The holiday season is approaching fast, and The Walt Disney Company (DIS) is already unwrapping something new, although it’s not exactly a gift for fans. Disney is reportedly raising prices on most of its park passes. But for anyone who has being following the House of Mouse, this isn’t a shocker. Bumping up ticket costs this time of the year has practically become an annual holiday tradition for the entertainment giant.

From the Walt Disney World Resort in Orlando to Disneyland in Anaheim, visitors will soon be paying more to step into the magic. In fact, for the first time ever, Disney World’s top-tier 1-Day 1 Park Per Day tickets for November and December 2026 will break past the $199 mark, hitting as high as $209. Until then, though, prices will stay capped between $119 and $199 through October 2026.

Meanwhile, at Disneyland, for holiday hotspots like Thanksgiving week, tickets will jump from $206 to $224. Still, the company isn’t touching the lowest-priced ticket at Disneyland, which has stayed frozen at $104 since 2019.

Behind this move is more than just tradition. The price hike is likely meant to help Disney offset rising wages and operational costs, while also fueling ambitious upgrades and expansion plans. On deck are some bold upgrades and expansions, including additions to the Tropical Americas at Animal Kingdom as well as a Villains-themed expansion at Disney World.

With current price hikes and a few big plans underway, should investors buy, sell, or hold DIS stock?

About Disney Stock

Founded in 1923, California-based Walt Disney Company has grown into one of the world’s most beloved entertainment giants. From magical theme parks and iconic animated classics to ESPN and blockbuster movies, Disney brings joy to millions around the globe. With a mission to entertain, inform, and inspire, the company combines creative storytelling, cutting-edge technology, and its legendary brands to create unforgettable experiences. The company operates through three segments: Entertainment, Sports, and Experiences.

With a market capitalization of roughly $197 billion, DIS stock has been anything but predictable lately. Shares are down by 4% over the past month and 9% over the past three months. Much of this volatility has been fueled by the September 2025 temporary suspension of Jimmy Kimmel’s show, which sparked backlash and prompted some Disney+ and Hulu cancellations.

In fact, investment firm Jefferies, using Morning Consult data, noted that sentiment toward Disney and its streaming platform fell to a two-year low following the Jimmy Kimmel controversy. Yet, zoom out and the picture brightens. Shares of the entertainment giant are still up a decent 15% over the past year, outpacing the broader S&P 500 Index’s ($SPX) 14% return during the same stretch.

Given its recent headwinds, Disney’s valuation paints a compelling picture for bargain hunters. DIS stock trades at just 17.2 times forward earnings, a steep discount to its own five-year average. The stock also appears especially cheap compared to streaming rival Netflix (NFLX), which boasts a much richer valuation at 46.1 times forward earnings.

Inside Disney’s Q3 Earnings

Disney delivered a strong showing in its third-quarter results for fiscal 2025 on Aug. 6, demonstrating resilience across its diverse entertainment empire. Total revenue climbed 2% year-over-year (YOY) to $23.7 billion, narrowly missing Wall Street’s $23.75 billion estimate. On the other hand, adjusted EPS soared a notable 16% annually to $1.61, beating consensus by an impressive 10% margin.

Disney’s Experiences segment — which includes theme parks, resorts, cruises, and consumer products — posted robust growth with revenue up 8% to $9.1 billion. Domestic theme parks were a standout, generating $6.4 billion, up 10% thanks to higher guest spending, increased resort stays, and more passenger cruise days.

The Entertainment segment — encompassing TV networks, streaming platforms, and film studios — saw a modest 1% revenue growth to $10.7 billion. Within that, while the direct-to-consumer streaming business grew 6% to $6.2 billion — bolstered by Disney+ adding 1.8 million subscribers for a total of 128 million and Hulu rising 1% to 55.5 million — the segment was weighed down by traditional TV, which declined 15% annually to $2.3 billion.

Anchored by ESPN, Sports posted steady gains, with total revenue up 1% YOY to $4.3 billion. Domestic revenue grew 1% to $3.9 billion, while international revenue rose 2% YOY to $379 million.

Looking ahead, Disney’s streaming platforms are set for continued growth. For Q4 fiscal 2025, total Disney+ and Hulu subscriptions are expected to rise by more than 10 million versus Q3. Hulu is poised to lead the way thanks to the expanded Charter deal, while Disney+ is projected to see modest gains.

For the full fiscal year 2025, Disney anticipates adjusted EPS of $5.85, an 18% YOY increase.

What Do Analysts Expect for Walt Disney Stock?

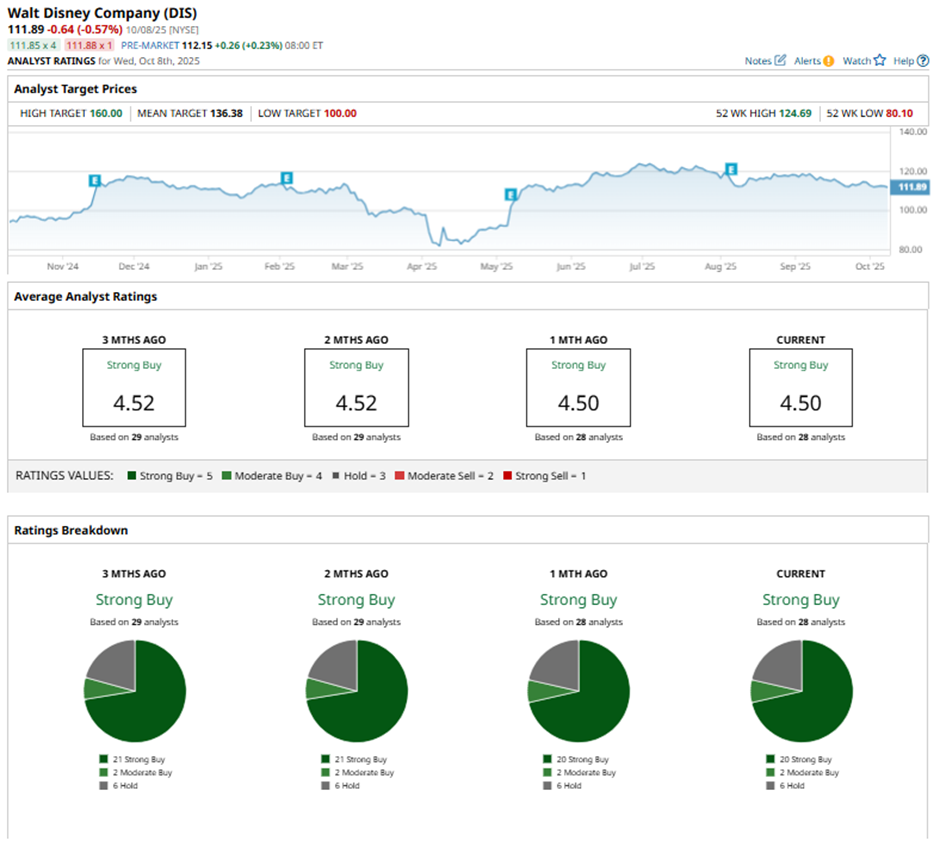

Wall Street appears to have strong faith in DIS stock, maintaining a consensus rating of “Strong Buy” overall. Of the 28 analysts offering recommendations, 20 advise a “Strong Buy,” two suggest a “Moderate Buy,” and six analysts give a “Hold" rating. The average analyst price target of $136.38 indicates potential upside of 24%, while the Street-high price target of $160 suggests that DIS could rally as much as 45% from here.