CNBC guru Jim Cramer’s reluctance to recommend Tesla (TSLA) stock despite its beaten-down valuation reflects growing investor frustration with CEO Elon Musk’s political entanglements overshadowing the company’s technological innovations. The “Mad Money” host criticized Musk’s focus on “politics instead of humanoids,” highlighting how political distractions are derailing Tesla’s core mission.

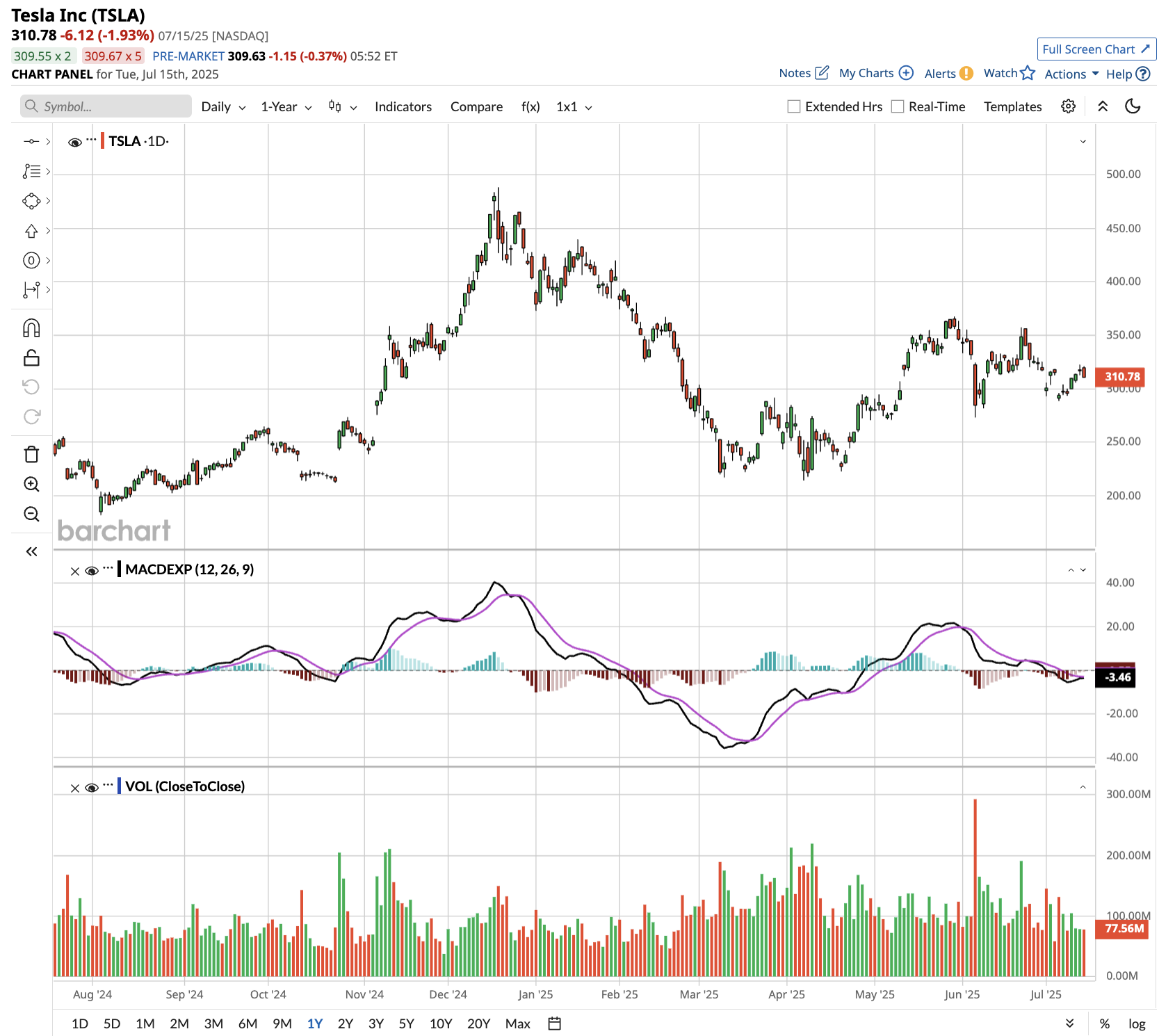

Tesla stock has faced selling pressure following Musk’s announcement that he was forming the “America Party,” a new political venture targeting select Senate and House of Representatives races. TSLA stock plummeted nearly 7% in a single trading session earlier this month, erasing over $68 billion in market value as investors expressed concern about Musk’s divided attention during a crucial period for the electric vehicle company.

The situation deteriorated further when President Donald Trump threatened to cut government subsidies for Musk’s companies, suggesting the Department of Government Efficiency (DOGE) should investigate the billionaire’s extensive government support. Trump’s comments that Musk could “lose a lot more than that” sparked additional selling pressure for TSLA stock.

Musk’s criticism of the administration’s tax-and-spending bill has reignited tensions with Trump, who previously praised the Tesla CEO’s early political involvement. The One Big Beautiful Bill Act, which eliminates EV tax credits and reduces support for renewable energy, poses a direct threat to Tesla’s business model.

Financial Dependencies at Risk

Tesla’s vulnerability to government policy changes extends beyond vehicle sales. The EV giant has generated more than $11 billion in revenue on automotive regulatory credits since 2015. SpaceX, another Musk venture, holds $22 billion worth of federal contracts, highlighting the extensive government relationships at stake.

Tesla also faces operational challenges with second-quarter deliveries down 13.5% year-over-year. Rising competition, particularly in China, exacerbates these difficulties, as Musk’s attention is divided between corporate leadership and political activism.

