When it comes to building cars that define speed, luxury, and sheer prestige, Ferrari (RACE) hardly needs an introduction. The Italian icon has become a symbol of automotive brilliance, with a legacy on the racetrack and a reputation for crafting some of the world’s most coveted machines. Now, Ferrari is shifting gears into a new chapter, recently pulling back the curtain on the technology powering its first-ever electric vehicle (EV) model: Elettrica.

The sneak peek — shared on Oct. 9 at Ferrari’s investor day in Maranello — wasn’t a full car reveal, but it gave the world its first look at what will eventually hit the roads in late 2026. But what should have been a proud milestone quickly turned into a bumpy ride for the company. Investors chose to punish RACE stock instead, rattled by Ferrari’s long-term financial targets, which came in below Wall Street’s hopes.

Shares tumbled in Milan by the steepest drop ever recorded, while Ferrari’s U.S.-listed shares also nosedived almost 15% on Oct. 9, marking RACE stock's worst trading day since its initial public offering (IPO) back in 2015.

So, given all these latest twists, what’s the best move for investors eyeing Ferrari stock now? Let's take a closer look.

About Ferrari Stock

Currently valued at a market capitalization of roughly $96.7 billion, Ferrari isn’t just about fast cars. It’s a brand built on exclusivity, innovation, and a deep motorsport legacy. With roots in Maranello, Italy, the company has become inseparable from Formula 1, where its Scuderia Ferrari team has claimed a record 16 Constructors’ and 15 Drivers’ Championships since the sport began in 1950.

Beyond the track, Ferrari’s influence stretches into lifestyle and design, offering everything from luxury goods to unique experiences, all carrying the same passion and prestige that define its iconic sports cars. The company’s success story also hinges on strategy. By capping annual production, Ferrari creates an air of exclusivity, driving demand and safeguarding its elite brand status.

But even with its legendary reputation, RACE stock has hit some bumps this year, pressured by a slowdown in the broader luxury market, tariff concerns, and sluggish sales in China. The company also scaled back its EV ambitions. While the automaker revealed its first electric model, the Elettrica, all-electric cars are now expected to make up only 20% of the lineup by 2030. That's a significant drop from its 2022 target of 40% — another reason why investors were disappointed.

Ferrari isn’t alone in this challenge. Luxury automaker peers like Porsche (DRPRY) and Mercedes-Benz (MBGYY) have also stumbled in the shift to electric, as high-end buyers remain hesitant to embrace plug-ins. Shares of RACE stock have dipped 6% so far this year, although they are up 5% in the past five sessions.

A Closer Look at Ferrari’s Q2 Performance

Ferrari released its fiscal 2025 second-quarter earnings report on July 31, revealing a mixed picture that sent shares tumbling 11% that day. The luxury carmaker reported net revenues of 1.79 billion euros ($2.03 billion) for the quarter, a 4.4% increase year-over-year (YOY), but came in slightly below Wall Street’s forecast of $2.15 billion. Revenue from Cars and Spare Parts reached 1.5 billion euros, up 2.3% YOY, driven by a richer product mix, a favorable country mix, and increased personalizations.

Operating profit (EBIT) rose to 552 million euros, up 8.1%, delivering a 30.9% operating margin for the quarter. Total shipment volumes remained roughly flat at 3,494 units compared to the previous year, reflecting Ferrari’s ongoing focus on preserving brand exclusivity. On an adjusted basis, EPS rose 4% YOY to 2.38 euros ($2.70), comfortably above Wall Street’s forecast of $2.57. Importantly, the quarter saw no major impact from the newly imposed tariffs on EU cars in the United States.

While reflecting on the Q2 performance, CEO Benedetto Vigna highlighted that the company continues to drive innovation and expand its product lineup, which supports a strong order book. The CEO noted the high demand for the 296 Speciale family and praised the positive market response to the newly launched Ferrari Amalfi, describing it as a “coupé that redefines the concept” of the modern grand tourer.

Ferrari Lifts the Veil on Its First EV, But Guidance Leaves Investors Cold

While the company did scale back its long-term EV ambitions, Ferrari has pulled back the curtain on the tech powering its first-ever electric car, the Elettrica. At its headquarters, the company showcased a production-ready chassis fitted with a battery pack and electric motor, though still missing wheels and the outer shell.

The final version of the car is set to deliver a top speed of 310 kilometers per hour and a range of at least 530 kilometers. To stay true to its racing DNA, Ferrari has also developed a custom sound system that amplifies real powertrain vibrations to create a unique electric Ferrari soundtrack, rather than faking engine noise.

