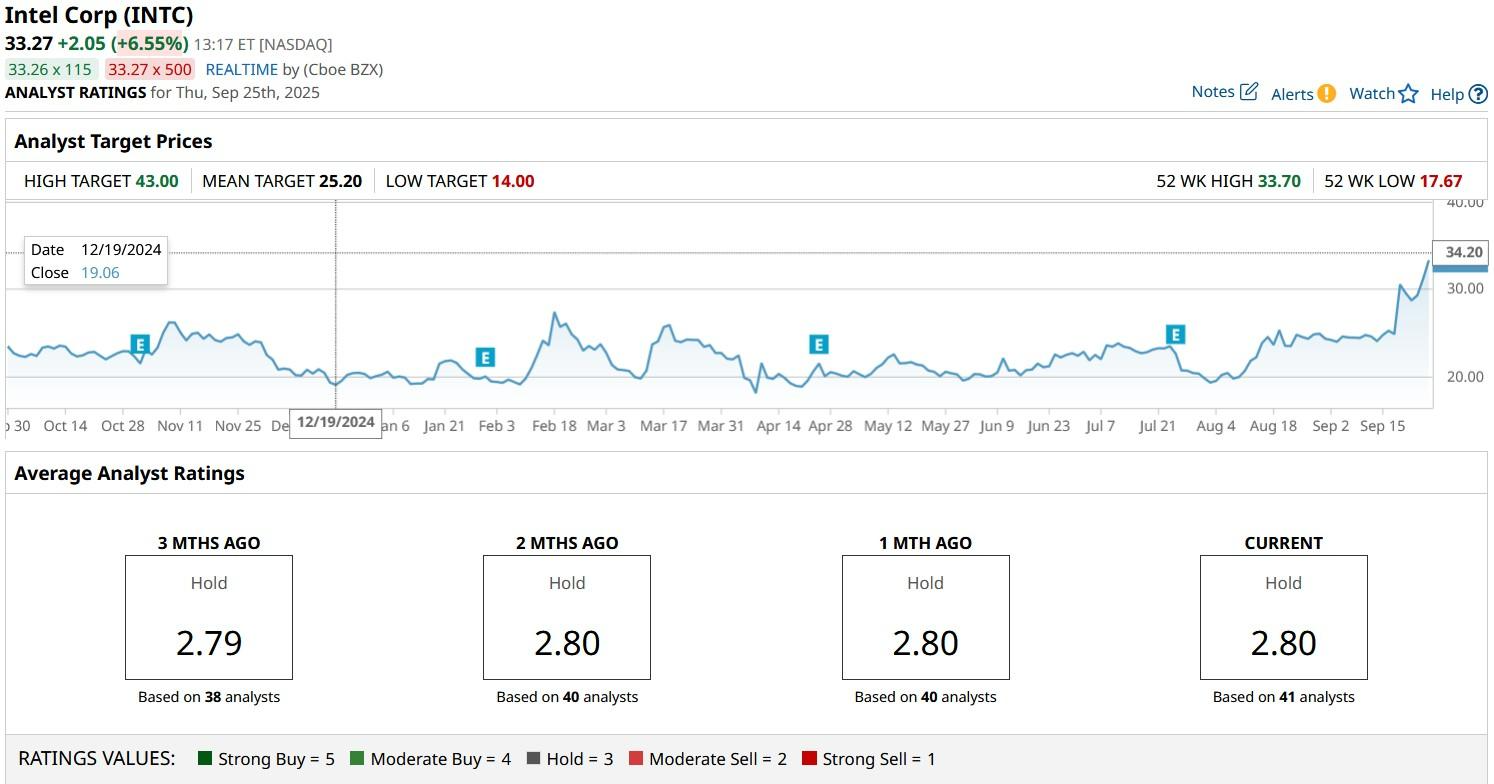

Wall Street analysts also believe the rally in Intel stock since early August is largely overdone.

The consensus rating on INTC shares remains at “Hold” only, with the mean target of roughly $25 indicating potential downside of about 25% from here.