DraftKings (DKNG) is reportedly in talks to acquire Railbird, a federally regulated prediction market platform. This development signals the sports betting giant’s expansion into a rapidly growing industry. Prediction markets have been gaining traction following the recent election cycle.

Railbird, founded in 2021 by former Point72 analysts Miles Saffran and Edward Tian, received CFTC approval as a designated contract market in June, making it one of the few regulated prediction markets in the United States. The platform allows users to trade contracts on real-world events, including economic indicators, policy decisions, weather patterns, and sports outcomes.

The acquisition interest follows DraftKings’ failed bid to secure its own federal prediction market license. Meanwhile, competitor FanDuel has reportedly explored partnerships with established player Kalshi.

For DKNG stock investors, the potential acquisition could diversify DraftKings’ revenue streams beyond traditional sports betting, tapping into growing interest in event-based trading. However, the regulatory complexity and competitive landscape pose challenges.

The acquisition would align with DraftKings’ strategy to expand its digital entertainment offerings and attract new user demographics, thereby boosting long-term growth prospects in an increasingly competitive sports betting market.

Is DKNG Stock a Good Buy Right Now?

In Q1 2025, DraftKings reported revenue of $1.41 billion, an increase of 20% year over year. It reported an adjusted EBITDA of $103 million while maintaining strong operational momentum across key metrics.

The company’s Sportsbook handle increased 16% year-over-year to $13.9 billion, meeting expectations despite challenging March Madness outcomes.

Its structural hold percentage improved to 10.4%, up 60 basis points year-over-year, driven by increased parlay betting and enhanced product offerings from recent acquisitions, such as Simplebet.

Management revised full-year 2025 guidance to $6.3 billion in revenue and $850 million in adjusted EBITDA, citing $170 million in revenue headwinds from unfavorable sports outcomes year-to-date. However, core business fundamentals remain strong, with live betting now accounting for more than 50% of the total handle for the first time.

DKNG continues expanding its AI capabilities while maintaining disciplined capital allocation, repurchasing $140 million in shares during the quarter. With $1.1 billion in cash, the sports betting giant expects to report $750 million in free cash flow this year.

Key growth drivers for DKNG stock include improving promotional efficiency, rising structural hold rates from increased parlay adoption, and expanding live betting capabilities. The integration of Jackpocket into the main platform, planned for the second half, is expected to provide additional user engagement opportunities, supporting diversification beyond traditional sports betting.

Is DKNG Stock Undervalued Right Now?

Analysts expect DraftKings’ revenue to increase from $6.3 billion in 2024 to $11.3 billion in 2029. Comparatively, adjusted earnings are forecast to expand from $1.31 per share to $3.82 per share, while free cash flow is projected to improve from $712.5 million to $2.6 billion in this period.

Wall Street expects DKNG stock to benefit from economies of scale, widening its free cash flow margin from 11.3% in 2024 to 23% in 2029. If DKNG stock is priced at 25x forward FCF, which is a reasonable valuation, it could potentially triple over the next four years.

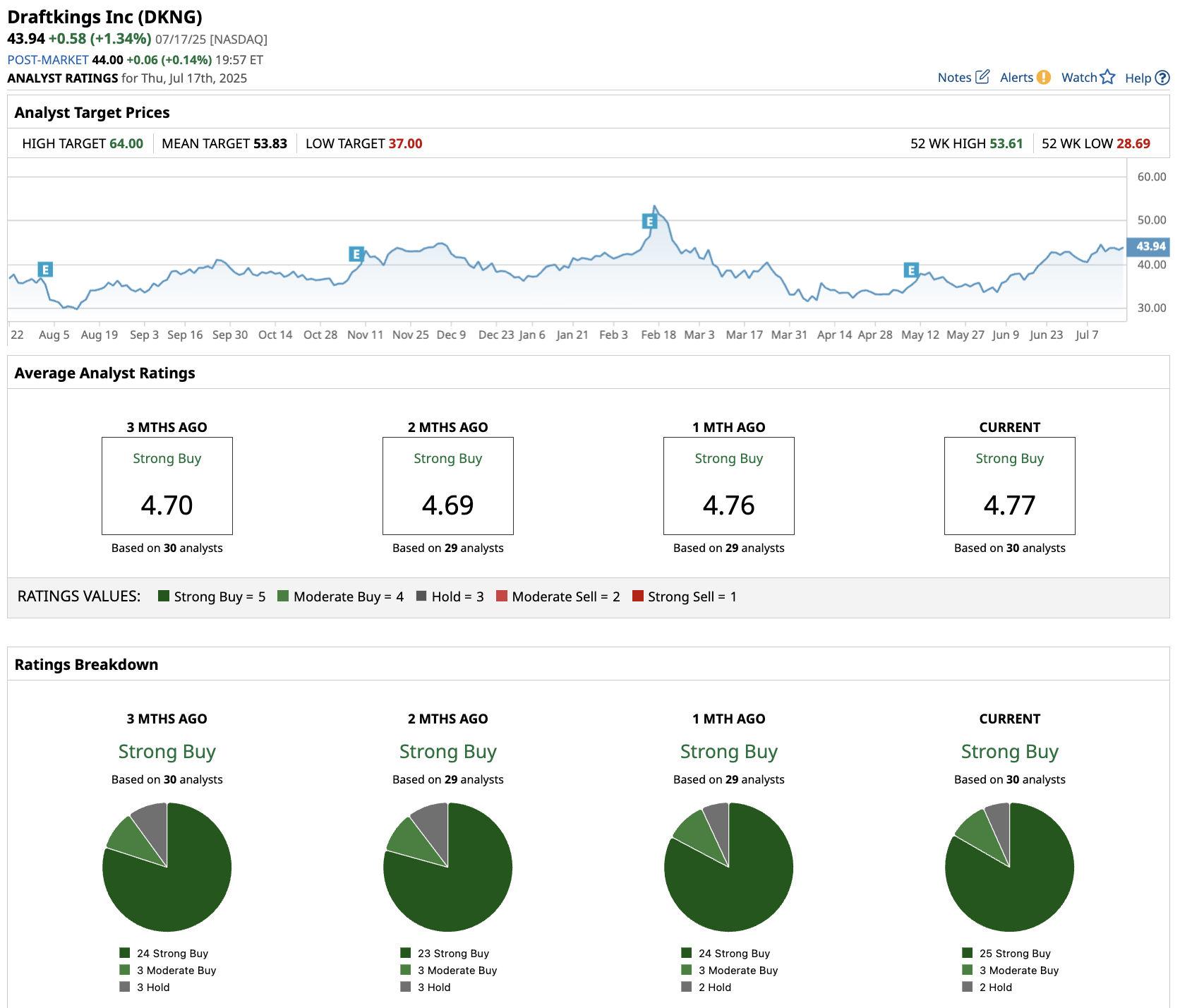

Out of the 30 analysts covering DKNG stock, 25 recommend “Strong Buy,” three recommend “Moderate Buy,” and two recommend “Hold.” The average stock price target for DKNG is $54, 25% above its current trading price.