GameStop (GME) shares opened about 5% higher today after the White House’s official X account reposted the retailer’s latest tweet with a meme featuring President Donald Trump as a “Halo” character.

The company’s post declared “console wars are over” referencing Microsoft’s (MSFT) decision to bring its flagship Xbox title, Halo, to Sony’s (SONY) PlayStation for the first time.

The meme-driven moment reignited retail interest in GME stock that is, nonetheless, down roughly 30% versus its year-to-date high set in the final week of May 2025.

Is Microsoft News Positive for GameStop Stock?

The Halo-on-PlayStation news is bullish for GME shares as it signals a more open gaming ecosystem.

If console exclusivity fades, GameStop will likely see broader demand for cross-compatible titles, accessories, and collectible merchandise, reinforcing its status as a one-stop-shop for video game enthusiasts.

Additionally, pre-owned game sales could revive as more titles become playable across platforms, increasing trade-in and resale activity.

In short, with MSFT embracing a more inclusive distribution model, GME stands to benefit from broader inventory appeal and renewed foot traffic especially during major game launches, which may now span multiple consoles.

Investing in GME Shares Remains a Gamble

Investors should note, however, that GameStop’s stock price surge this morning has less to do with the Halo news and more with the viral repost from the White House’s official X account.

The meme featuring President Donald Trump as a Halo character ignited social media buzz, fueling speculative buying, but meme-driven rallies are notoriously unstable.

They rely on fleeting attention rather than fundamentals, making GME shares vulnerable to sharp reversals once the hype fades. For serious investors, this kind of volatility poses real risk.

Without earnings momentum or strategic clarity, GameStop remains a sentiment play at best: more reactive to internet virality than business execution. That’s a shaky foundation for long-term owner ship.

How Wall Street Recommends Playing GameStop

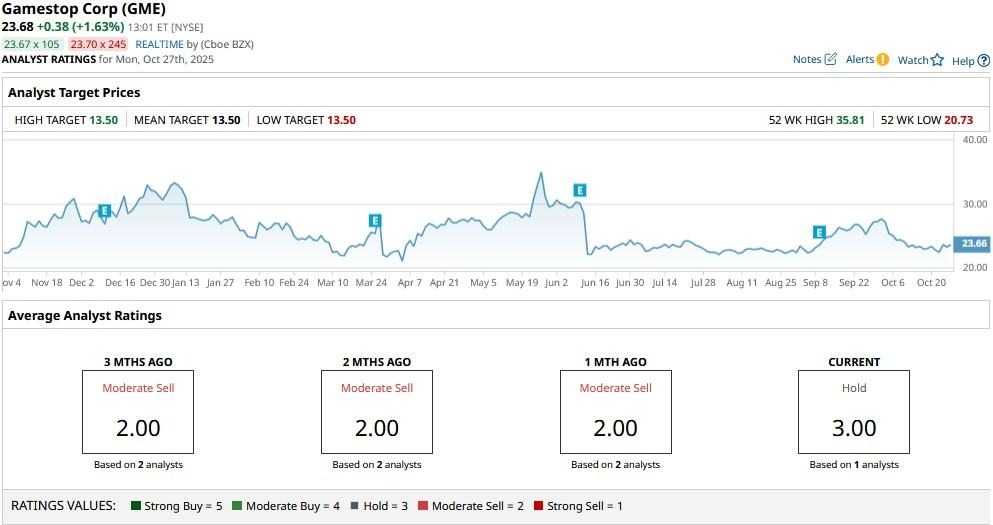

Another major red flag on GameStop shares is that they receive coverage from only one Wall Street firm.

And even that rates it at “Hold” currently with a price target of $13.50 indicating potential downside of about 45% from here.