The digital asset treasury (DAT) model has reached fever pitch in 2025. Dozens of new companies have rushed to rebrand themselves as crypto treasuries, with many seeing their stocks skyrocket 1,000% or more in just days. For investors chasing speculative momentum, these newly minted DAT firms have become the latest craze on Wall Street.

But while small players are riding the hype, the sector’s pioneer—Strategy (MSTR)—isn’t sharing in the rally. In fact, MSTR stock has slid 11% over the past month, underperforming its upstart peers. This comes despite Strategy being the original pioneer of the DAT model, with a massive Bitcoin (BTCUSD) “war chest” that has made it the go-to stock for investors seeking leveraged exposure to the cryptocurrency.

So, with MSTR stock down over the last month, is this just noise in a volatile sector—or a golden chance to buy the dip in the original Bitcoin treasury pioneer? Let’s find out!

About MSTR Stock

Valued at a market cap of $94.7 billion, Strategy, formerly MicroStrategy Incorporated, is recognized as a pioneering Bitcoin treasury company. It primarily operates as a digital asset company, focusing on acquiring and managing Bitcoin as its core treasury reserve asset, thereby providing investors with economic exposure to Bitcoin. MSTR strategically accumulates Bitcoin through equity and debt financing proceeds, positioning it as both an inflation hedge and a vehicle for potential value appreciation. Alongside its Bitcoin treasury operations, Strategy also provides AI-driven enterprise analytics solutions.

Shares of the Bitcoin treasury company have climbed 12% on a year-to-date (YTD) basis. However, MSTR stock is down almost the same amount over the past month at 11%.

A Deep Dive Into Crypto Treasury Hype

Hype around the DAT model has surged to unprecedented levels this year, with an increasing number of companies rushing to adopt it. The majority of more than 100 companies purchasing cryptocurrencies for their treasuries have been launched this year. These are typically small companies that have rebranded overnight—examples include a Japanese nail salon, a cannabis retailer, and a marketing agency.

Companies following the DAT model—buying crypto while often doing little else—have provided investors with a lucrative gateway into the digital asset boom. Investors have embraced it, as a publicly traded wrapper provides crypto exposure with potential upside leverage, all within the familiar framework of equity. That said, if the company announces a pivot to the DAT model, its shares tend to skyrocket. A recent prime example is Eightco Holdings (OCTO), whose shares spiked more than 3,000% last Monday after announcing a Worldcoin-buying plan and appointing Wall Street analyst Dan Ives to its board.

Still, while new companies continue to ride the speculative wave, leading DAT companies such as Strategy have seen their stock prices decline in recent weeks. Of course, the most obvious reason for this is Bitcoin’s pullback from record highs since mid-August. However, diving deeper, new data indicate that the DAT model may be starting to lose momentum under its own weight. CryptoQuant reported that digital-asset treasury firms bought only 14,800 Bitcoin in August, a steep drop from 66,000 in June. Notably, average purchase sizes dropped to 343 Bitcoin last month, which is an 86% decrease from the 2025 peak. As a result, the growth of total Bitcoin holdings has slowed significantly, with treasury firms’ accumulation rate falling from 163% in March to only 8% in August. Strategy announced last Monday that it had purchased a modest $217 million worth of Bitcoin between Sept. 2 and Sept. 7.

J.P. Morgan analysts recently warned against investing in crypto treasury firms, citing growing doubts about the sustainability of that corporate model. They noted that these crypto stocks face the risk of “overcrowdedness and investor fatigue,” making them even less appealing to own in the second half of 2025.

Meanwhile, Strategy was left out of the S&P 500 ($SPX) in the latest index rebalance, despite meeting the eligibility requirements. J.P. Morgan analysts described this as a major “blow not only to MSTR but to other corporate crypto treasuries.” A potential addition to the S&P 500 Index could trigger nearly $2-3 billion in passive institutional inflows, serving as a positive catalyst for MSTR stock regardless of Bitcoin’s performance.

There were also signs that traditional financial institutions are increasing their oversight of DAT companies. Nasdaq, home to many DAT firms, including Strategy, has reportedly started requiring certain token-holding companies to obtain shareholder approval before issuing new shares to finance token purchases. The share-sale model has been a key method for these firms to raise capital without incurring debt.

However, I see the impact of the aforementioned factors on investor sentiment as relatively limited, since Bitcoin’s price movement has been the real driving force behind MSTR’s stock performance. Of course, these factors can sometimes create a degree of decoupling—as seen now with Bitcoin rebounding slightly this month while MSTR stock trades sideways—but it’s always important to remember what really drives the stock.

Bitcoin Rally Fuels Strong Gains in Strategy’s Q2 Earnings

On July 31, Strategy released its financial results for the second quarter of fiscal 2025. The company reported strong earnings, driven by its Bitcoin Treasury, with operating income soaring more than 7,000% year-over-year to $14 billion in Q2. As a result, the company posted net income of $10 billion, or $32.6 per share on an adjusted basis. The surge in earnings was due to unrealized gains on Strategy’s digital assets, as well as the adoption of a new accounting rule allowing the company to report its Bitcoin holdings at fair value.

At the time of its Q2 report, Strategy disclosed holding 628,791 Bitcoins in its treasury, which is about 3% of Bitcoin’s total supply of roughly 19.91 million BTC as of August 2025, according to CoinMetrics. Notably, Strategy’s Bitcoin holdings were acquired at a total cost of $46.1 billion, representing a cost basis of $73,277 per Bitcoin.