Built with 75% recycled aluminum, the Elettrica’s chassis and body are designed with sustainability in mind. Its battery will also be seamlessly integrated into the floor, lowering the center of gravity for sharper performance. Plus, the model will come equipped with fast-charging capability. According to reports, the Elettrica is expected to start at around 500,000 euros, or roughly $580,400.

This unveiling marks a milestone in Ferrari’s cautious move into electrification, with the first battery-powered four-seat coupe set for launch in 2026. But what could have been a celebratory moment was overshadowed by concerns over the company’s outlook.

At its Capital Markets Day event, Ferrari raised its fiscal 2025 guidance slightly, stating that it expects net revenue of at least 7.1 billion euros ($8.2 billion) this year, up from a previous forecast of 7 billion euros. Adjusted EBITDA is projected at about 2.72 billion euros with margins steady at 38.3%, a touch higher than the earlier target of at least 2.68 billion euros. Meanwhile, adjusted EPS is now seen at 8.80 euros. But despite the upward revisions for the near term, the longer-term outlook fell flat.

By 2030, the company forecasts net revenue of around 9 billion euros, while adjusted EBITDA is expected to be at least 3.6 billion euros. That modest growth outlook failed to match market hopes, sending shares into a sharp slide and turning an eagerly awaited milestone into a bumpy ride.

What Do Analysts Expect for Ferrari Stock?

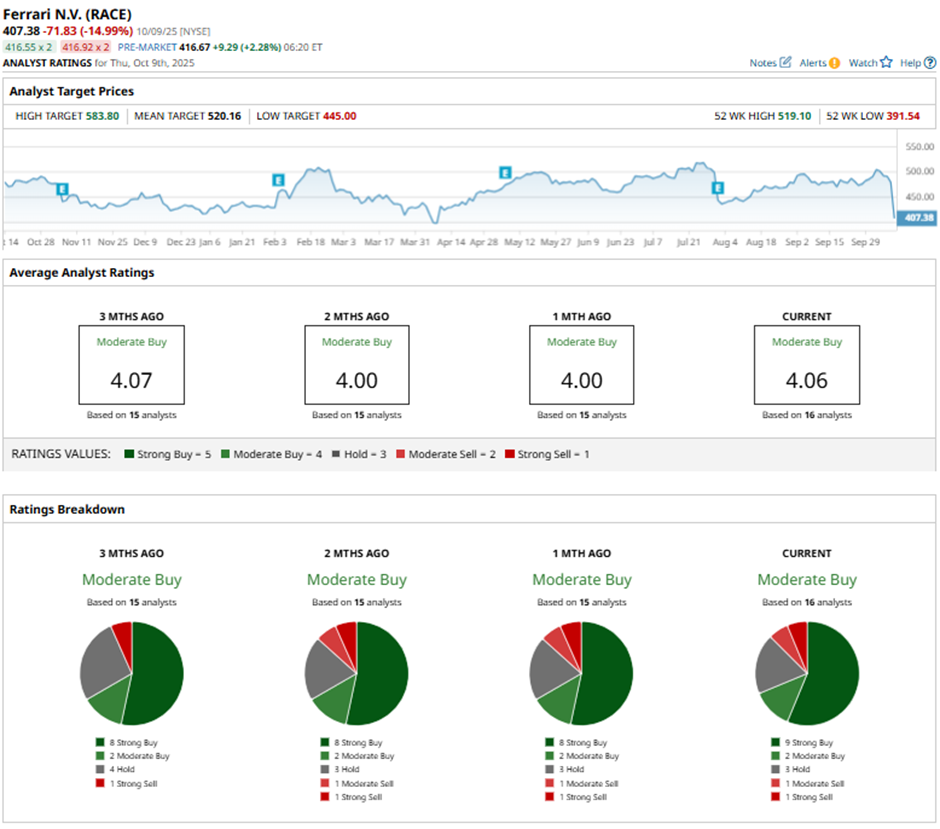

Despite the recent setback, Wall Street remains mostly optimistic on Ferrari, maintaining an overall consensus rating of “Moderate Buy.” Of the 16 analysts covering RACE stock, nine advocate for a “Strong Buy,” two recommend a “Moderate Buy,” three maintain a “Hold,” one suggests “Moderate Sell,” and the remaining one gives a “Strong Sell" rating.

The average price target of $505.64 represents potential upside of 27%. Meanwhile, the Street-high target of $570 suggests an even greater jump of 43% from current levels.