Wedbush analyst Dan Ives captured investor sentiment, noting “a broader sense of exhaustion from many Tesla investors that Musk keeps heading down the political track.” While Cramer acknowledges Tesla’s valuation creates a potential “price break” opportunity, the ongoing political drama makes it difficult for even seasoned investors to confidently recommend the stock.

Is Tesla Stock a Good Buy Right Now?

Tesla represents a complex investment opportunity in 2025. The EV maker’s diversified approach encompasses automotive manufacturing, energy storage, and cutting-edge technologies such as autonomous driving and humanoid robotics.

Tesla’s competitive advantages remain formidable, benefiting from a first-mover advantage, economies of scale, and an extensive supercharger network that fosters customer loyalty. Moreover, the company’s vertical integration strategy provides supply chain resilience against global trade disruptions.

Key growth catalysts include the deployment of robotaxis in Austin, with plans to expand to San Francisco and Phoenix soon. The Optimus humanoid robot program could revolutionize manufacturing efficiency, with thousands expected in Tesla factories by year-end and millions by 2030. Additionally, the energy storage business, targeting terawatt-scale deployment, addresses growing demands for grid modernization.

However, Musk’s political involvement has created investor uncertainty. Operational challenges include scaling production efficiently while managing model transitions. The company’s ambitious timeline for autonomous vehicles and robotics faces technological and regulatory hurdles.

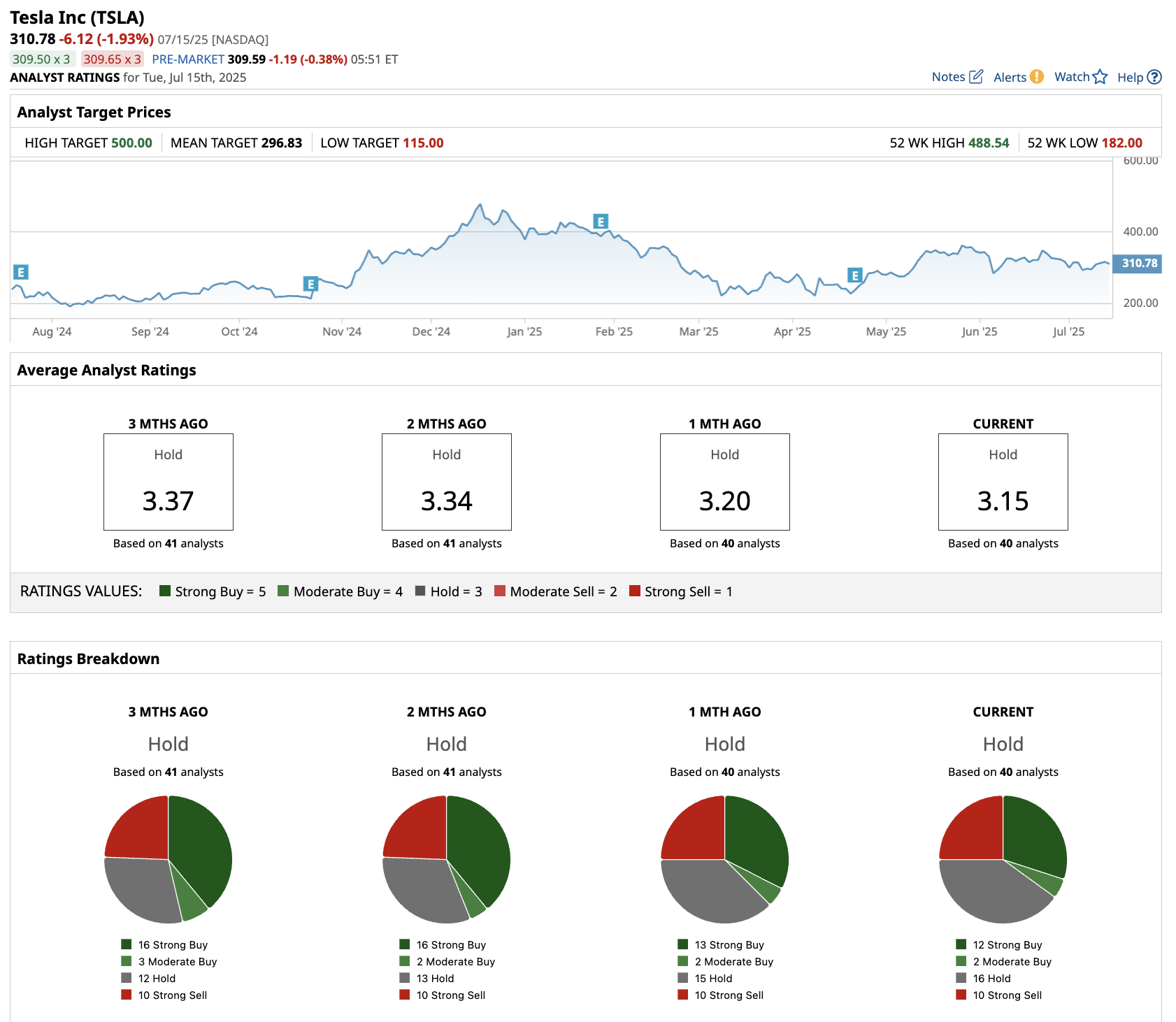

What Is the TSLA Stock Price Target?

Out of the 40 analysts covering Tesla stock, 12 recommend “Strong Buy,” two recommend “Moderate Buy,” 16 recommend “Hold,” and 10 recommend “Strong Sell.” The average TSLA stock price target is near $297, 7% below the current trading price.