DoorDash (DASH) has entered the autonomous delivery race with Dot, a compact robot designed to navigate streets, bike lanes, and sidewalks at speeds up to 20 mph. The delivery giant developed this delivery drone in-house, through its DoorDash Labs division. This marks its first standalone push into robotics after previous experiments with drones and partnerships with companies like Coco Robotics.

Dot can carry up to 30 pounds, roughly equivalent to six pizza boxes, and utilizes eight cameras, plus three lidar sensors, to handle challenging scenarios such as crowded parking lots and blocked bike lanes. The company is initially testing the robot in Phoenix and Mesa, Arizona, with plans to expand to other cities later.

DoorDash also unveiled its Autonomous Delivery Platform, which acts as an artificial intelligence (AI) dispatcher to match orders with the best delivery method, whether that's a human Dasher or a robot.

DoorDash insists that Dashers will continue to handle the majority of deliveries, with autonomous options filling gaps during peak times or late-night shifts. The company also introduced SmartScale, a weighing feature that has cut missing item complaints by up to 30% in testing.

Autonomous delivery remains expensive and operationally complex, with regulatory hurdles in many markets. Competitors like Uber (UBER) are pursuing similar strategies through partnerships rather than building their own in-house capabilities. For investors, DASH stock may benefit if Dot improves its margins and delivery efficiency; however, the technology is still early and unproven at scale.

DoorDash Continues to Expand Its Ecosystem

In the last month, DoorDash made several announcements that could reshape its competitive position and revenue mix. In October, DoorDash completed the acquisition of Deliveroo, a leading European food delivery platform. The all-cash deal strengthens DoorDash's international footprint and positions it as a more formidable global player in the local commerce space.

Deliveroo will continue operating independently while gaining access to DoorDash's scale and resources. DoorDash has launched Going Out, a new feature that allows users to book restaurant reservations directly through its app with no cover fees. The service integrates with SevenRooms and rewards customers with credits toward future orders for every booking.

The company also introduced DashMart Fulfillment Services, a white-label logistics solution that allows DoorDash to handle inventory management, picking, packing, and delivery for retail partners.

CVS (CVS) and Party City are already using the service, with Kroger (KR) set to join soon. This model enables retailers to offer fast delivery without investing in their own infrastructure. DoorDash secured a significant win by adding nearly 2,700 Kroger stores to its platform starting Oct. 1, making it the largest grocer available on DoorDash.

Customers can access Kroger's full assortment with loyalty discounts integrated into the app. The partnership extends to retail media and could drive significant grocery order volume.

Additional moves include expanding its Amazon (AMZN) Prime partnership in Canada to offer free DashPass on an ongoing basis, launching McDonald's (MCD) web ordering powered by DoorDash technology, and adding over 4,000 Ace Hardware locations for on-demand delivery.

DoorDash is diversifying aggressively beyond restaurant delivery into reservations, fulfillment services, and deeper retail partnerships.

What Is the Target Price for DASH Stock?

Analysts tracking DoorDash stock forecast sales to rise from $10.72 billion in 2024 to $25.51 billion in 2029. During this period, adjusted earnings are expected to increase from $2.69 per share to $10.25 per share.

Moreover, free cash flow is projected to improve from $1.80 billion in 2024 to $7.46 billion in 2029. If DASH stock is priced at 30 times forward FCF, which is reasonable, it should gain over 80% over the next four years.

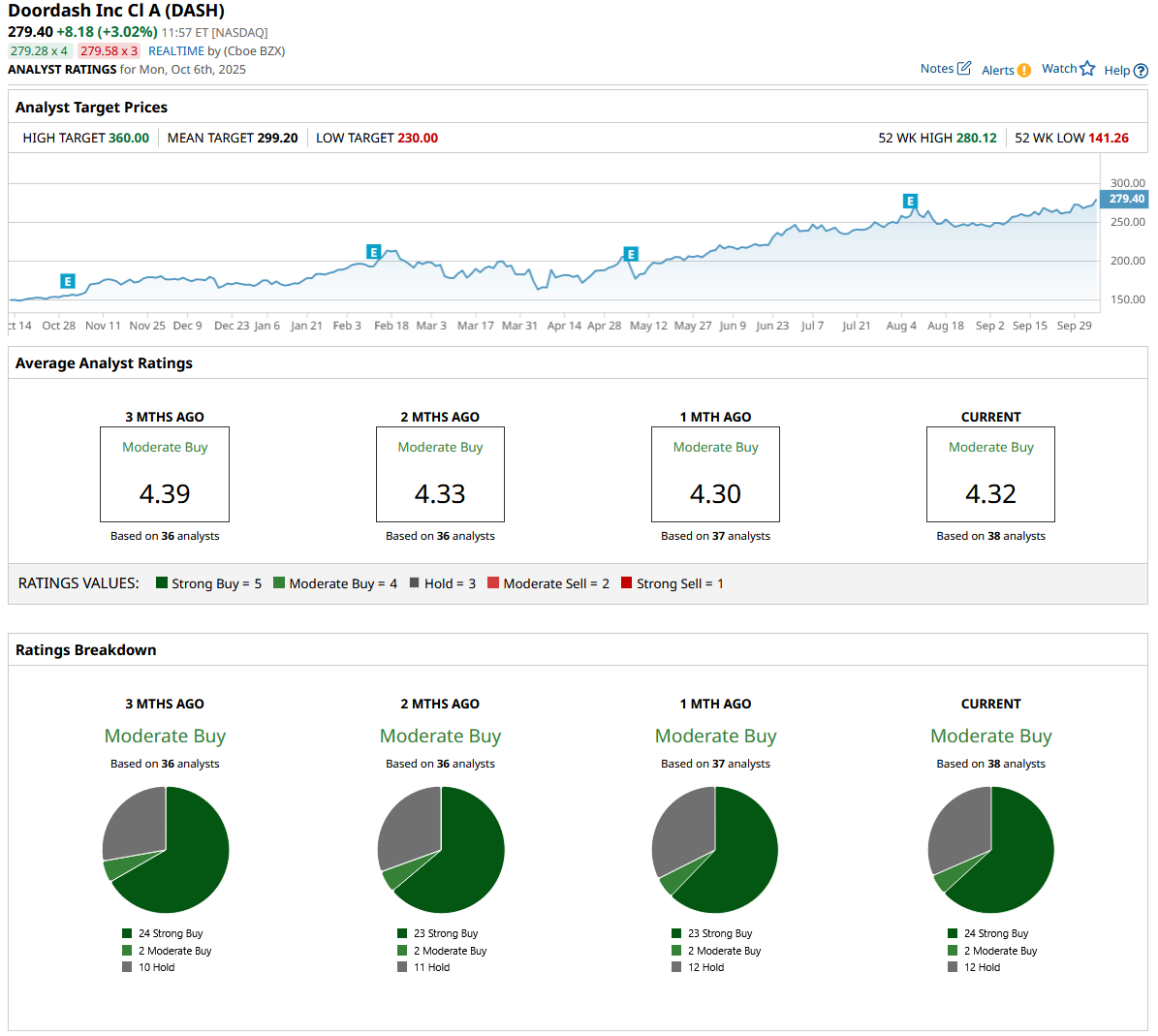

Out of the 38 analysts covering DASH stock, 24 recommend “Strong Buy,” two recommend “Moderate Buy,” and 12 recommend “Hold.” The average DASH stock price target is $299.20, indicating a 7% upside potential from current levels.