/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

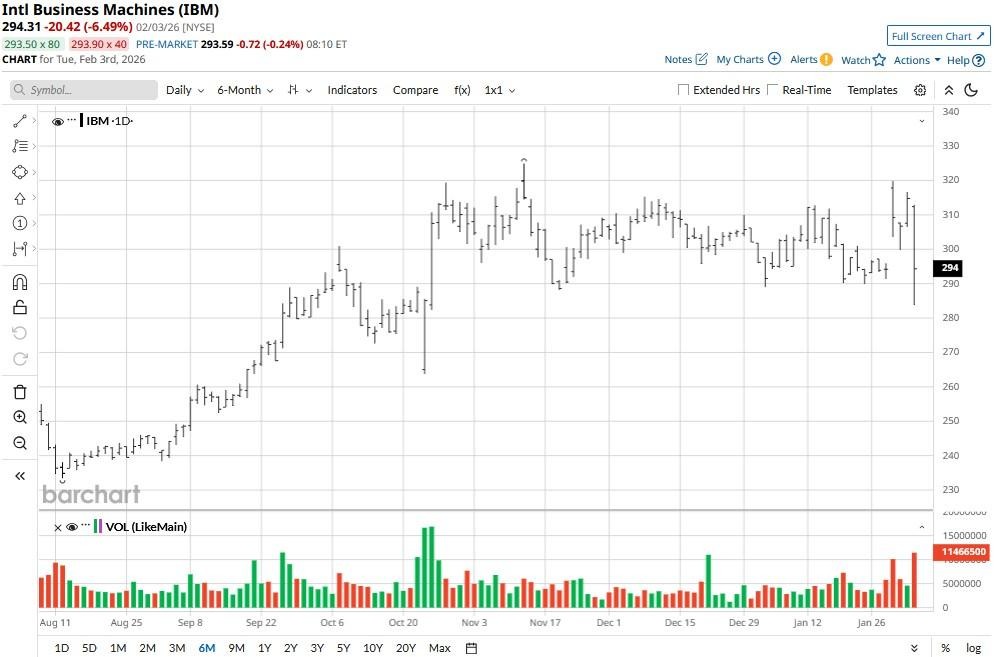

International Business Machines (IBM) shares have lost more than 6% this week after Anthropic launched new plugins for Claude Cowork, signaling it’s now moving into the application layer.

The downward pressure on IBM has pushed its price below a key support level — coinciding with its 100-day moving average (MA), signaling the bearish momentum could sustain in the near-term.

Despite the recent selloff, IBM stock remains up more than 25% versus its August low.

Why Anthropic’s Latest Offering Is Negative for IBM Stock

The Anthropic news is concerning for IBM shares given its new tools — specifically the legal, sales, and data plugins — directly automate complex workflows that IBM charges high premiums for.

If a Claude Cowork agent at about $30 per month can handle document review, NDA triage, and data analysis via a plugin, investors sure have reason to question the long-term value of traditional enterprise software licenses.

Still, famed investor Jim Cramer recommends loading up on IBM following its recent decline, as it’s a “rare AI winner with a fairly low price-to-earnings multiple.”

The tech stock is going for about 25x forward earnings at the time of writing, which makes it much “cheaper than some of the other big software-as-a-service (SaaS) companies,” Cramer said in a recent segment on CNBC.

Cramer Says IBM Shares Have a Lot More Room to Run

According to Cramer, long-term investors should buy IBM shares at current levels also because the multinational offered “a terrific full-year forecast for 2026” last week.

The Nasdaq-listed firm expects its revenue to grow by more than 5% and free cash flow to increase by a whopping $1 billion this year.

“Long story short, I’m betting IBM has a lot more room to run,” he told viewers, noting the tech firm has topped earnings expectations for 17 consecutive quarters.

Investors should also note that IBM has a history of closing both February and March in the green, a seasonal pattern that makes its stock even more exciting to own in the near-term.

Wall Street Shares Cramer’s Positive View on IBM

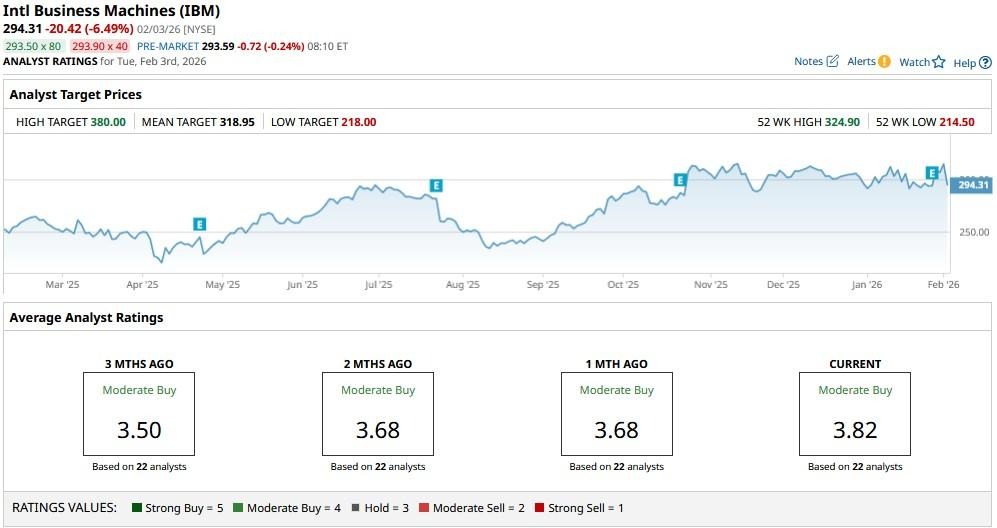

Wall Street analysts agree with Cramer’s optimism on IBM stock as well.

The consensus rating on International Business Machines remains at a “Moderate Buy,” with price targets as high as $380 indicating potential upside of some 30% from here.