It’s worth noting that the company has already met its 2025 Bitcoin Yield target of 25%, reaching the goal five months ahead of year-end. As a result, management raised their guidance, now projecting Bitcoin yields of up to 30% and anticipating $20 billion in gains from their Bitcoin holdings this year. This forecast, however, hinges on a key assumption—that Bitcoin will rally to $150,000 by year-end.

Turning to Strategy’s software business, it generated revenue of $115 million in Q2, up 2.7% year-over-year. The Subscriptions segment of the software business remains a bright spot, growing 69.5% year-over-year to $40.8 million in Q2, with growth accelerating from the previous quarter.

What Do Analysts Expect for MSTR Stock?

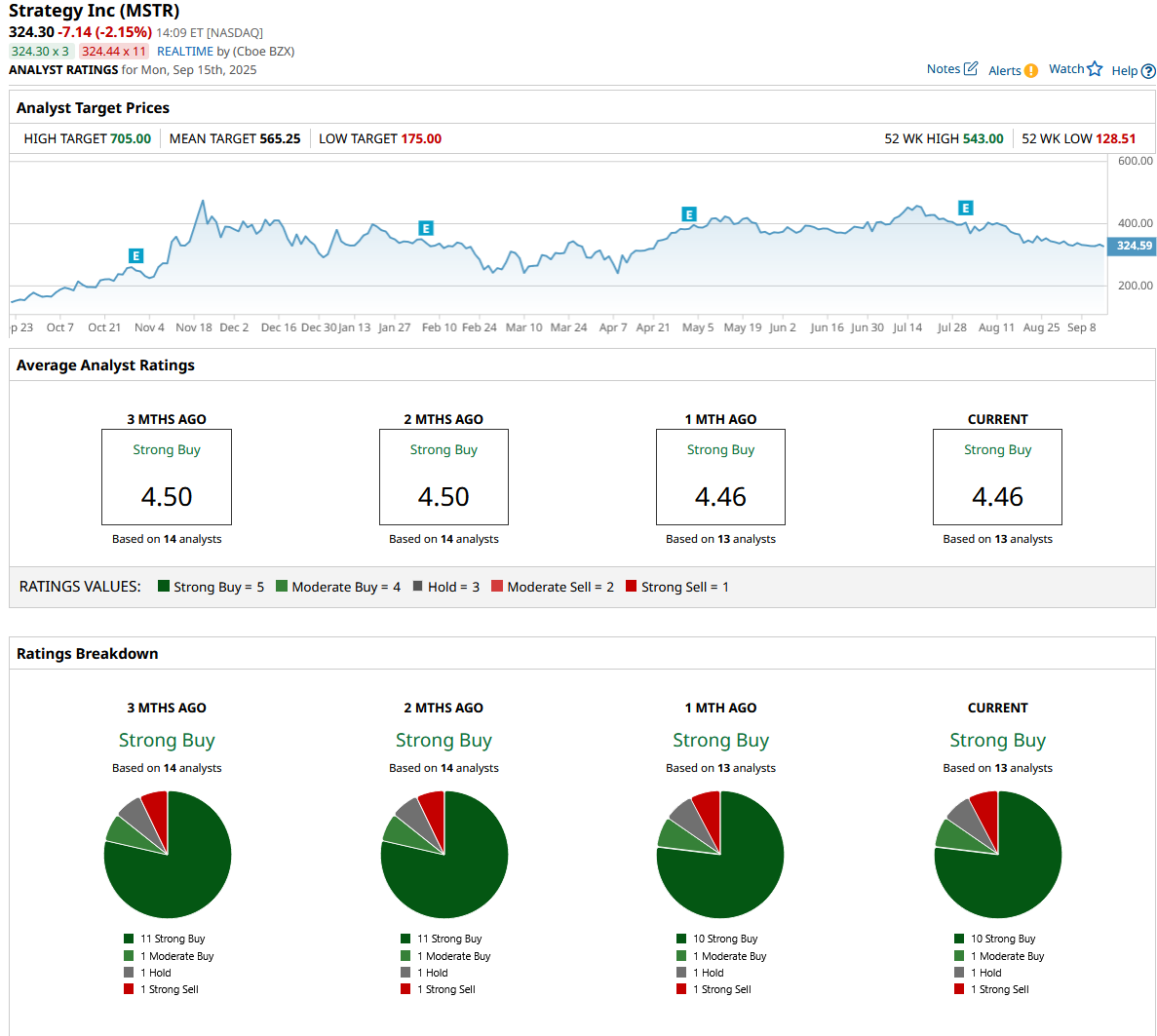

Wall Street analysts maintain a bullish outlook on MSTR, as reflected in a consensus rating of “Strong Buy.” Of the 13 analysts covering the stock, 10 assign a “Strong Buy” rating, one a “Moderate Buy,” another a “Hold,” and one a “Strong Sell.” The mean price target for MSTR stock is $565.25, suggesting a huge upside potential of 70.5% from Friday’s closing price.

Putting it all together, Strategy’s shares provide a great opportunity to gain Bitcoin exposure with a degree of leverage. And if you believe the Bitcoin rally will continue, the recent pullback in MSTR stock presents an attractive point to enter or increase your position. However, an increasing number of investors are beginning to question the DAT model, finding it difficult to justify buying crypto through a company burdened with expenses, risks, and equity dilution. If you share that view, then purchasing Bitcoin directly on a crypto exchange or gaining exposure through an ETF is a great alternative.